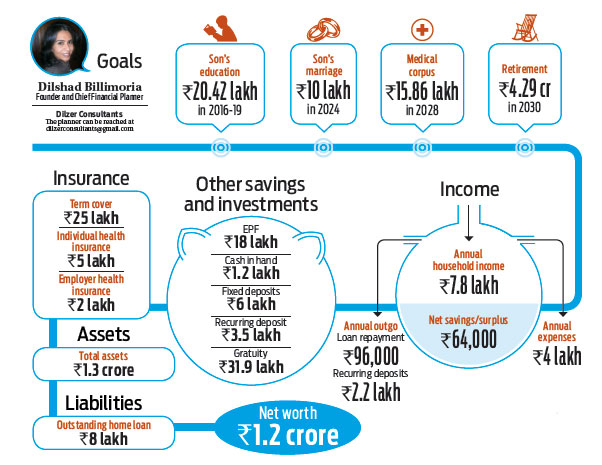

In a quiet locality in Jamshedpur, the Ojha family of Rajat, 44, his wife Jhuma, 43, and 17-year-old son Rahul are working towards making their dreams come true. Theirs is a nuclear family and Rajat, who works with the Punjab National Bank, is the sole income earner.

Rajat has been employed with the bank for most of his working years, but he is posted in a branch which is out of town, resulting in the majority of his time spent in travelling and working. One of the biggest dreams of the family was to have a house of their own, which they achieved in 2011. Like scores of others, Rajat, too, managed to achieve this goal by digging into his savings and borrowing around Rs.10 lakh to own his biggest financial asset.

Changing with the times

The next financial goal the Ojha’s are expecting to meet is their son’s higher education expenses. Overall, the family does not spend too badly, but they still need to rescale some of their financial goals to ensure that they sail through the rest of their lives without any difficulty. To start with, Rajat needs to think of investing his money rather than being satisfied with bank term deposits and fixed return instruments, where he has saved his money so far.

He also needs to relook at his insurance cover because, at this stage, his family completely depends on his income. To ensure that they do not face a tough situation in case of an unexpected event, Rajat should immediately increase his life insurance cover and take one for his wife as well. Although he does have health insurance, he should consider individual plans for his wife and son, who will definitely be in need of a health cover later in life.

For now, the biggest financial challenge they need to tackle is Rahul’s education, the estimated cost for which is Rs.20 lakh, a sum that the Ojha’s do not have ready at hand. The upside is the fact that one does not need to pay the entire fee upfront but in a phased manner over three to four years, depending on the stream Rahul opts for in college. Fortunately, education loans are easily available and that Rajat works with a bank should help. The other financial goal, which is still far away but very crucial, is the family’s retirement plan. Instead on relying solely on the provident fund contribution, Rajat should consider investing surplus funds in equities, through mutual funds, to accumulate money for his retirement in 2030.

Like a typical Indian home, Rajat may manage to spend his retirement years with his son, but that is betting too much on uncertainty.

A plan to act on

Emergency fund

■ The Ojhas should maintain a contingency fund equivalent to their expenses for four to six months

■ A contingency fund of Rs.2 lakh should be sufficient to start with

■ They should utilise cash in hand and part of the money in fixed deposit towards this fund

Insurance

■ Rajat needs to increase his life insurance cover by Rs 20 lakh

■ Although Rajat has adequate health cover; he should take individual health policies for the entire family

■ He should buy a critical illness cover for Rs.10 lakh each for himself and Jhuma

Son’s education

■ They will need money for Rahul’s college education from next year onwards till 2019 ■ Assuming inflation at 8 per cent, they need to set aside Rs.20.42 lakh in all or about Rs.5 lakh each year

■ They can use Rs.5 lakh in fixed deposits and Rs.3.5 lakh in recurring deposits to partially fund Rahul’s education

■ For the deficit, think of taking an education loan

Son’s wedding

■ Assuming Rahul marries in 2024, the Ojha’s will need Rs.10 lakh towards his wedding expenditure

■ To meet this goal they need to save Rs.56, 976 annually, but there isn’t sufficient cash surplus

■ Start saving in 2017 at a slightly higher amount when cash flow becomes positive or postpone the goal

Long-term medical corpus

■ The family needs to build a long-term medical corpus of Rs.15.86 lakh by 2030

■ As there are no resources left, they should invest Rs.3, 000 every month in a diversified equity fund to achieve this goal

■ As an act of safety, they should start transferring money from the equity fund to a debt fund from 2025 so that there are no surprises when they actually need the money

Retirement

■ We have assumed a life expectancy of 75 years for Rajat and Jhuma

■ Going by this assumption, they will need about Rs.4.29 crore to manage their life in retirement

■ Rajat’s gratuity corpus will fetch around Rs.31.90 lakh and accumulated EPF would be Rs.18 lakh in 2030 and both these sums will be needed to fund their post-retirement expenses

■ In order to fund the deficit amount, a monthly investment of Rs.55, 000 at a return of 12 per cent is needed

■ Since the family does not have the luxury to set this sum aside, it is suggested that they start paring small sums from their committed savings (recurring deposits) towards this goal and increase it over time in a manner that they bridge as much of the deficit as possible

■ Rajat could also consider extending his working life by some years to make sure his retirement works without any financial difficulties.