Sumit Kumar, 37, stays in Mumbai with his wife Swagata Sinha, 36, and son, Mihir, 6. Sumit is a central government employee while Swagata is a homemaker.

The family’s income as on date is Rs. 55,000 per month. Though Sumit was promoted and his salary was increased by Rs. 22,000, the enhanced income will reflect after a few months. The family spends Rs. 35,000 per month on household and lifestyle expenses.

Their investments include gold (Rs. 2 lakh), Public Provident Fund (Rs. 1.6 lakh), Employees’ Provident Fund (Rs. 11 lakh), mutual funds (Rs. 22.25 lakh) and bank balance (Rs. 45,000). They do not have any liabilities. Sumit has total life coverage of Rs. 59 lakh and Swagata has a traditional plan with a sum assured of Rs. 50,000. Their annual premium outgo towards all life, health and vehicle insurance is approximately Rs. 60,000. Their main goals include buying a house, planning for their retirement and Mihir’s education and his wedding.

Contingency planning: 6 months

Contingency planning: 6 months

Monthly expenses (post recommendation) Rs. 36,762

- Allocate (Rs. 2.2 lakh) to meet six months expense

- To start with, maintain minimum of three months expenses

- Allocate bank balance and any arrears towards this goal

- Invest Rs. 4,000 per month for next 18 months to increase contingency fund to desired goal

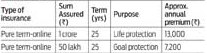

Life insurance

- Continue to hold all current insurances

- Additional buy required

Health and other insurances

- Adequately covered, but evaluate requirement annually

- Buy critical illness of Rs. 10 lakh either as a rider to term policiesor as a standalone product

- Buy personal accidental cover of Rs. 10 lakh either as a rider to term plan or a standalone policy

Property purchase

- Buy property towards end of 2014 or beginning 2015 only after building considerable emergency corpus

- Pay 40 per cent downpayment to reduce debt

- A 20-year loan at an average rate of interest of 10.5 per cent will entail an equated monthly instalment of Rs. 29,950

- Allocate rental income from property until retirement to long-term investments

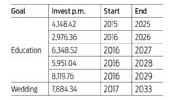

Child’s education and wedding

- Allocate PPF, direct equity, IDFC bond and the maturity of insurance policies for these goals

- Additionally, invest in a diversified equity fund per month to meet the deficit

Retirement goals

With a reduction in goal value, Sumit will need Rs. 50,000 per month in today’s value (Rs. 1.90 lakh per month starting 2035). The inflation-linked corpus of Rs. 5.10 crore is expected to last till Swagata is 85 years old. Sumit’s EPF maturity proceeds assuming his contributions continue till retirement has been allocated to this goal. But additional receivables on account of gratuity, leave encashment and superannuation (if any) have not been included. So, to meet the deficit Sumit should:

- invest Rs. 16,200 per month in growth-oriented investments with a long-term view from 2020

- Increase investment by 3 per cent annually till 2027 and by 25 per cent annually thereafter

Tax goals

Sumit can avail himself of tax benefits under Section 80C of the Income Tax Act, 1961 through his contributions to his EPF, PPF and his life and health insurance premium outgo.