The insurance industry is not untouched by AI. In fact, many innovations that the health insurance industry has seen in recent years have been driven by technology, with AI playing a large role. We list some areas which AI has impacted, whether the changes are beneficial for customers, and the caveats they come with.

How AI Is Changing The Future Of Insurance

The insurance industry has adopted AI in a big way and is relying on it for several backend processes from underwriting to claims processing. However, data privacy and biased recommendations remain a concern

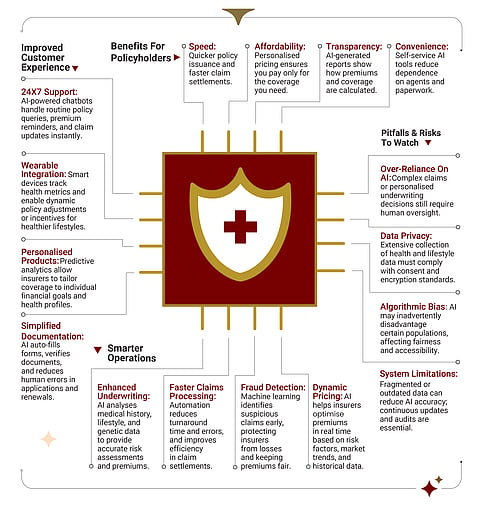

Better Customer Experience

Generative AI has boosted customer retention in insurance by 14 per cent, according to a recent report by Aritvatic, an AI insurtech platform.

Personalisation And Affordability: A key benefit of AI is the personalisation it can provide by tailoring policies to individual needs. This helps insurers to come up with better pricing strategies so that costs stay low and the market doesn’t become too fragmented. This also improves customer satisfaction and enhances customer engagement.

This brings us to another benefit of AI: affordability. “AI will enable the design of highly targeted products for micro-segments, which will offer better coverage at affordable premiums,” says Santosh Bhat, head, advanced technology, Policybazaar, an insurance aggregator.

Quicker Policy Issuance: AI has already shortened the turnaround time in the issuance of health policies by optimising several backend processes, such as underwriting and risk assessment. “AI can assess risk with greater precision and determine fair premiums. It has also improved the claims process,” says Bhat.

Simplifying Claims Process: AI in health insurance started with processing claims, finding problems in the claims process, and using advanced document intelligence. “In the next 10 years, we think AI will keep getting better. This will speed up the claims process,” says Krishnan Badrinath, head, technology, Tata AIG General Insurance.

Aiding Decisions: The crux of insurance policies lies in the details of the terms and conditions and how they relate to a customer’s specific situation. This is where Gen AI-based solutions can help. “It can look at the customer’s specific situation, like age, location, medical history, and match those against the policy terms and conditions, features, price, and recommend the ones that fit the specific need,” says Amitava Deb, vertical head, insurance, business development, Decimal Point Analytics, a provider of AI-powered data analytics.

He adds: “AI systems can provide detailed recommendation that break down the reasoning behind each suggestion, including comparative analysis charts and risk-benefit explanations that can be shared with customers and satisfy regulatory transparency requirements, too.”

Risks To Be Addressed

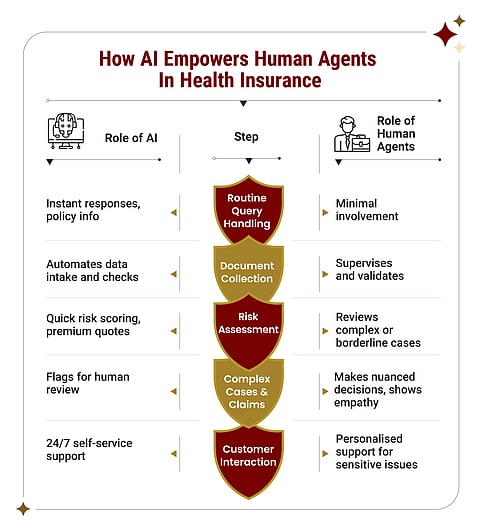

May Not Handle Complexities: AI tools like agentic AI, generative AI, and predictive modelling help health insurers handle routine queries, claims, and policy recommendations effectively. However, over-reliance on AI can cause problems.

