The latest film, Mrs, a remake of the The Great Indian Kitchen (released in 2022) that is making waves on the issue of women empowerment, is an eye-opener on how patriarchy works in India and the kind of life women are forced to lead even in today’s day and age. The protagonist, Richa, is a modern-age girl, a choreographer in her 20s, who tries to fulfil all the demands of the institution of marriage, but revolts against it in the end when she realises that there’s no hope of changing or expecting anything positive from it. She goes on to make an independent career of her own and even chides her own parents—a symbol for Indian parenting—for pampering the son.

How Women Can Define Their Financial Future

There are incremental changes that you need to make in your financial plan as you age, though the essence remains the same. We have stories of six women from different age groups that show how resilience and grit can secure your future, how awareness can define your path, and fill the financial gaps

Some say that her case is extreme, but scores of Indian women, especially of the earlier generation, have spent similar lives and were unable to break from the grind. Even today, several others, like the second wife of Richa’s husband, are stuck in a similar situation.

But the good news is that more and more women living in the metros, especially in the age groups of 20s and 30s, are now becoming conscious about their surroundings and financial independence. In fact, a lot of them have started investing independently, according to a dip-stick survey carried out by this reporter. Experts agree that there is rising awareness among women in this age cohort.

Says Renu Maheshwari, CFP and a Securities and Exchange Board of India-registered investment advisor (Sebi-RIA): “I have witnessed that compared to any other age group, women in their 20s and early 30s are consciously choosing to invest and are self-starters without any push. If I had to estimate (women’s participation in general), around 90 per cent of them (her clients) actively track their investments.”

Despite varied income brackets of different age groups, women are investing 37 per cent of their income, according to the survey.

“However, when it comes to in-depth knowledge of financial products and policies, less than 50 per cent seek out that information independently,” says Maheshwari.

In the past, many women struggled after their marriage ended, because the husband managed all the finances, but that seems to be changing now.

“Learning from such experiences, women today are becoming more involved in financial planning,” says Nisha Sanghavi, CFP and co-founder, ProMore, a fintech firm.

Some of the initiatives of the younger women seem to have rubbed off on the older generation as well, though mostly in the metros and big cities, who have moved on from just saving money to investing in a structured manner.

“Earlier, women focused solely on saving, money was stashed away in kitchen jars. Now, the shift is towards investment and wealth creation,” says Sanghavi.

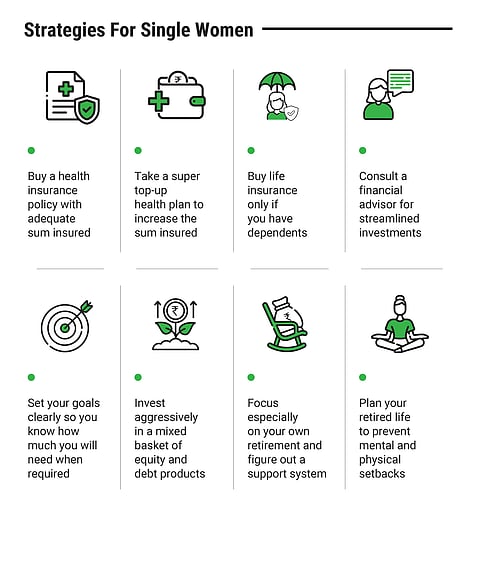

Experts agree that women need to take finances in their own hands if they want to secure their future and well-being. However, sometimes different age cohorts and situations have different demands.

Says Maheshwari: “Financial security is the primary goal for most women, but beyond that, it varies significantly based on individual circumstances and life stages. For instance, women in their 20s often prioritise experiences, weddings, or higher education, while those with children focus on securing funds for their children’s education. By their 40s, many women aim for financial independence and early retirement.”

We spoke to women in three age buckets—young-to-middle age, middle age, and nearing retirement or retired—to figure out how they are faring on their financial journeys, mapping their successes and challenges.

We also give you a lowdown on how to navigate finances at different life stages.

