Gold has outperformed the Nifty 50 in CAGR terms over the short-term

Equities are less likely to give negative returns over longer periods of time

Gold has witnessed periods of subdued returns after touching record highs

Gold Outperforms Equities Over Near-Term and Long-Term, Says FundsIndia Report - Know What Investors Should Do

A report by online investment platform FundsIndia showed that the trend of gold outperforming the Nifty 50 has sustained over a wide time horizon. The comparison between the two asset classes, equities and gold, becomes significant as investors contemplate shifting their focus towards the yellow metal, given the rally in gold prices

Gold has given stellar returns in 2025, outperforming the returns offered by equities. The price of gold is Rs 12,507 per gram, indicating a gain of 60.34 per cent year-to-date. On the other hand, the Nifty 50 is trading around 25,950.85 levels, indicating year-to-date gains of 9.29 per cent.

A report by online investment platform FundsIndia showed that the trend of gold outperforming the Nifty 50 has sustained over a wide time horizon. The comparison between the two asset classes, equities and gold, becomes significant as investors contemplate shifting their focus towards the yellow metal, given the rally in gold prices. However, before making such a decision, investors must consider the short-term returns, long-term returns, and other factors associated with the performance of an asset.

Gold vs Equity In The Near Term

The report stated that over the past one-year, three-year, and five-year periods, the Nifty 50 has underperformed gold. The compounded annual growth rate (CAGR) of the Nifty 50 has been around 7.6 per cent in the past year; on the other hand, the CAGR of gold has grown by 54.9 per cent.

Notably, this rise in gold prices has been driven by the heightened geopolitical tensions, economic uncertainty, and expectations of interest rate cuts by the U.S. Federal Reserve, and consistent buying by global central banks. In 2025, investor sentiment shifted towards gold for its safe-haven asset appeal as it acts as a hedge against market volatility and risk. Volatility has remained high amid ongoing conflicts, such as the Russia-Ukraine war, tensions in the Middle East, and renewed U.S.-China trade friction.

However, the trend has also sustained on the three-year and five-year time horizons. In the last three years, Nifty grew at a CAGR of 13.9 per cent and gold grew at a CAGR of 37.9 per cent. Over a five-year time horizon, the CAGR of Nifty 50 stood at 18.6 per cent, and the growth rate for gold stood at 20.6 per cent.

Gold’s Long-Term Returns

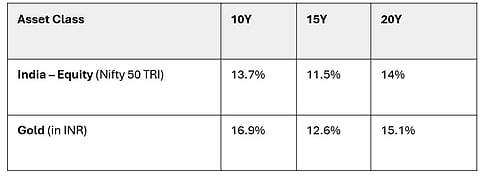

Gold has outperformed equities on a long-term basis as well. According to FundIndia’s report, the price of gold has surged at a CAGR of 16.9 per cent in the last ten years, while Nifty 50 has given returns of 13.7 per cent. On a 15-year and 20-year basis, the yellow metal’s price increased with a CAGR of 12.6 per cent and 15.1 per cent, respectively.

Why Investors Should Look Beyond Returns

Gold’s returns continue to attract investors to the yellow metal. However, the report also showed that while gold has outperformed equities, the precious metal also goes through cycles. The yellow metal has given strong returns over the long-term and short-term, but also goes through long intermittent periods of subdued returns. The report showed that between 1980 and 2025, gold has witnessed several long periods in which the asset gave no returns after hitting record highs.

In 1980, gold prices touched a record high amid factors such as high global inflation and the Soviet invasion of Afghanistan, which led to safe-haven buying. However, the yellow metal took 10 years to reclaim the peak it had touched in 1980. Thus, gold grew at a CAGR of 0 per cent between 1980 and 89. The report found that a similar phenomenon occurred between 1996 and 2002, wherein the yellow metal took seven years to hit its 1996 peak, growing at a CAGR of 0 per cent. In recent times, the phenomenon repeated again between 2012 and 2019.

The report also showed that over longer time frames, gold is more likely to give negative returns than equities. The report showed that in a month, the likelihood of getting negative returns from gold is 45 per cent, and the chances of getting negative returns from equities are 38 percent. Over a three-month time horizon, the likelihood of getting negative returns from an investment in gold and equities remains around 38 per cent and 35 per cent, respectively.

However, the likelihood reduces over the three-year and five-year time horizons. In a three-year time horizon, the chances of getting negative returns from gold and equities are 14 per cent and 6 per cent, respectively. Over a five-year time horizon, the likelihood of getting negative returns from gold and equities reduces to 11 per cent and 0.1 per cent, respectively.

What Should Investors Do?

The buzz around investment in gold remains high. Especially given recent corrections in gold prices. As of November 17, the price of gold is significantly off its recent record high of Rs 1,32,770 per 10 grams. However, investors should proceed with caution and keep in mind the pros and cons of investing in gold. Historically, massive jumps in gold prices to record highs have followed periods of underperformance and stagnancy. Thus, investors should avoid over-allocating towards gold, relying solely on the hype and rise in prices.

Analysts typically suggest allocating 5 per cent to 15 per cent of your total investment portfolio towards gold. However, investors should consider their own financial goals and choose an allocation accordingly.