When it comes to income tax, the focus is more towards savings than planning it efficiently, which leads to suboptimal way of using the available tax deductions. One of the biggest challenges that every taxpayer faces is to preserve the value of his money; basically ensure that it does not lose its worth, which is possible only if it beats inflation. The only known asset class that beats inflation in the long run is equity and it is for this reason that every taxpayer should make the most of the available tax deduction that can be deployed in suitable equity instruments.

The positioning of the Equity Linked Savings Scheme (ELSS) is unique within the universe of instruments in which one can save and invest to bring the income tax liability down. It is also the most unique mutual fund scheme as it is open for investments to only individual taxpayers and HUFs (Hindu Undivided Family). This diversified equity fund is approved by the central board of direct taxes (CBDT) to qualify as a tax saving instrument. So, investments in this fund qualify for tax exemption under section 80C of the Income Tax Act.

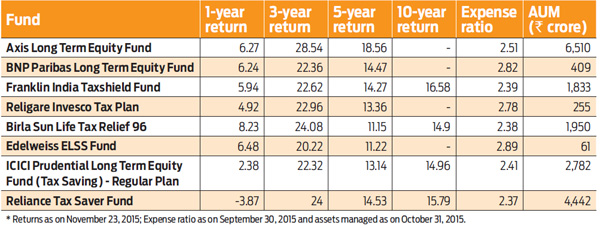

As each tax planning fund is constructed differently, which means there is choice with varying degree of risk when investing in these schemes. Keeping this in mind, the OLM Elite has a mix of ELSS that suit the risk profile of different taxpayers. What this means for you as a taxpayer is that you can use the different benchmarks, portfolios and investment approaches to choose a fund that meets your twin needs of tax savings and wealth creation.

Like other diversified equity schemes, ELSS is also actively managed and has different characteristics which aids in their performance. To arrive at a wide variety of ELSS that you can consider before investing between now and March 2016, we have hand-picked eight different schemes with varying risk profile and investment approach from the ELSS universe. All these schemes are well diversified equity mutual funds, with a proven track record and history, making it a suitable option for every investor looking to save tax and also invest in equities.

To know how each of these 8 hand-picked funds is managed, we spoke to each of the fund managers. You can read each of them has to say about managing their fund schemes over the next few days.