Every year brings with it a historic event which goes down in the history books to be discussed in later years. Without doubt, long queues at banks, and numerous caricatures of the impact of demonetisation will mark any future reference of 2016. Money was a major concern for every Indian this year— for the rich and the poor; for the urban and the rural. For those tracking the financial services, it was a year marked with several changes that provided many new opportunities to explore. One of the biggest changes that one will witness in the coming years will be transition in taxes with the passage of the GST Bill.

Another painfully long wait in order to enter a bank I Photo: Tribhuvan Tiwari

1) Policy

On the policy level, inflation was the key focus area for the central bank, which also witnessed a change at the top with the tenure of Dr. Raghuram Rajan coming to an end and Dr. Urjit R. Patel taking charge from September 4, 2016. The RBI target for retail inflation is expected to be 5 per cent by March 2017. To achieve this level, the central bank has been reducing the repo rate with successive cuts of 25 basis points since its June policy review when it stood at 7.25 per cent, and which now stands at 6.25 per cent. The repo rate is the rate at which the RBI lends money to commercial banks in the event of any shortfall of funds and is used by the RBI to control inflation.

This is how I manage inflation; former RBI Governor, Dr. Raghuram Rajan I Photo: Tribhuvan Tiwari

Age no bar when it comes to demonetisation woes I Photo: Jitender Gupta

2) Markets

For investors, the stock returns were rather insipid as the returns were pretty flat for the benchmark BSE Sensex. Yet, a lot transpired in the financial services to excite a bystander. Retail investors lapped up mutual fund investments with the number of folios crossing the 5 crore mark this year. Another factor to cheer was the flow of funds into equity mutual funds all throughout the year with SIP contributions that crossed the 1 crore active SIP accounts mark as well. The change in the mutual fund consolidated account statement (CAS), which started reporting the gross commission paid to the distributor, has so far not impacted the investors much, but could shift the route taken by investors to the direct model.

A glum RBI Governor, Dr. Urjit Patel watches Economic Affairs Secretary, Shaktikanta Das, present the new currency notes I Photo: Tribhuvan Tiwari

3) Jhan Dhan all the way

One cannot stop singing paeans of the Pradhan Mantri Jan-Dhan Yojana, which resulted in the opening of bank accounts for over 200 million Indians. The naysayers will sing a different tune as they start seeing activity in these accounts with the demonetisation drive, which in future, aided with the direct benefit transfer, could become the catalyst to make India less cash-dependent.

In case of no change, traffic defaulters are being asked to settle the fine at the court I Photo: Tribhuvan Tiwari

4) Easy KYC

The much needed Know Your Customer (KYC) procedure got easier and uniform with the functioning of the Central KYC Registry (CKYCR) platform, which paved way for the inter-usability of KYC records across the entire financial sector. For avid investors, the move removes the hassle of multiple KYC processes, and for those in the financial services business there is tremendous cost savings and convenience.

Midnight rush at the airport as passengers wait for their turn at the ATM

Now, when was the last time I filled a form to collect my own money from the bank? I Photo: Narendra Bisht

5) Real Estate and Real Estimates

On the real estate front—the long awaited real estate regulation saw light of the day with the passage of the The Real Estate (Regulation and Development) Bill, which will help establish state level real estate regulatory authorities (RERA) and appellate tribunals to regulate transactions relating to both residential and commercial projects and ensure their timely completion and handover. RERA should be in place from 2017, and provide greater certainty to buyers.

Gender-bender: women form a separate queue to get their way to the bank I Photo: Nirala Tripathi

6) My EPFO

Some bold steps by the EPFO will benefit subscribers to one of the oldest provident fund schemes in the country to get a greater benefit from investing in equities. The EPFO investment of about Rs 7,000 crore in the stock markets in 2015 will go up this year. The Minister of State for Labour and Employment, Bandaru Dattatreya, told us: “While we are creating awareness amongst workers, we believe that seeing the positive returns generated by investments in capital markets, the workers themselves will agree.”

For those cribbing, a few months ago people flocked to lay their hands on a SIM for free data connection I Photo: Sanjay Rawat

7) IPO Party Continues

The IPO party continued from 2015 with about a dozen big IPOs testing the markets in the first half of the year, raising over Rs 8,100 crore. Big names like L&T Infotech IPO and the first private life insurer ICICI Prudential Life opened the doors for investors to take part in primary markets.

Our first brush with the pink note— worth every minute in the queue I Photo: Jitender Gupta

A wholesaler wondering when will it be Acche Din I Photo: Nirala Tripathi

8) Gold Bonds

At the same time, the government gold bonds opened the doors for traditional investors to move from investing in physical gold to paper gold through this scheme. The demat form of the bonds ensured safety and convenience for people who otherwise fear losing the bond certificate or damaging it. A total of 10,155 kg worth of gold with investments of Rs 3,060 crore flowed through first five tranches alone in this scheme.

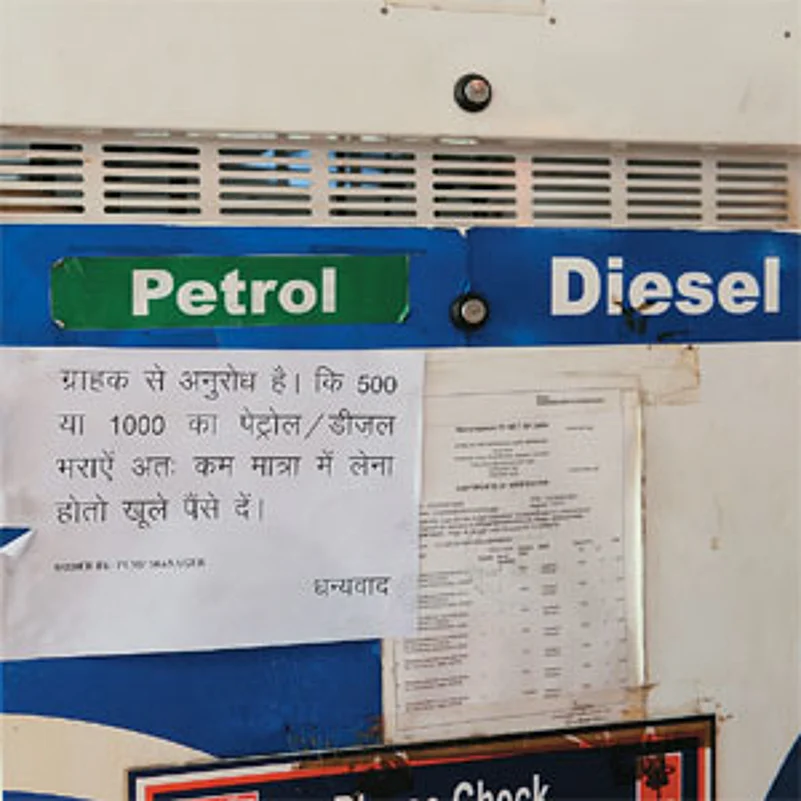

Fuel pumps are having a roaring business as they continue to accept old notes I Photo: Tribhuvan Tiwari

Fill it, shut it, forget it seems to be in the minds of the car owners on the night of announcement I Photo: Jitender Gupta

9) Insurance

The insurance sector was also impacted with the e-insurance accounts coming into play which allow policyholders to manage their policies online. With this move, policyholders benefit from the e-insurance account as it will help them consolidate all their insurance policies like life, health, motor and other forms through a single account. The year saw an overall exciting and active development on a lot of fronts. With the implementation of GST and the rippling effects of demonetisation, there is no doubt that 2017 is going to be an interesting year.

Both caution sign and money speak the same language everywhere