Young Age

When you are in your 20s or 30s, there’s a lifetime ahead to plan for—emotionally, professionally and financially. Also, it is at this stage that you can build healthy financial habits, such as starting to save, not taking too much debt, understanding and bifurcating your needs and wants, and so on. This is the time when you should think about what you want from your life. That process will help you understand the financial aspects you need to prepare for.

For those in the 20s, the biggest thing to fight against is overspending. While it’s natural to spend more when you first start earning and stop living life on a student budget, some may forget that in this zeal, taking on debt could be dangerous. It could easily land you in a debt trap as, typically, salaries are low in this phase, and the rate of interest on credit cards and small loans are steep. Striking a balance would be advisable instead.

Says Dilshad Billimoria, certified financial planner (CFP) and Sebi-RIA, and founder and managing director at financial planning firm Dilzer Consultants: “Women in their 20s who are just starting their careers should understand the importance of investing over spending. One common trend among this age group is to buy high-value gadgets, which are not appreciating assets, on credit cards.”

These are years when you first start earning and look at fulfilling all your wishes and dreams, but it’s important to consider how much you can afford, after putting away some savings for investments for goals, such as higher education or buying a car.

Once you are a few years into a job, start investing for larger goals. Women in this stage usually wish to get married and settle down or take a career break for caregiving to children or parents. Having enough liquidity can help them fulfill all that. Says Billimoria: “The first step to take is to build an emergency nest-egg to have enough liquidity. At the same time, start savings for children and own retirement.”

Insurance is also important. “Have enough medical insurance to prepare for medical emergencies that you or your dependents may have,” says Maheshwari.

Having a term plan for your dependents is a must. This is true in any circumstance—whether you are married, planning to marry soon, or have parents to take care of. It is feasible to take health insurance for your parents if they don’t have one, as with age, health complications may multiply.

Shramana Chatterjee

28, Marketing Professional, New Delhi

Her Learning

Cutting down one’s spending and increasing savings is possible, if you don’t use food aggregator and other quick commerce apps

Shramana Chatterjee, a 28-year-old marketing professional based out of Delhi, started her investment journey in 2021 after she realised that her monthly savings from her income weren’t enough to build the kind of wealth she aspired to accumulate and the kind of life she wants to have.

Initially, she found herself drawn to cryptocurrency, particularly when she came across the hype around meme coins on social media platforms. But after some time, she realised that it is important to diversify, and delved into market investing. She invests directly in stocks and in mutual funds through systematic investment plans (SIPs).

Shramana credits her father as her financial torchbearer, but her ongoing experience also taught her a lot. She says: “The first year was frustrating because I barely saw any portfolio growth unless I got lucky. There’s also a strong impulse to spend, making it difficult to stay disciplined with investments. Over time, though, the growth becomes evident, making it worthwhile.”

She calls herself financially disciplined and controls her spending to ensure she is able to invest more. For instance, she doesn’t use food aggregator and grocery apps, as those end up bleeding the account.

Another good thing is she stays informed to make the right decisions on investments, especially in the stock market. “I keep reading stock market projections and expert columns. I analyse historical trends and growth patterns to determine stable investment options.”

A part of her portfolio is still invested in cryptocurrencies, but it’s worth noting that these are highly risky and speculative instruments and the risk of fraud is pretty high. Several experts equate crypto investing to gambling.

Shramana wants to start goal-based investing by building an emergency fund of up to Rs 10 lakh. Typically, this is the first head you should start investing for.

Eventually, she wants to transition into a freelancing career by her mid-40s and travel across the country in a mobile van. All that needs money and she feels she is on the right track to fulfil her desires and live life on her own terms.

Mahek Tomar, a 36-year-old entrepreneur who started working as a bank employee, managed to buy a fancy BMW car recently. Her financial journey has been a roller-coaster and it was not easy for her to achieve her current financial status.

She started earning and supporting her family when she was in her early 20s, when her father was diagnosed with kidney failure and passed away in a few years. Fortunately, she was already working when the diagnosis came and was earning a decent salary. At 25, she was earning a handsome amount of Rs 1.5 lakh per month.

