The latest bad news for fixed income investors is that interest rates have started to fall even without any rate cut by the Reserve Bank of India (RBI). It started with the State Bank of India (SBI) cutting deposit rates across medium and long tenure deposits by 0.25 per cent on 16 September, 2014. It is a big move, especially for senior citizens. These deposits were earning around 9 per cent interest before the cut. It might not be long before other banks follow suit. This may be the reason why the appeal of corporate fixed deposits (FDs) and non-convertible debentures (NCDs) is increasing by the day. Company FDs give higher tax adjusted returns over bank FDs, which is crucial for those in the highest tax bracket.

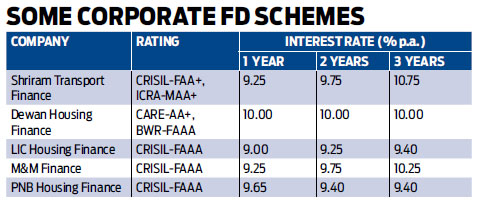

Even NCDs are offering higher returns than bank FDs. Take Shriram Transport Finance, for instance. The company issued NCDs at 10.7-11.5 per cent, depending on the payout option and duration of the bond, in July 2014. This is much higher than the banks’ rate, which stands at 8-9 per cent for various tenures. Many NCDs like Muthoot Fincorp and Manappuram Finance are offering interest rates of over 12 per cent. While there are plenty of company FDs that you could look at (see table), it is advisable to note a few points before you choose one.

Role of company FDs and NCDs in your portfolio. Just because these instruments offer higher yields, one shouldn’t invest all their money in them. It is important to allocate a percentage of your portfolio based on your age and risk appetite.

Says Suresh Sadagopan, founder, Ladder7 Financial Advisories, “If the investor is conservative and invests predominantly in bank deposits and NSCs, corporate deposits may prove to be a better option.”

The young could look at higher yield for their debt portfolio by decreasing investment in bank FDs and increasing the same in company FDs or NCDs. Says Hiren Dhakan, associate fund manager, Bonanza Portfolio, “For middleaged investors, corporate FDs are ideal instruments to lock in their savings at fixed interest rates for extended period of time. This way they can save for their retirement, for their children’s marriage and other similar goals.” The old could look at making higher yields by investing in company FDs and NCDs so that returns from their investments are able to beat inflation.

Risks involved. Corporate FDs and NCDs involve credit risk or default risk. This means that the investor faces the risk of default on interest, as it becomes due, or on principal at the time of maturity. So it is important to invest only in rated corporate deposits. Says Manish Jain, founder, Knowledge Partners, “Most investors should stick to AAA rated companies with an occasional AA rating.” Another important factor is liquidity. Most of the time, the repayment of corporate fixed deposit, if withdrawn prematurely, is at the sole discretion of the company. This means that the company reserves the right to not return your principal until maturity, even if you want to make a premature withdrawal. So, in case you need money in an emergency, you might not be able to get your hands on your FD within the time you want. Even if you do manage to get your money, the penalty might be heavy. “Corporate FDs cannot be broken till three months and after that they impose a penalty of 2-4 per cent on the agreed interest rate. So if liquidity is an important consideration, bank FDs are a better bet,” says Sadagopan. Today, many banks do not charge any penalty for premature withdrawal of deposits. Liquidity in NCDs is also low. Even though NCDs are listed on stock exchanges, it could prove tough to find buyers if you want your money before maturity.

Further, there is a chance that interest payments get delayed as this too is at the discretion of the firm. For seniors who need regular interest payments, it would be a better option to invest in sovereign fixed income instruments like the Senior Citizen Savings Scheme (SCSS). Says Vivek Karwa, chairman, Vridhi, a financial services firm, “One could invest in the Senior Citizen Savings Scheme, where for an investment of Rs. 15 lakh one would receive Rs. 34,500 every quarter at 9.2 per cent per annum.”

Due Diligence. It is recommended that you do research before you choose corporate deposits. Not all companies are authorised to take deposits. According to the new rules by the Securities and Exchange Board of India, if public limited companies want to take deposits, they need to have a net worth of over Rs. 100 crore and a turnover exceeding Rs. 500 crore. It is also compulsory for eligible companies to obtain a credit rating every year from a recognised rating agency.

One also needs to look at the financial performance of the firm. Says Jain, “Current financial health and numbers of the company should be looked at before committing.” For hassle-free investing, go for rated firms and shorter tenures. Longer tenures mean more risk. Don’t invest in a single company. Spread your money across firms.