It is the story playing out with the millennial generation— they are smart, fast on the uptake and highly consumption driven. Garbed in their smart phones and smart watches, wearing swanky branded clothes, they have a different perspective on how they view money. Result: the word ‘savings’ has disappeared from their financial lexicon with ‘spending’ taking charge. The fallout—majority of urban youngsters today are living salary-to-salary, some scrimping the month with great difficulty.

It is common to meet millennials who go broke a week before the end of the month, yet stretch their credit limits on multiple cards and easy-to-borrow-routes—parents and friends. “While few urban youngsters are financially savvy and good savers due to family influence, most of them have no clue of money concepts. They are tempted to buy the best of electronics and spend on exotic vacations, with no clue about their future,” says Renu Maheshwari, CEO, Finscholarz.

App to the rescue

It is never too late to reassess your finances and the first step towards doing it is to track and analyse where your money is going. While keeping an expense diary and updating it can be an exhaustive affair, the other way of doing it is by reading your bank statements and trying to deduce where you spend the most. Plastic money and wallet spends have lead to the urban youngsters not feeling the same pinch one senses when one dispenses the same amount in cash. But remember, each transaction and card swipe is depleting your money from your bank account and it is important that you do not spend beyond your means.

For the digital savvy youngsters, using budgeting app can be one of the best ways to ensure they are on the right track to be financially fit. For a generation that likes everything on the go and loves automation, the budgeting apps can be a big boon.Most of these apps credit limits on multiple cards and easy-to-borrow-routes—parents and friends. “While few urban youngsters are financially savvy and good savers due to family influence, most of them have no clue of money concepts. They are tempted to buy the best of electronics and spend on exotic vacations, with no clue about their future,” says Renu Maheshwari, CEO, Finscholarz. App to the rescue It is never too late to reassess your finances and the first step towards doing it is to track and analyse where your money is going.

While keeping an expense diary and updating it can be an exhaustive affair, the other way of doing it is by reading your bank statements and trying to deduce where you spend the most. Plastic money and wallet spends have lead to the urban youngsters not feeling the same pinch one senses when one dispenses the same amount in cash. But remember, each transaction and card swipe is depleting your money from your bank account Aju Thomas, 25, Bengaluru Started using Walnut after experimenting with various apps and cut down on his eating out expenses that formed a considerable chunk.

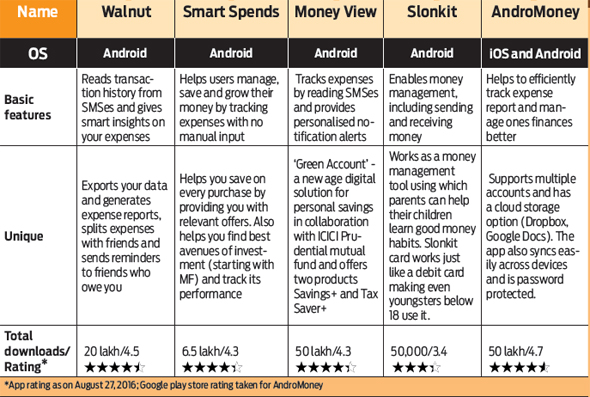

“I now have a view of my expenses divided among different categories and spend more time weighing my options before any big purchase.” Top five budget apps that you can use use the information from SMS and read the messages received from banks, merchants, other billers and automatically analyse the spending and divide it into different categories without having to manually fill each expense in the app every time you transact.

Bengaluru-based IT professional, Aju Thomas (25), recognised the need for a budgeting app when he realised he was spending all his money without keeping a track of his expenses. After doing some research and using multiple apps for a while, he settled for Walnut, an Android-based app used by over 20 lakh people.

“Our app is up-to-date, tracks ones expenses and provides a daily notification and budget recommendations to help its users become financially disciplined,” says Amit Bhor, co-founder, Walnut. “Our app is also used actively to set bill reminders and split dues between friends,” adds Bhor. Through this app, Thomas now has an allocated budget which he never overshoots and has altered his spending habits to align with his income. “I realised that I was eating out a lot and started cooking at home as it is cheaper, healthier and tastier,” quips Thomas.

“Once the urban youngsters start earning, the usual tendency is to fulfil their desires—this could be an expensive phone or gadget buy or a vacation, or any branded clothes that they couldn’t buy in college. The same is the case in tier-II and tier-III cities as nothing is out of reach due to the booming e-commerce sector. They have the money at their disposal and have the urge to spend more rather than save,” says Uday Dhoot, founder, Oyepaisa.com.

Vivek Luke Cornelio (27), a communication each, thus diversifying his investments into mutual funds and small savings.

“These apps are extremely useful when it comes to setting reminders for your bill payments. In our busy schedule and multiple bill payment dates, we end up forgetting the payment days. In case of credit card payments, etc, this can affect your credit score. So having an app-based reminder really helps,” says Dhoot.

For 23-year-old Delhi-based Mehul Dhikonia, graduating from IIT-Delhi meant landing up a high paying job. He started splurging most of his salary in the beginning without keeping a track of his expenses and soon realised his exorbitant spending habit. “Spending money in a city like Delhi is way too easy and initially I went wild with my spending. The amount I was spending on others was startling and that lead to me putting brakes on my spending,” says Dhikonia. Being from a banking family soon made him open a RD and contribute Rs. 30,000 towards it monthly.

Money View is yet another popular Android-based app that has more than 50 lakh downloads. “Money View maps your income and expenditure automatically and gives you a cohesive picture of your budget in real time. Apart from that, Savings+ is an innovative and firstof-its kind app-based liquid funds investment solution from Money View, in partnership with ICICI Prudential,” says its co-founder Puneet Agarwal. Dhikonia had started using this app few months ago and it has helped him in understanding his spending patterns better. “The ability to effortlessly add accounts and the new ITR filing service in this app has made my money matters effortless,” says Dhikonia.

Investing better

Tracking your expenses is only one part of attaining financial discipline. Once you are frugal with how you manage your money and are able to save it, you should slowly move towards investing for the future and set different financial goals and work towards attaining them. Make sure when you start earning, you don’t increase your expenses with an increase in your salary. “Follow the natural cycle of earn, save, invest and do not pile up on EMIs so early in life,” advices Maheshwari.

Tracking your money early in life can go a long way in making you financially stable, than living salary-to-salary. Always keep aside a surplus amount that can be used to meet your expenses while switching jobs or meet unexpected big expenses. Yes, a Zara sale, Aldo shoes, an expensive iPhone, Xbox 360, partying or eating out at a high-end place, going for an high-priced concert, etc might seem tempting and desirable as a young adult. Make sure you are not doing it by borrowing money from friends and spending beyond your means. Foregoing small pleasures today can help you achieve and fund bigger financial goals in the future.