But unlike most people her age, she didn’t spend on luxuries, and most of it went towards her father’s treatment, as he did not have health insurance. “I was the eldest daughter and responsible for my family, and my father’s treatment became my priority,” says Mahek.

This became a major financial lesson for her—the importance of buying health insurance. “I learnt the importance of health insurance in my life. Now, every member of my family is insured,” says Mahek. Given the rate of medical inflation, which is usually above regular inflation, a single serious medical condition can drain your savings and investment accounts, especially when you are retired.

Despite the odds, she managed to save around 50 per cent of her salary from an early age. It was this capital that came in handy when she invested in her own start-up. Her sacrifices and focus then have now earned her a life of luxury, where she can drive a car of her choice without putting her finances under strain.

She always had a growth mindset, so when she got a chance and support to start something on her own, she jumped at it and even delayed her personal goals. Her entrepreneurial journey began after her marriage in 2015, inspired by her husband, who had over 20 years of experience in the stock market.

Mahek, who is passionate about her start-up that helps founders raise funds, says, “Around 10 days after my marriage, I was sitting with my husband and working on buying the domain for my start-up instead of going on a honeymoon.”

Now Mahek puts all her money back into her start-up. Her financial goals include buying a house and growing her business for now.

Middle Age

The grind is more or less the same for women of this generation—you need to have an emergency fund, invest for your long-term goals, have life and health insurance—but everything needs to be reviewed thoroughly, as responsibilities and liabilities increase at this life stage.

The responsibility now is multi-pronged: for self, children, spouse (in some cases) and parents. Naturally, there are more expenses, but you need to strike a balance between expenses and investments. In this phase, typically, salaries are higher and reducing lifestyle costs and helping children understand the value of money can enable you to save and invest more.

Says Gurleen Kaur Tikku, CFP and founder of Hareepatti, a financial planning firm: “This age cohort wishes for a balance between career advancement and family responsibilities. They also have increased responsibilities towards parental care and support. Then they have an increased risk of health conditions, and their potential impact on income and finances.”

At this stage, you may do well to expand the emergency fund and focus more on your retirement corpus and children’s higher education. “Maximise retirement contributions and invest in a mix of asset classes based on risk appetite,” says Tikku. You may also want to relook your asset allocation if certain goals like children’s higher education are closer. It makes sense to park the money you need in the next six months to a year in safer risky investment products.

Likewise, you need to review your insurance coverage. The importance of having an adequate term plan and an emergency fund plays out as the possibility of events like untimely deaths or job losses increases. These should be replenished, if needed. “Breadwinners must be careful about what type of insurance they choose. When looking at life insurance, only consider term life insurance. Avoid endowment, money-back, or whole-life policies,” says Maheshwari. Taking insurance against liabilities like home loans is equally important and if you own a house by now, do not forget to buy home insurance, she adds.

It is also important to start thinking about yourself as an independent entity because life and even marriages can be unpredictable. Says Billimoria: “Women in their 40s should also plan for an independent corpus for their retirement. We call it the financial independence corpus only for women, which will help them stand on their feet post retirement.”

Dr. Anchal Gupta

42, Opthalmologist, New Delhi

Her Learning

Consulting a financial advisor helped her. She thinks it’s the most important step in anyone’s financial journey

From the beginning of her career, Dr. Anchal Gupta, a 42-year-old Delhi-based ophthalmologist, trusted her funds with a financial advisor. The organised approach paid her off in the long run.

Before turning 40, she fulfilled her dreams of buying a luxury car, a house in a posh locality in New Delhi, and opening an eye hospital. She is proud to say that she achieved all of this without any financial help from her husband, though she is happily married.

What worked for her, she says, is dividing her investments between three strategies—long-term, mid-term and short-term. “I go heavy with my investments in (equity) mutual funds for the long- and mid-term and in fixed deposits (FDs) for the short term. To be very precise, 80 per cent of the money has been invested in mutual funds, 10 per cent in gold, and the rest in FDs.”

