Rajesh and Shikha Chaudhari are a couple who work as a team—he is a real estate investment consultant and she is an interior designer. The importance of planning is well ingrained in them, as they help scores of others realise their dreams of owning a house. Expectedly, when it comes to their own financial plans, things have been smooth and in order. This has been of immense help as they prepare to send their son Rohan for graduation in US. “The flexibility in choosing subjects he wants is not available here and we wish he pursues his interest,” says Rajesh. “I want to major in Economics;

I also want to study Mathematics, Political Science, Computer Science and maybe, even Psychology. Our rigid education system does not allow for such a combination,” rues Rohan. Having just completed his Indian School Certificate (ISC) examination from St. Xavier’s Collegiate School in Kolkata, he had been scouting liberal arts colleges in the US that allowed students to take up such courses, resulting in an extremely well-rounded and holistic education. “I have got admission into Colgate University in Hamilton, New York for a 4-year undergraduate course in Liberal Arts with a primary focus on Economics,” he says, beaming with pride.

Planning ahead

Rohan’s session commences in late August, but he has been working towards his dream for well over a year. “Once I realised that I had to look for options abroad, I started working on taking the SAT, SAT Subject Tests and TOEFL in 2013 and started my application process in July 2014,” he says. Although the deadline for most colleges is January 1 every year, he started early because he wanted to apply to as many colleges as possible to maximise his chances of admission with financial aid. Rohan is getting a grant, which will take care of most of his education-related expenses over the next four years. On their part, the Chaudharis have also done their bit by saving and investing for Rohan’s education. “I lost my father at an early age and have been responsible with my finances for long and have always believed in saving for the rainy day, than spending mindlessly,” stresses Rajesh. So, as soon as Rohan was born, the parents opened a PPF account in which they meticulously saved for this day. “I also put money in NSCs and endowment policies, as these are all simple and straightforward investments,” explains Rajesh.

Funding gap

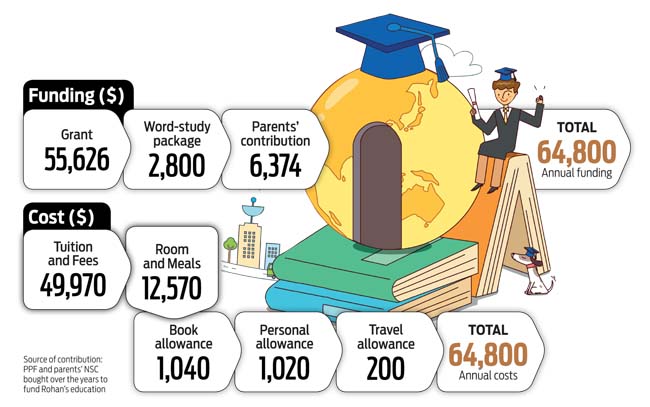

Having successfully built an education corpus for Rohan, Rajesh is happy that his son has got a grant, which takes care of most of the education expenses. “I did not have a ballpark figure in mind about education expenses, but now that he is going abroad, it is a very different situation,” explains Rajesh. No doubt the grant is handsome; the gap that needs self-funding would have been a stretch but for the early planning by the Chaudharis. Of course, there are other expenses besides education: a trip to India and back at least once a year for Rohan, and also the need to create a contingency fund for a parent to make a trip to the US.

The lesson for others from this is that education costs have skyrocketed over the last decade. As a parent, you need to know how critical meeting those costs will be in future, so start saving and investing early. Of course, if you are lucky, your child may also manage a grant the way Rohan has managed to cushion the financial implications significantly.