Ask any army officer about the many places he has been stationed at and he will get into a long drawn narration of at least a dozen different places he has been posted to. Residing in Jalgaon, Ravi Srivastava’s two decade career can even leave behind some of the seasoned military men—18 postings and counting, is what he says. At 43, this middle-level SBI Life insurance employee is using all his financial acumen to strive for a financial plan that can take care of his immediate family needs.

After a few initial postings, where he lived with his wife, Ranjana, and two children, Shrey, 16, and Ananya, 14, Ravi made them settle down in Lucknow while he still moves from city to city, depending on where his job takes him next. No wonder, he credits his wife for being the backbone of his life—raising their two children and being a constant support to his parents. The decision to put up his family in Lucknow is to do with stabilising their children’s education and maintain a permanent residence for his aging parents.

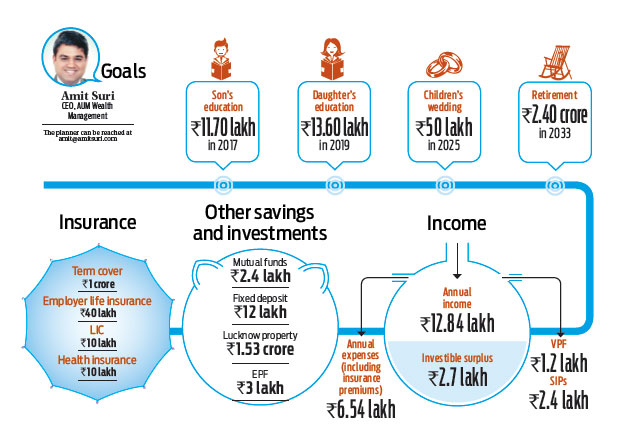

Traditional approach

Ravi has taken a conventional approach in handling his finances and it is reflected when he talks of how he built his Lucknow house. He used all his PF savings to repay the financial liabilities that occurred during the construction of his house. Yes, it does leave him with no liabilities and takes his total net worth to Rs.1.70 crore but, at the same time, it also leaves him exposed with no savings towards retirement, something that he needs to start building on, given the fact that less than 20 years remain for that. Moreover, with two land parcels forming his other major investments, when it comes to liquidity, Ravi is not on a very strong wicket.

The immediate financial outgo for him is towards higher educaton of teenage children, which will start kicking in from 2017. One way is to use education loan and the other is to use one of his land parcels to fulfil this goal. Alternately, he can use his bank deposits and borrow a limited sum to manage his way through this important financial goal. After all, unlike, say, buying a house, which can be postponed by a few years, a child’s education has no such flexibility. He is better prepared for his daughter’s higher education, for which he will need money in 2019, and has a fixed deposit linked to that goal that will pay him Rs.20 lakh the same year.

The next milestone for the Srivastavas is their children’s wedding, for which they wish to spend Rs.50 lakh combined, a sum that they could taper down. However, if they do not wish to reduce this sum, they need to start setting aside Rs.22, 000 in a balanced fund each month.

Being in the insurance industry has been a boon as the family is adequately insured. But it would help them if they add a critical illness health cover of Rs.10 lakh each. Given the extent of Ravi’s travels, he should also add a personal accident life cover of at least Rs.25 lakh for himself. As for his retirement plans, he should continue invsting in his current monthly SIP of Rs.20, 000 for a comfortable life in his sunset years.

The Plan for Ravi

Emergency fund

■ You should maintain at least six to nine months’ expenditure as your contingency fund

■ Based on your current expenses, you should maintain a contingency fund of at least Rs.4 lakh

■ You don’t have any liquid assets besides a fixed deposit of Rs.12 lakh in your wife Ranjana’s name. A part of it can be utilised as emergency fund

Insurance

■ Based on the current expenditure, your existing life cover is adequate. However, you should review it regularly and increase the coverage based on an increase in your income and expenditures in the future

■ Health insurance coverage of Rs.10 lakh is also adequate but looking at the increasing cost of hospitalisation, it should ideally be increased every alternate year

■ You should buy a personal accident policy of Rs.25 lakh for yourself and a critical health insurance policy of Rs.10 lakh each for yourself and your wife

Shrey’s higher education

■ Shrey’s higher education is only two years away and money will be required over a period of three to four years starting from 2017. Assuming that Shrey will need Rs.10 lakh for his education in terms of today’s cost and given the current inflation rate of 8 per cent, you will need around Rs.11.70 lakh in 2017

■ Even though you have a decent net worth, it has limited liquidity in it. You should sell your smaller plot of 1,250 sq. ft to meet Shrey’s higher education expenses. This will start the process of creating a better asset allocation for him

■ If you are unable to sell the plot at this stage, then you should withdraw partly from your wife’s bank deposit while the rest can be covered by taking an education loan

Ananya’s higher education

■ Ananya’s higher education is four years away and, in her case too, the money requirement will be spread over a period of three to four years, starting from 2019. Assuming that Ananya will also need Rs.10 lakh towards her education and with the current inflation rate at 8 per cent, you will need Rs.13.60 lakh in 2019

■ Fixed deposits of Rs.12 lakh will mature to Rs.20.5 lakh in 2019

■ Maturity proceeds of this fixed deposit can be used to fund Ananya’s higher education

Children’s wedding

■ It is expected that the weddings of both Shrey and Ananya will take place about 10 years from now and you are looking at spending Rs.50 lakh for the same

■ Since the goal needs more money than you can save at present, you should start with a systematic investment plan (SIP) of Rs.22, 000 in balanced funds and increase the contribution by at least 5 per cent every year. In this way, you will easily be able to save the required amount towards your children’s weddings.

■ You should start transferring your investments from balanced funds to debt funds in the last two years to minimise any volatility risk to your investment portfolio

■ You also have a 4,500 sq. ft land parcel in Lucknow whose current value is estimated at Rs.45 lakh. This land parcel can also be utilised to meet the goal. Since real estate is not a liquid asset, you should initiate to sell it at least two years before the D-day and invest the proceeds in bank deposits and gold for the interim period

Retirement

■ Assuming both you and your wife have a life expectancy of 80 years, you will need around Rs.2.4 crore to maintain the same lifestyle and have a stress-free life post retirement

■ Your retirement proceeds from employment are expected to be around Rs.1 crore

■ You should continue investing Rs.20, 000 per month in mutual funds by way of SIPs to meet the retirement corpus deficit of Rs.1.40 crore.