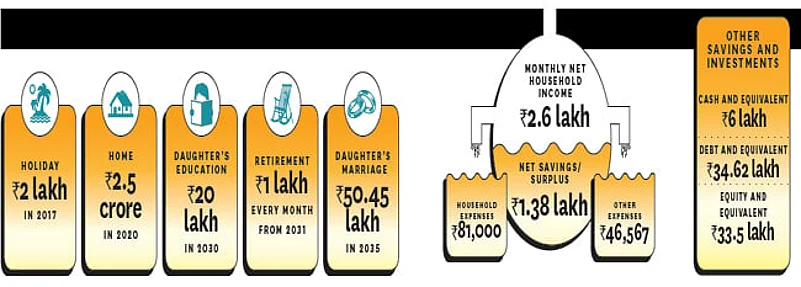

Mumbai-based Borwankar family is a dual income household with Prasad and wife Vaidehi adding to the household income. The Borwankar family also includes Prasad’s parents and his 2-year old-daughter, who is unmistakably the apple of their eyes. Prasad (34), like several others, has been saving and investing his money and has several financial and nonfinancial assets. Over the past eight years, Prasad has been investing without any clear cut financial goal. Naturally, even though the investments were regular, they were not channelised to offer a financially healthy future.

One of the reasons why he got his finances analysed was to get them in order and have a clear roadmap with his money. His financial foundation is secure with adequate life insurance on his and his wife’s life. Likewise, he has appropriate health insurance, which also covers his ageing parents. He comes across as an aggressive investor when analysing his risk tolerance; yet it is baffling to note that large sums are sitting in fixed deposits instead of, say, a liquid fund or other alternatives. This oversight is more due to lack of awareness than anything else, he confesses.

Spreading the money

The Borwankars lead a frugal lifestyle, which leaves them with sufficient surplus every month. However, the way their finances are placed, every provision has been made to ensure that they achieve their retirement goal. Thus by bringing order to their investments, the Borwankers are much closer to meeting their goals. Their monthly expenses are Rs1.3 lakh and it is recommended that they maintain three months’ emergency fund of Rs3.9 lakh.

As per Prasad’s income, expenses and other savings, he is recommended to increase his equity holdings from 27 to 35 per cent and reduce his debt allocation from 28 to 18 per cent, to be in line with his aggressive profile. The surprising part of his finances is that he has made several investments in equities on his own. Although it is good to note a significant allocation to equities, there are several overlaps in his investments, which means it is diversification only in numbers. It is advised that he shift his equity investments systematically to debt about 3 years before retirement age, including any new investments during this period. Likewise, he should limit his mutual fund investments to 4-5 schemes by consolidating existing investments. He should also exit direct equity investments and move to manageable portfolio of mutual funds.

Debt management

The allocation towards real estate has been marginally increased from 40 to 43 per cent, for he wishes to buy one more property to eventually live in it after selling his Malad house and be left with one house as an investment. At present, Prasad’s existing outstanding loan is Rs23 lakh on which he pays Rs26,000 EMI at 10.5 per cent interest. This should be transferred to SBI’s Maxgain Scheme at prevailing interest rate of 9.9 per cent. In doing so, he will not incur any pre-payment charges in the future and will also save on EMIs.

To ensure that the family manages to enjoy their financial goals in time, Prasad needs to monitor his investments more frequently. Likewise, some of his goals are really far away like his daughter’s education and marriage—while it is a good move to start investing towards them, he should take a reality check once every few years. Given the roadmap to improve his finances, Prasad should now start checking the progress at least once a year and make any changes to his investments accordingly.