Like scores of Indians, Mumbai-based Sanjay V.Shirodkar, 47, is a die-hard believer in real estate and swears by investments in fixed return instruments. It’s a different matter though that exposure to fixed return instruments should be better off being in terms of savings than investments. Likewise, having too much exposure to realty is being overly exposed to a single asset class, which comes with its share of illiquidity. The Shirodkar family includes Sanjay, his wife Sukhada, 45, who works with the Indian Overseas Bank, and their two children Sohan, 17, and Sailee, 12.

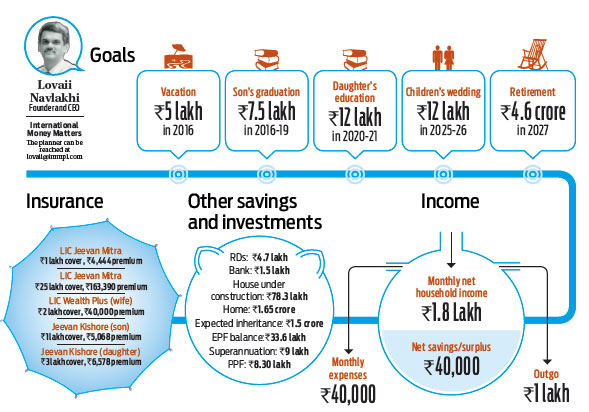

The family earns Rs.1.8 lakh a month and spends Rs.40,000 towards house-hold expenses and Rs.1 lakh on three home loans, a personal loan and an auto loan, with the balance Rs.40,000 as surplus. The family’s belief that they can build physical assets on borrowings is evident, and it has worked well, too. They live in a self-occupied house and have three under-construction flats (one in Talegaon and two in Umbergaon), which will be handed over after completion this May-June. Upon possession, these flats will generate an extra income stream and let the family fund many of their financial goals.

Plans in place

Although the Shirodkars have no exposure to equity, their financial goals will fall in place with some luck and plans that meet their objectives. The family is grossly under-insured, despite several life insurance plans. They seem to have approached life insurance more as savings plan for future financial goals than insurance. Considering their age and stage in life when their financial goals towards their children’s education, wedding and their own retirement goals are yet be achieved, they should increase their insurance cover. Likewise, they need to allocate funds to meet emergencies and also consider increasing the health insurance cover for themselves and their children.

Focusing on savings is a good habit and will help the family assess their financial needs in a better way and plan accordingly. However, the impact of inflation is a reality, which will not only eat into their savings, but also impact their financial goals. For instance, for a 60-year-old, if the return from a bank deposit was to underperform inflation even by just 2 per cent a year, the worth of the retirement corpus will be worth almost 50 per cent less by the time one turns 90. And 90 is not a huge number given the increasing longevity.

Their savings in PPF and endowment-type insurance plans that start to mature starting 2016, will meet their cash flow needs for approaching financial goals. Besides, their auto loan and personal loan will get over by August 2015, leaving them with enough surplus to invest in equity mutual funds. But what is important is to invest in inflation-beating financial instruments like equity to meet their retirement needs. With age on their side, it is still not too late to increase their overall equity exposure to benefit from the power of compounding and long-term benefits of equity investing. Likewise, as they have four houses in all, including the one they live in, there is every bit of a possibility to sell one of them in the future if they find income generation difficult when they retire.

A plan to act on

Emergencies

- You should be looking at having about Rs.10 lakh easily available to you for emergencies, which works to about six months’ household expenses

- Keep Rs.1.5 lakh from your bank balance towards the contingency fund

- Keep the RD balance towards meeting emergency needs

- Work towards increasing your savings in the future to create a sizeable emergency fund

Insurance

- Continue your existing life insurance policies

- Considering the loans that you are servicing and the financial goals that you have, it is recommended that you take a Rs.1 crore term plan and your wife takes a Rs.50 lakh term plan to cover your loans

- Purchase independent health cover or port the existing health cover to the ones which do not have too much exclusion for a cover of Rs.5 lakh for both of you

- Take a Rs.33 lakh health cover for each of your children

- Both of you should additionally take Rs.10 lakh critical illness cover

- Continue the health policies for as long as you can take them

Holiday

- Use a portion of LIC Jeevan Mitra that matures next year for the goal

- At the same time, start a systematic monthly investment of Rs.36,428 beginning June 2015—once the commitment towards your car loan ends—for 12 months in a liquid fund

Son’s education

- Use a portion of your RD investment and of LIC Jeevan Mitra maturing in 2016 towards this goal

- Use proceeds from the PPF as and when needed

- Start an SIP of Rs.10,168 from 2016 till 2018 in short-term debt funds

- Use LIC Jeevan Kishore maturing in 2019

- Also use portion of LIC Wealth Plus maturing in 2018

Daughter’s education

- Set aside a portion of LIC Wealth Plus maturing in 2018

- Set aside LIC Jeevan Mitra maturing in 2019

- Use her PPF

- Start a monthly SIP of Rs.9,128 from 2016 to 2020 in a hybrid scheme

- Use LIC Endowment with profits policies maturing in 2020

- Use your wife’s PPF that you have set aside to meet any shortfall

- Start a monthly SIP of Rs.7,932 from 2016 to 2021 in a hybrid scheme

Children’s wedding

- Use proceeds from LIC Jeevan Kishore maturing in 2025 to meet the wedding expenses of your children

- Start a monthly SIP of Rs.2,209 from 2016 till 2025 in diversified equity funds

- Start another monthly SIP of Rs.4,766 starting 2016 till 2026 in diversified equity funds

Retirement

- You will need Rs.2 lakh per month from 2027 when you retire, which is Rs.1 lakh in today’s terms to meet your monthly expenses

- Towards this end, you will need a Rs.4.6 crore corpus for inflation-linked expenses to run the 20 years of your retired life

- Use the maturity proceeds from your EPFs towards this end

- Use the LIC Jeevan Mitra maturing in 2030 and in 2031

- Additionally, deploy the rental income from the 2BHK in Talegaon towards your retirement goals

- Also, use the rental income from the 2BHK in Umbergaon for this

- Proportionate rental income from the inherited properties have also been assumed to be available to fund a part of the retirement needs

- To accumulate the deficit after considering future rentals and the assets earmarked, it is recommended that you start an SIP of Rs.35,352 from 2016 till your retirement

- Also remember to increase this SIP investment once your liabilities towards your loans and children’s education are met.