Her current goals include paying for her 10-year-old daughter’s higher education and making her financially wise. Anchal helps her daughter understand the importance of earning and saving, by giving her small tasks to earn her pocket money. For instance, she sometimes asks her daughter to arrange the kitchen utensils or intern at her clinic. “My daughter has been earning money from the age of 8,” she says.

Her other goal is to increase the valuation of her venture to `100 crore and open five new eye centres in the next three years. Last, but not least, she wants to buy the Mercedes Maybach luxury car for her 50th birthday.

One of the aspects that defined her financial life was hiring a financial advisor from an early age. That helped her save and invest systematically for her various goals and gave her enough time to let her investments grow.

Bhawana Sharma

41, Consultant at MNC, Noida

Her Learning

Planning for the death of the breadwinner is an absolute must to secure a family’s needs comprehensively

Noida-based Bhawana Sharma, 41, who works as a consultant at a multinational company (MNC), has a story of personal and financial loss. In 2024, she lost her husband to cancer, pushing her and her two daughters, 13 and 6 years old, into not just an emotional but financial crisis. Even though her husband had health cover, the sum insured was not enough to cover all the costs.

Bhawana, who had quit work to become a stay-at-home mother, went back to work after a 10-year-long break last year. The payout from her husband’s term insurance policy was not enough to cover all the costs and debts. They took a home loan cover for 60 per cent of the amount, but the remaining 40 per cent had to be paid by the term insurance payouts.

Adding to Bhawana’s struggles was the challenge of retrieving her husband’s provident fund (PF) details. “He worked with four or five companies before, and I wasn’t aware of his PF number. If I hadn’t had access to his mobile password, it would have been nearly impossible for me to track down these details,” she shares.

The family is still struggling, as the salary of Bhawana’s husband was 6-7 times than what she is getting now. “My husband’s salary for around 6-7 times more than what I am getting right now.” This drastic reduction in income meant Bhawana had to rethink her entire financial strategy while ensuring her children’s future remained secure. “It’s very difficult for me to manage things with that amount. Once you start living a certain type of life, then it’s difficult for you to downgrade,” she says. She also plans on getting rental income from a joint property with her brother to supplement her income.

Now Bhawana is focused on her children’s future and higher studies, and wants to invest whatever is left from the term insurance payout and PF. “Everyone’s idea of investment is different, but we could have planned better. My husband never invested in any mutual fund or similar instrument,” she says.

She is gradually learning to take control of her finances, learning and adapting along the way. “I’ll start with small investments and then scale up depending on how things go,” says Bhawana, who appears to be risk averse as of now.

Her financial goals include achieving a stable passive income.

Nearing Retirement Or Retired

When you enter your 50s, treat it as another milestone where you need to pause and review your investments, insurance, and life circumstances. You may need to increase your investments, as retirement is round the corner.

“In your 50s, accelerate your retirement contributions, rebalance the investment portfolio, and write a Will for the distribution of assets after death,” says Tikku. The proportion of equity and debt in your portfolio will also need to be considered again, depending on whether you are looking forward to an early retirement.

There are emotional changes to deal with, too. Says Tikku: “Women in their 50s were seen to be going through the empty nest syndrome, adjusting to life after children leave home and potential emotional impact. They may also experience job loss or early retirement.”

By the time you are in your 60s, you should be sitting on a retirement and health corpus. “Women in their 60s should be aware of all the assets the family owns and ensure a health corpus is created outside of health insurance to take care of outpatient costs,” says Billimoria.

You may give up the term plan if your children are independent and you have no other dependents.

Says Tikku, “Rebalance and have a withdrawal plan, downsize or relocate to reduce expenses and free up capital. Explore part-time work to supplement income and review and update the Will if needed.”

Women in 50s and 60s may find themselves single due to death or divorce. Women outlive men, and divorce rates are also increasing.

At present, the life expectancy of women is 73 years compared to 70 for men. On the other hand, the number of divorces has more than doubled over the last 20 years, according to Adjuva Legal, a law firm. Tier-I cities, such as Delhi, Mumbai, and Bengaluru, have divorce rates exceeding 30 per cent.