For instance, for complex queries related to claim resolution or personalised underwriting, AI can give faulty recommendations. This may affect customer trust and risk regulatory scrutiny. So human oversight is crucial. In such cases, the policyholder will finally suffer.

Insurers are addressing this by retaining the human touch. “We build our models using data from diverse sources right from the start, which lowers the risk of bias. These models are there to guide and not take the final decisions,” says Bhat.

Bajaj Allianz General Insurance, follows a “human-in-the-loop” model where AI handles the routine queries and high-volume interactions, providing instant responses to queries, while humans focus on complex and sensitive cases.

Says Avinash Naik, chief information officer, Bajaj Allianz General Insurance: “Our AI model is capable of deciding whether a query needs human intervention and transfers it when necessary. This way, customers always get attention and empathy for complex queries.”

“We leverage semantic understanding (via our GenAI Studio with Retrieval-Augmented Generation (RAG) pipelines, predictive modeling (via our MLOps pipelines) which refers to automated deploying, monitoring, and managing machine learning models for continuous, reliable production, and feedback-loop reinforcement learning—all wrapped in explainable AI so every recommendation has a reason code attached,” says Sandeep Khuperkar, CEO and Founder, DSW (Data Science Wizards) UnifyAI, an enterprise grade GenAI platform.

Updates Are Crucial: AI systems need constant updates so that the data stays relevant. Says Deb: “The main issues include establishing robust frameworks for constant health data monitoring, and ensuring that algorithmic fairness doesn’t inadvertently exclude vulnerable populations from affordable coverage, while developing technical standards that balance personalisation with privacy while maintaining the fundamental insurance principle of risk pooling across diverse socioeconomic segments.”

Privacy Concerns: Insurers claim they align with the government’s Data Protection Bill, and encrypt customer’s data and use it with consent. “Internal and third-party audits are conducted regularly for data protection,” says Naik.

Transparency Is A Must: Experts say audit trails are required to capture the entire decision-making process, allowing insurers to demonstrate to the Insurance Regulatory Development Authority of India (Irdai) exactly how recommendations were generated and ensuring compliance with emerging AI governance frameworks.

Says Naik: “Our AI models are developed with Explainable AI embedded from the outset. It means that by maintaining transparent decision logs, we can trace every recommendation back to the underlying factors and data sources.”

Risk Of Bias: At present, AI model evaluations are an evolving area and need constant human oversight.

“Using another large language model (LLM) as a judge can help, but it must be complemented with human oversight,” says Deb.

Such bias can also have an effect on pricing, coverage, or policy recommendations. “This is especially important in India’s heterogeneous market, where access to healthcare coverage is vital,” Deb adds.

The Way Forward

In the coming years, AI will transform the health insurance industry from a reactive service to a proactive, preventive health partner. AI will be utilised for early detection of health risks, personalised wellness plans, and policy structures tailored to individual needs. “With this level of personalisation, AI will help companies broaden their reach and make products affordable,” says Naik.

Integration of AI with India’s digital health infrastructure, like the Ayushman Bharat Digital Mission (ABDM), could create seamless, paperless claim processing and enable predictive healthcare interventions that reduce overall system costs while improving patient outcomes, says Deb.

However, the main issues include establishing robust consent frameworks for constant health data monitoring, ensuring that algorithmic fairness doesn’t inadvertently exclude vulnerable populations from affordable coverage, and developing technical standards that balance personalisation with privacy.

How AI Can Help

Automate Routine Tasks: AI handles repetitive tasks like data entry and claims processing, cutting down on labour costs.

Speed Up Claims Processing: Faster claim settlements reduce administrative overhead and customer churn.

Enhance Risk Assessment: More accurate underwriting lowers the chance of costly claims and fraud.

Improve Customer Self-Service: AI chatbots reduce the need for large call centres and support teams.

Optimises Pricing: Dynamic pricing models based on real data help insurers avoid overcharging or undercharging.

Detect Fraud Early: AI flags suspicious claims, saving money by preventing fraudulent payouts.

Reduce Errors: Automated checks minimise costly human mistakes in documentation and policy issuance.

Personalise Products: Tailored insurance plans prevent unnecessary coverage, cutting premium costs for customers and risk for insurers.

meghna@outlookindia.com