Amit Barolia is 31 years old and works in the life insurance industry. He has two children—5-year-old daughter Durvi and son Mikul, who is just 7 months old. Barolia has some financial liabilities which includes a personal loan and a home loan.

As such he has just set out on his journey and while doing so, at this stage of his life, care must be taken not to be overly conservative but rather go out and make hay while the sun shines. Their household expenses are approximately 84 per cent of the income and they are left with Rs.8,000 as saving. There is so much magic that can be attained from this money and also by restructuring some of the existing investments.

Children’s education

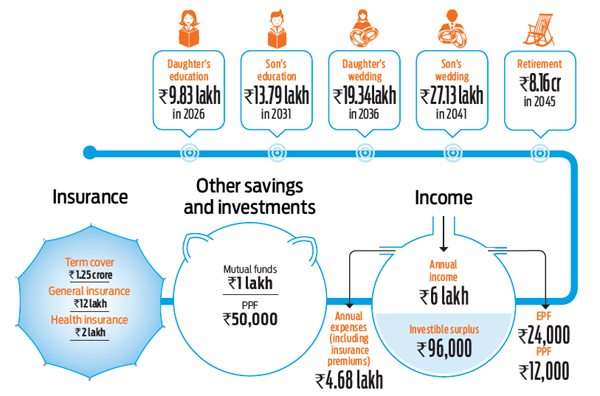

Education costs are spiralling every year. Planning early for children’s education will ensure that you do not have to compromise on this front when the actual need arises. To give a fair idea of Amit’s financial goals, the Rs.5 lakh requirement for education now will become approximately Rs.9.83 lakh in 2026 for his daughter and approximately Rs.13.79 lakh in 2031 for his son. This is assuming an inflation rate of 7 per cent annually. To fund this, Amit would need to earmark Rs.3,500 every month for his daughter and Rs.2,000 every month for his son. This is assuming a growth of about 14 per cent annually.

So, the Barolias are aiming too low for this goal. The costs are going to be much more than what they have anticipated and that would require reworking on their plans. Ideally, they’ll have to triple the savings at the very least. It may be difficult to manage for now but it is also important that they know what they will need to cater for in years to come by. So, they should increase allocations in this goal as and when they can.

Children’s marriage

As children are young, there is enough time in hand to meet this goal. When you start early in life to save, you require lesser amount for accomplishing a goal. The below table shows what their family needs to save each month.

Strategy for retirement

After providing for above goals we see that there is hardly any savings which can be diverted towards retirement. So they’ll need to either cut down on expenses or figure out a way to increase income to meet retirement requirement. Both these are easier said than done; but that is what the Barolias will need to do so that they are able to get a loan to fund education for children; however, there are no loans for retiring! Looking at things as of now, Amit would require Rs.30,000 per month post retirement (today’s value) to maintain the similar standard of living. The above amount will become approximately Rs.3.04 lakh (pre-tax). This is considering an inflation rate of 7 per cent and tax rate of 30 per cent. To meet the above monthly cash flows for the next 25 years starting from age 60 years, Amit will need to accumulate a corpus of approximately Rs.8.16 crore by age 60. And to do that he has another 29 years of working life to generate this corpus. He would require a monthly saving of Rs.17,000 each month to achieve this successfully.

For now, the family cannot fund the above requirements; hence the focus should be on increasing their disposable income. He should aim to close the personal loan at the earliest and divert the money towards retirement. He can also look to divert the annual bonus towards retirement savings. Last but not the least; a very important aspect of planning comprises of life insurance, health insurance, asset insurance and contingency funds.

As far as life insurance is concerned, a cover of Rs.1.25 crore seems adequate for now. They can increase it to about Rs.2 crore in coming three to four years. Coming to health insurance, Barolias must have their own private medical cover of minimum Rs.5 lakh (floater) unless they are absolutely sure that they will be employed forever with one company or that all their prospective employers would take care of the medical needs. Do not go overboard on the general insurance policies though. Accident and disability policy is fine to have as the premium is affordable from Amit’s perspective while the critical illness type of policies can be really expensive. So think twice.

Topping it off

As it is seen from above, the monthly surplus of Rs.8,000 has to go a long way. Voluntary PPF savings can also be diverted to ELSS so that longterm wealth creation as well as tax savings can happen simultaneously. Retirement goal as of now looks farfetched. However, with a combination of prudent budgeting and increase in income, Amit will be in a position to contribute towards this goal over time.

In order to achieve the goals, it is imperative that you start investing early, maintain a disciplined approach towards it and compulsorily invest in equities and later on in some real estate, too. This is not the time to be conservative. Rest assured that the calculated risk taken now will bear great results in years to come and help achieve the goals.