Yes, small savings are a big hit with the middle class and scores of tax savers, who find the simplicity and assured returns offered by them a smart way to save money, and in some cases like the PPF, save on taxes as well. So, when on March 18 the government announced steep cuts in their returns it was just acting on what it had suggested a month earlier when it had mentioned its plans to moving interest rates on small saving instruments closer to market rates. In fact, it had cut rates on short-term post office deposits by 0.25 per cent immediately, clearly indicating what was next to follow with small savings.

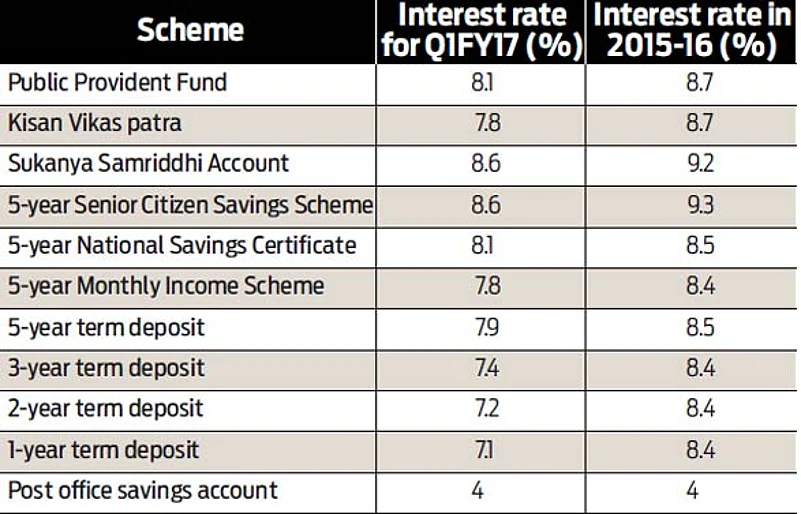

Assured returns on small savings have been fluctuating since 2011, when the National Small Savings Fund (NSSF) was reviewed and the rates on these products were benchmarked to government securities (G-secs) of similar maturity periods with a positive spread of 25 basis points (bps). Ever since, the government notifies the interest rates applicable for the year on various small savings instruments before April 1 every year. As far as the spread is concerned, in case of the senior citizens savings scheme (SCSS), the mark-up was 100 bps, and for the recently launched Sukanya Samriddhi Account, it was 75 bps.

Arbitrage

Naturally, assured interest rates are far better compared to the falling rates with savings bank and other options available. The spill off; banks felt the heat most with deposits in banks going down due to the higher returns from post office small savings. In its bid to bring parity to similar products, the government decided to reduce the rates and removed the positive spread of 25 bps on products competing directly with bank deposits. Additionally, the government will now on calculate the interest rate on all small savings schemes on a quarterly basis to align their interest rates with the market rates of the relevant government securities from the next financial year (FY17).

For those coming in late, this move is similar to what one experienced in 2014, when the government removed the tax advantage that fixed maturity plans (FMP) offered by the mutual fund companies had over bank deposits. The reasoning was that this product was driving away deposits from banks to these mutual fund schemes. What it means to you is that henceforth there is less interest rate arbitrage that you can play with. However, the move should not make you stop from staying put with the PPF for now. The tax advantages at the time of withdrawal with this product is still a factor which tilts the scale in its favour. Not to forget the fact that if you have been putting money into it, you should stay till maturity.

olmdesk@outlookindia.com