In the last five years, systematic investment plans (SIPs) have emerged as a key driver of growth in mutual funds, its value more than tripling from Rs 8,055 crore in March 2019 to Rs 25,999 crore in February 2025, according to data from the Association of Mutual Funds in India (Amfi). But data also shows that the trend seems to have reversed in the last six months, along with the market movement.

The Sahi Question: Should You Continue With Your SIPs Or Stop Them

The market downtrend combined with a high SIP stoppage ratio has left many mutual fund investors in a quandary on whether they should continue their SIPs or not. We tell you when it makes sense to stop SIPs

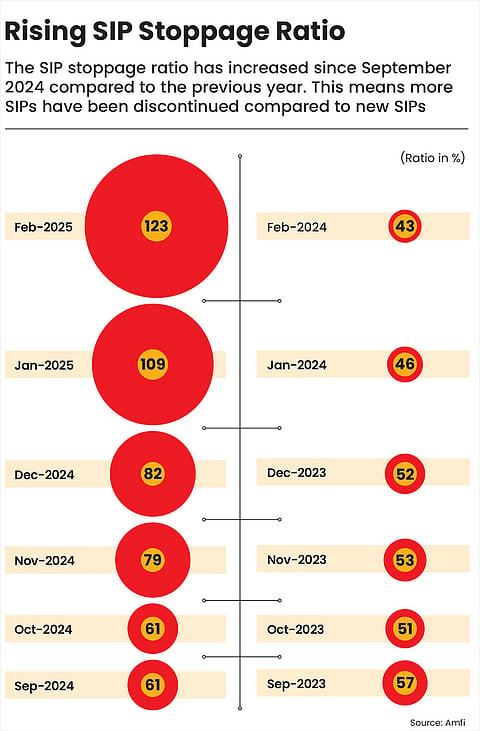

While the number of SIPs discontinued has increased, so has the SIP stoppage ratio (see Rising SIP Stoppage Ratio). The SIP stoppage ratio is calculated by comparing the number of SIPs that have been discontinued to the number of new SIPs that have been started. As of February 2025, the SIP stoppage ratio has hit a record high, surging to 122.76 per cent, from 109 per cent in January 2025, 82.73 per cent in December 2024 and 60.72 per cent in September 2024.

In fact, the number of SIPs discontinued has risen every month from 3.88 million in October 2024 to 5.47 million in February 2025.

Indian stock markets have continued to trade under pressure between October 2024 and February 2025. The benchmark indices, the BSE Sensex and the Nifty, have closed in the red consistently for the last five months. Notably, this is the longest such streak since 1996. As of February 28, 2025, the Nifty and the Sensex have fallen 15.8 per cent and 14.86 per cent, respectively, from their 52-week high in the five-month period. However, there was slight recovery later in March, at the time of going to print.

The downtrend combined with a high stoppage ratio has left many mutual fund investors, who are still invested and have not given in to the herd mentality of exiting the market when they are lower, in a dilemma much like Shakespeare’s protagonist Hamlet. Our modern day Hamlets struggle with a financially loaded decision whether to ‘SIP or to STOP SIP’.

Though investors are tempted to redeem or stop their investments during corrections, as markets wear down their patience with each fall, the fear of missing out is also palpable, since lower market levels present good buying opportunities. What has added to the confusion is various market experts weighing for and against stopping SIPs, especially in the beleaguered small- and mid-cap categories.

So how do you navigate this dilemma? In such times, one of the redeeming factors is having a clear view of your financial goals, short or long term, and the quality of your fund. We list a couple of possible situations in which you may opt to discontinue your SIP investments, irrespective of the market movement.

Mismatch With Goals

It is a common misconception that any SIP is good, but for it to work for you, it needs to be started in a scheme that has the potential to perform and is suitable for your goals and needs.

Even aware investors, who invest only after reading about a scheme, may end up with a fund whose strategy does not align with their overall financial goals and end use. For instance, returns from a debt fund may not align with long-term end-use, such as children’s education. Similarly, equity funds may not be suitable for short-term needs like the need for payment of college fees within a year or two.

Therefore, at any point, if you realise that your end-use and investment do not align, you may consider discontinuing your SIP and switching to a more appropriate one.

Viral Bhatt, founder of Money Mantra and personal finance consultant, says that apart from discontinuing their SIPs, investors can also consider reassessing the asset allocation or fund selection.