Thus, it is necessary for women to understand financial dealings, and ensure there is sharing of all investment passwords and documents with the partner. Maheshwari highlights the importance of succession planning. “Share all financial details with your spouse and organise your records. Ensure you have adequate term insurance and liability coverage. Estate management tools like nominations are also crucial.”

Moreover, it’s important to attend to health concerns. “Prioritise physical and mental health to enjoy a fulfilling retirement,” says Tikku.

Kavita Talreja

55, Schoolteacher, Mumbai

Her Learning

Planning for financial independence is important and for that one needs to start earning early. Money brings confidence and security

Kavita, a 55-year-old schoolteacher based in Mumbai, has managed to build a healthy corpus of around Rs 15 lakh-20 lakh despite earning a modest four-figure income all her life.

Her investment strategy has primarily been conservative until recently, and she has mostly invested in FDs and government small savings schemes.

“I played it safe by investing in post office schemes like the National Savings Certificate (NSC) and Post Office Monthly Income Scheme (MIS), as well as FDs and recurring deposits (RDs). These investments helped generate passive income, supplementing my low salary as a teacher. I also took private tuition to boost my earnings,” she says.

These instruments guarantee returns, but, typically, are unable to beat the inflation rate.

Her outlook towards investment and wealth creation has changed somewhat now, and she is keen on a balanced approach when it comes to the choice of investment instruments.

“My son, who has a background in finance, advised me to diversify beyond traditional savings. I now see that mutual funds offer better growth potential,” she says.

Her disciplined savings and investment strategies, coupled with advice from her son, have helped her achieve financial stability, which she wants to strengthen.

Nothing comes easy in life and Kavita’s case is an example of that. She had her own challenges and life propelled her on the path of investments after she became a single mother. She had to balance work, home, and carve out a life from the small salary she had over the years. It was only her grit and awareness about securing her future that enabled her to invest in a disciplined manner despite the odds.

She separated from her husband just 10 days after the birth of her son, with no financial backing or any job. Says Kavita: “Being a single parent with limited income was my biggest challenge. When my son was born, I had no job. I started giving tuitions and later pursued a teaching career. Achieving financial independence was difficult, but I made consistent efforts to save and invest.”

Kusuma Murthy

62, Retired, Mumbai

Her Learning

Kusuma feels women should take charge of their finances early and seek professional advice on money matters

Kusuma Murthy, a 62-year-old reinsurance broker, is in the second inning of her life. She is a relaxed retiree because she has been able to fulfil her goals, such as buying a house in Mumbai and building a retirement corpus. Now she wants to sit back and make travel plans, for which she saves regularly. She is now working on her own firm, driven by her passion but not needs.

She has come far from the situation she faced around eight years ago, when she lost her husband in 2017. Though her husband had laid out all the details that she would need to manoeuvre her way into the financial world, it was still a task because she was a financial novice.

“I didn’t even know my user ID and password for my own bank accounts. But my husband had left behind notes on how to manage everything. It was a challenge, but I learned,” says Kusuma. At that critical time, she had the support of her trusted financial advisor.

But she didn’t let the situation overpower her. Kusuma not only adapted, but thrived, and also managed to build a robust investment portfolio.

Says Kusuma: “My investment strategy is a balanced mix of mutual funds, fixed deposits, and insurance pension plans. I invested around Rs 80,000 per month through SIPs and allocated additional lump sums whenever I had surplus funds.” She also contributed to her Provident Fund (PF). Over the years, her annual investments have grown from Rs 7 lakh to Rs 10 lakh.

Now she has enough savings to enjoy her retirement independently.

“I want to travel and enjoy my life without depending on anyone. That’s why I still save and invest diligently,” she says.

For Kusuma, financial independence means the freedom to spend without worry, the ability to help others, and the peace of mind that comes from knowing she is financially prepared for any unforeseen circumstances.

Her story is a testament to the importance of timely financial planning, and how seeking the help of a genuine financial advisor can help you organise your finances and tide over the uncertainties of life with confidence.

Her grit and adaptability is inspirational for many women who find themselves in similar situations.

shivangini@outlookindia.com