· Punjab National Bank reduces MCLR by up to 15 bps effective September 1, 2025

· Bank of India also revises MCLR, effective the same date

· Interest rates adjusted across various tenures for both banks

· Punjab National Bank reduces MCLR by up to 15 bps effective September 1, 2025

· Bank of India also revises MCLR, effective the same date

· Interest rates adjusted across various tenures for both banks

Two public sector banks revised their marginal cost of fund-based lending rates (MCLR), effective September 1, 2025. The revision is a cut in lending rates. As a result of the Reserve Bank of India's (RBI) 1 per cent (100 basis points – bps) repo rate cut this year, banks are adjusting their interest rates, including both lending and deposit rates. The latest to join the wagon are Punjab National Bank (PNB) and Bank of India (BoI). Both banks have reduced their MCLR by up to 15 per cent. The lower MCLR means lower interest rates for borrowers.

In the last few months, several other banks have also revised their lending rates, including the State Bank of India (SBI), Central Bank of India, Bank of Baroda, HDFC Bank, among others. Here are the latest MCLR rates of PNB and BoI.

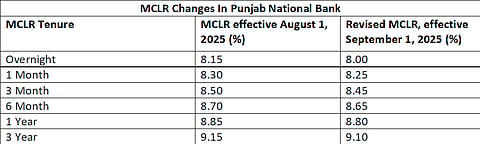

The public sector lender has revised MCLR by a maximum of 15 bps for overnight tenure. For all the other tenures, the reduction is only 5 bps. For a month, it is now 8.25 per cent, whereas for three and six months, the revised MCLR stands at 8.45 per cent and 8.65 per cent, respectively. The longer tenures of one year MCLR changed to 8.80 per cent and three years to 9.10 per cent.

A comparison with its previous MCLR:

Source: Bank Website

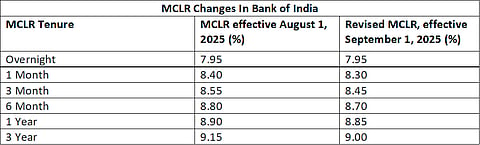

Bank of India’s revised MCLR is also effective September 1, 2025. The bank kept MCLR unchanged for overnight tenure, but has reduced it for other tenures. It has reduced the MCLR by 10 bps to 8.39 per cent for one month and by 5 bps for three months. Similarly, for six months, the rates are reduced by 10 bps to 8.70 per cent, and for a one-year tenure, the rate cut is 5 bps to 8.85 per cent. The highest cut is in the three-year MCLR, which is reduced from 9.15 per cent to 9.00 per cent now.

A comparison with its previous MCLR:

Source: Bank Website

MCLR is the minimum interest rate at which banks can lend money to borrowers. Every bank sets its own MCLR rate, which includes the repo rate. The four components of determining MCLR include the marginal cost of funds (the repo rate is considered under this), cash reserve ratio, operating expenses, and the tenure premium.