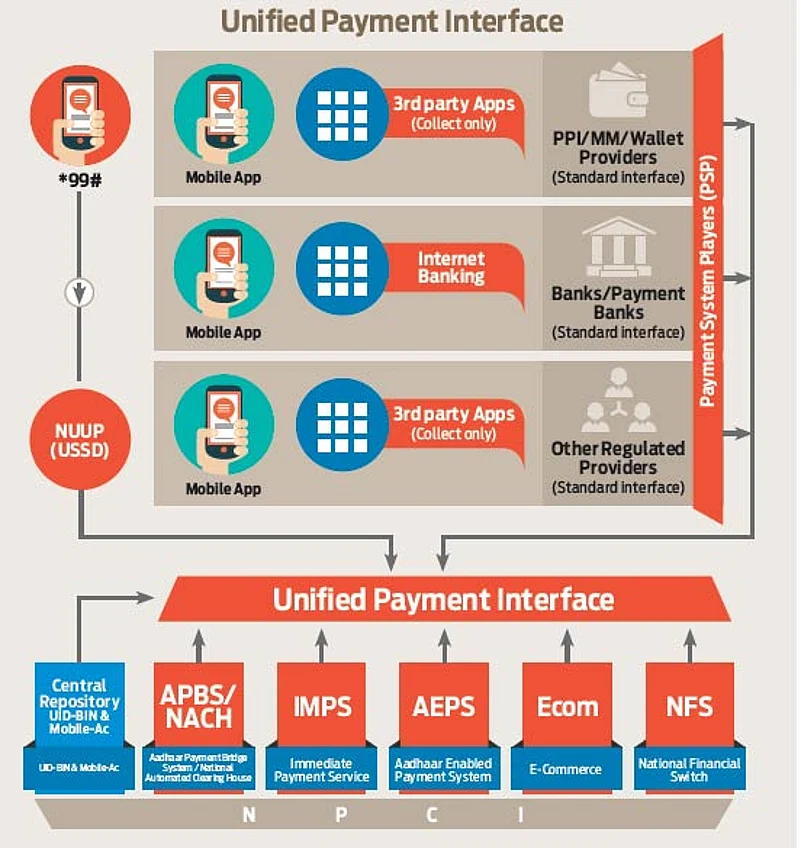

With the launch of the Unified Payments Interface (UPI) by National Payments Corporation of India (NPCI), we are entering into a mobile first payments design which is interoperable and makes instant payments. The UPI interface allows customers to make payments through a single identifier like Aadhaar number or virtual address. Basically it enables you to make payments using your mobile phone as the primary device for payments including person-to-person, person-to-businesses, and businesses-to-person— with the ability to pay someone as well as ‘collect’ cash from someone.

How it works?

One can use UPI app instead of paying cash on delivery on receipt of product from online shopping websites and can carry out miscellaneous expenses like paying utility bills, over- the-counter payments, donations and school fees, among others. For instance, when you are making a purchase on a portal by using you virtual ID after selecting UPI as the payment mode, a pop-up or push notification is received on your payment service provider (PSP) app requesting for a confirmation of the payment.

All you need is to then simply enter your secure pin to authenticate the purchase transaction and within seconds you receive a confirmation of a successful online purchase from the merchant. When you create a virtual ID or address as part of your registration process with the PSP, you reach the payment section on the merchant site post adding goods to your shopping cart and select UPI as the payment mode You are only required to enter your virtual ID to proceed and nothing else.

When the transaction request hits the merchant’s server, it is immediately passed on to the acquiring bank’s server where a UPI collect transaction is initiated on the virtual ID shared by you from the merchant’s server. This request is then routed to the UPI server and using your virtual ID the transaction request is directed towards your PSP app. A pop up appears on the app screen requesting for the secured pin.

You authenticate the transaction request and the transaction proceeds to the UPI system where the actual account details are fetched up against the mapped virtual ID.

This transaction is then pushed to your bank account, where the credentials are validated and your account is debited. The confirmation is again pushed back to the UPI servers and in turn it initiates a credit message to the merchant’s acquiring bank and credit to the merchant happens in real time. You can use UPI in merchant establishments, online payments, utility bill and school fees payments and even appbased taxi hailing services.

You can also pay-by-date: you can set future payments depending on the last date without missing on payments on your insurance or even phone bills.

Likewise, in case of recurring payments for which you may be using the ECS (electronic cash payments) such as utility bills, school fees or mobile bills, you can do so with a one-time secure authentication and rule-based access. Organisations could use this to even pay salaries.

UPI Interface

The platform allows you to use Aadhaar number, mobile number, and account number in a unified way, while not giving it away during the payment process. You could just create a ‘virtual payment address’ that are aliases to your bank accounts. What this means is that the virtual payment addresses don’t allow your security to be compromised. This move could just be the end of the mobile wallet dominance with payments.

Already a few banks have gone live with UPI, out of 29 banks that have concurred to provide service to their customers. The NPCI is confident that others will join UPI this year and the number will multiply. The initiative is in line with the government and RBI’s vision for a less cash economy with a stronger digital banking focus.