He says: “Investment goals should be the guiding force behind any decision regarding SIPs, not just short-term returns. If an investor realises that their current SIP is not aligned with long-term objectives—such as retirement, child’s education, or wealth creation—it’s worth reassessing the asset allocation or fund selection rather than discontinuing the SIP altogether.”

This usually happens as you advance in age. Your financial goals are likely to shift dramatically as you enter new phases of life.

For instance, some of the early-career financial goals for which most people begin to invest in mutual funds through SIPs include buying a home or vehicle. As they grow older, the priorities shift to saving towards goals, including creating a corpus for retirement or a child’s education. In other words, most of the financial goals would graduate from being short-term in nature to long-term.

In this case, you may consider stopping your SIPs catering to short-term goals, and switch to schemes that need to be held for longer durations. You may also consider a systematic withdrawal plan (SWP), where your savings left in debt funds can be transferred regularly to an equity fund, which you might need for goals at least 10 years away.

Manish Mehta, joint president and national head sales, marketing and digital business, Kotak Mahindra Asset Management, urges investors to consider the time horizon for achieving their investment goal and remain invested vis-a-vis SIPs, and be patient.

“Investment goals can vary from person to person; for some it can be retirement, and/or a child’s education and wedding. Time horizons vary for each of these goals. For the goals to play out, one needs to give time and be patient. That’s what SIPs do: help you achieve your goals in a disciplined manner over various periods,” Mehta says.

Underperformance

A fund may underperform due to various reasons, such as change in the investing strategy by the fund managers, a market downturn, or negative news hitting a particular sector or category. But not all such cases warrant stopping an SIP.

Fund Manager Issues: When a fund underperforms, one of the things that you may look at is the investing choices and strategy adopted by the fund manager.

However, it’s never advisable to judge the fund manager on the basis of a single phase of underperformance, which may be due to a market downturn, which may be the case with some funds in recent times.

New investors often look at a fund’s past performance. Though it gives a view of the overall trend, but that is not a guarantee to future returns

In such cases, it makes sense to hold the fund for a while and assess if the fund manager fails to generate returns from opportunities that similar funds are benefiting from over a longer period of time. If your fund consistently underperforms other similar funds, then you may consider discontinuing your SIP.

Says Bhatt: “If a fund manager’s strategy has shifted significantly—for instance, if a growth-oriented fund starts adopting a value investing approach—it may create a mismatch with the risk appetite and financial goals. Investors should periodically review fund manager commentaries, portfolio changes, and the overall investment style. If the new strategy doesn’t align with the investor’s expectations, they may consider switching to a fund that better suits their investment philosophy. However, making a decision purely based on short-term changes can be counterproductive. A well-diversified portfolio should account for different styles of fund management.”

Bad Pick: Investors, especially new ones, often look at the past performance of a fund to make the right choice. The metric is useful, as it gives you a broad idea about the overall trend in the past. However, past performance does not guarantee future returns. For example, in the past, a fund may have performed well due to cyclical rises in the overall market.

Instead, you should look at various other metrics to pick a suitable fund. These include its ability to generate alpha, its performance against peers in the same category, its portfolio turnover ratio, key investing ratios, and others. If you are unable to choose a fund on your own, consult an advisor.

If you are already holding such a fund and investing in it through an SIP and have realised its shortcomings only recently, you may consider stopping your SIP investment.

Conclusion

When it comes to fund performance, it’s always advisable to rationalise your expectations according to the market movement.

Says Mehta: “During one’s investment journey, there will be bouts of volatility and instances where a scheme may underperform the benchmark, but if the investment horizon is long term, then one should allow the investments to continue. There is enough available data to demonstrate that most schemes have generated returns better than the benchmark over long periods of time.”

It is counter-intuitive to discontinue SIPs solely because of short-term underperformance, which may be a result of market volatility. Vaibhav Porwal, co-founder of wealth management company Dezerv, says that investing during a downturn may be beneficial as investors tend to gain from rupee-cost averaging in such situations. “Market corrections allow SIP investors to accumulate more units at lower prices, lowering the average purchase cost,” he adds.

Typically, discontinuing SIPs during a downturn locks in losses, and, historically, investors who have continued to stay invested have been rewarded by the market.

So, to answer Hamlet’s dilemma in your investing journey, balance the risk and reward of your actions before discontinuing your SIPs.

ayush.khar@outlookindia.com