When the Reserve Bank of India (RBI) put a six-month ban on the New India Cooperative Bank, panic prevailed, and customers thronged the bank branches to withdraw their money. While RBI prevented the bank from allowing withdrawals, it assured that the customers are secured up to Rs 5 lakh in their accounts under the Deposit Interest and Credit Guarantee Corporation (DICGC) insurance cover.

DICGC And Daava Soochak Portal: How They Secure Bank Customers And Help Track Deposit Claims When A Bank Fails

Deposit Interest and Credit Guarantee Corporation (DICGC) provides deposit insurance to bank depositors, while the Daava Soochak portal is an online tool that allows customers to track their deposit withdrawal claim

Regarding this, on February 17, 2025, M Nagaraju, Secretary, Department of Financial Services, announced that a proposal to increase the DICGC insurance cover is under ‘active consideration’, according to a PTI report.

Notably, DICGC insurance comes into use when a bank fails and liquidates. Let's understand what DICGC is and how bank customers can benefit from it.

What Is DICGC?

The DICGC is a subsidiary of RBI to provide deposit insurance to bank customers in case of a bank failure. The insured deposits, including saving, current, fixed, and recurring deposits, are covered under insurance for up to Rs 5 lakh per account holder per bank.

How It Came Into Existence?

After a few banks failed in 1960, the Deposit Insurance Corporation (DIC) Bill was introduced in 1961, and DIC started functioning effective January 1, 1962.

The scheme started with 287 banks covered under it. In 1968, it included ‘eligible co-operative banks’ also. In 1978, Credit Guarantee Corporation of India Ltd (CGCI) and DIC were merged to form the current Deposit Insurance and Credit Guarantee Corporation (DICGC) with the core objective to reduce systemic risk, ensure financial stability, and avert panic among public.

What Is Covered Under The DICGC Scheme?

DICGC covers all commercial banks, including public sector banks, private sector banks, regional rural banks, foreign banks, small finance banks, payment banks, local area banks, and co-operative banks, including state cooperative, district central cooperative, and urban cooperative banks.

If in case a bank fails and goes bankrupt, the depositors’ money in these banks remains safe up to the stipulated limit.

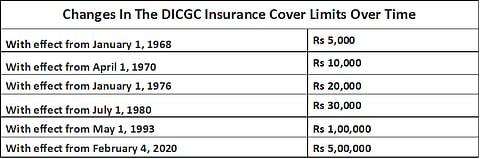

However, this limit has not always been the same from the beginning. According to the DICGC website, initially, the insurance cover was limited to 1,500. It was changed several times later to the current limit.

Source: DICGC

While the limit enhancement is again under consideration, for now the customer are secured only up to Rs 5 lakh per bank per account holder.

What Is Daava Soochak Portal And How To Track Deposit Claims On The Portal:

DICGC launched the portal Daava Soochak in August 2024 for this purpose. The portal provides an online claim-tracking facility to customers. As per the DICGC’s press release dated August 28, 2024, “Depositors can now track the status of their claims by entering their mobile number (registered with their bank) on the DICGC website”.

How Can A Depositor Access This Tool?

To track the claim status, one needs to visit the DICGC website and click on the ‘Daava Soochak – Claim Status Tracker’, tab. In the next window, select the bank from the dropdown list and enter your mobile number to generate the OTP and the next screen will show the claim status. As per the DICGC website, “Currently the information is available only for banks placed under All Inclusive Directions after April 1, 2024 / banks under liquidation in respect of which claim list is received after April 1, 2024”.

How DICGC Claims Are Settled?

As per the RBI website, “In the event of a bank's liquidation, the liquidator prepares depositor wise claim list and sends it to the DICGC for scrutiny and payment. The DICGC pays the money to the liquidator, who is liable to pay the depositors. In the case of amalgamation/merger of banks, the amount due to each depositor is paid to the transferee bank”.

According to the DICGC (Amendment) Act, 2021, “DICGC shall pay the depositors of the insured banks (as per list) placed under AID (with restrictions on withdrawal of deposits), an amount equivalent to the deposits outstanding (up to a maximum of Rupees Five Lakh only) within a period not exceeding 90 days”. The banks need to submit the claim within 45 days after obtaining the depositors’ willingness to claim deposits, and then DICGC verifies and settles the claim in the next 45 days.

As far as the New India Cooperative Bank is concerned, RBI has directed the bank to submit the list of depositors to DICGC as prescriber within 45 days, that is by March 30, 2025.