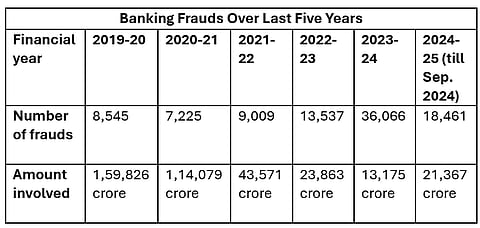

The financial and banking sectors have undergone significant changes in recent years due to digitalization and the introduction of new products and services. Amid this progress, banking frauds have surged significantly. According to the Reserve Bank of India’s (RBI) Report on Trends and Progress in Banking 2023-24, while the number of frauds continues to rise annually, the monetary value involved has shown a downward trend.

Number Of Frauds In Last Five Years:

In the financial year 2023-24, around 36,066 frauds were reported, nearly three times the number recorded in 2022-23, involving Rs 13,174 crore.

The highest number of frauds occurred in the cards and internet banking categories.

The largest monetary losses were linked to loan and advance-related frauds.

Private sector banks accounted for 24,210 cases, representing 67.1 per cent of the total frauds in terms of numbers.

Public sector banks led in terms of value, with frauds amounting to Rs 10,507 crore, about 75.3 per cent of the total amount.

While the monetary value of frauds declined in FY 2023-24 compared to the previous year, it increased significantly in 2024-25, with an almost 80 per cent rise to Rs 19,748 crore as of September 2024 compared to Rs 11,017 crore for the entire FY 2023-24.