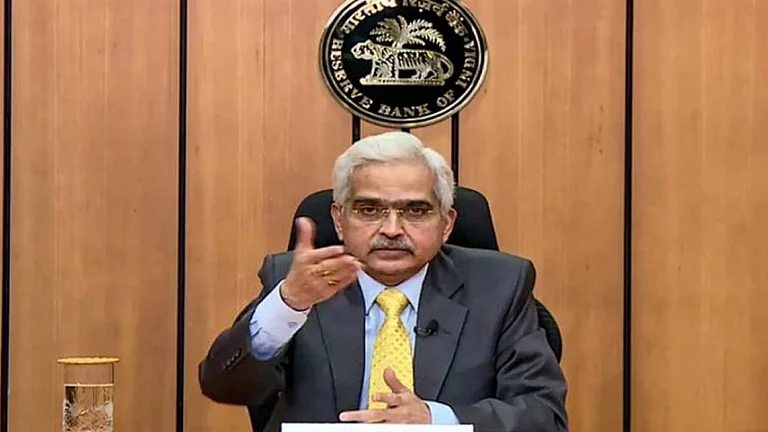

Shaktikanta Das, whose term as RBI Governor ends on December 10, has served longer than the typical five-year tenure, making him the second-longest-serving governor in RBI history. His leadership has seen significant reforms that have shaped India’s financial system.

Shaktikanta Das: 6 Customer-Focused RBI Announcements Under His Leadership

Six RBI announcements under Shaktikanta Das that impacted customer finance in India

In a major development on Monday, Sanjay Malhotra, a senior bureaucrat, was named as the next Governor of the Reserve Bank of India. He will succeed Shaktikanta Das when his tenure concludes on Tuesday.

During his last Monetary Policy Committee (MPC) meeting as governor, Das left the repo rate at 6.5 per cent, which is the eleventh consecutive hold. The decision has clearly portrayed a balanced approach towards the stability of the economy and curbing inflation. The six key customer-focused announcements that characterized his leadership are examined as his term comes to an end.

Here's the 6 Customer-Focused RBI Announcements Under Shaktikanta Das Tenure:

1. Promotion of UPI 2.0 and UPI LITE

In August 2018, UPI 2.0 was introduced, bringing with it additional capabilities like overdraft protection, linked credit accounts, and improved security for automated payments. Launched in March 2022, UPI LITE allows low-value transactions (up to Rs 200) without requiring a PIN. Under Das's leadership the discussions regarding cross-border UPI transactions began, starting with Singapore and Bhutan.

2. Integrated Ombudsman Scheme

The RBI combined three different grievance redress systems into the Integrated Ombudsman Scheme in 2021. The goal of this action was to give customers a simplified method of resolving grievances pertaining to banking and financial services.

The three systems that were integrated are :

Banking Ombudsman Scheme,

Consumer Education and Protection Cell,

Digital Transactions Ombudsman Scheme

By combining these, the RBI improved efficiency and accessibility, ensuring quicker and more transparent resolution of consumer grievances.

3. Central Bank Digital Currency (CBDC) Pilot

The RBI started the CBDC (Digital Rupee) experiment in the wholesale market (e₹-W) in November 2022 with the goal of facilitating government securities transactions and interbank transfers. The retail CBDC pilot (e₹-R) followed in December 2022, aiming to bring the benefits of digital currency to everyday consumer transactions, enhancing the efficiency of the payment system and boosting financial inclusion.

4. Digital Lending Framework

The RBI launched the Digital Lending Framework in 2020. This is aimed at making sure there's transparency in lending, thereby preventing predatory lending and keeping consumers safe. It sets interest rate caps, calls for clear loan terms disclosures and sets standards for responsible loan collection practices. It is a move toward creating a more secure and regulated environment for digital lending in India.

5. Withdrawal of Rs 2,000 Notes

The RBI started withdrawal of Rs 2,000 notes in 2023 to combat counterfeit money and promote electronic payments. This was an attempt to encourage transparency and lessen reliance on currency. Launched in 2016 after demonetization the Rs 2,000 note was initially introduced to replace high-value notes withdrawn from circulation. However, with the objective of promoting a cashless economy, the RBI decided to withdraw these notes, further promoting financial inclusion.

6. Tightening NBFC Regulations

After the IL&FS crisis, the RBI introduced stricter regulations for Non-Banking Financial Companies (NBFCs) in order to strengthen their financial stability and avoid risk for the broader financial system. Key measures included raising the capital adequacy requirements, enhancing the liquidity management, and strengthening the norms of asset classification. These steps were taken so that the funds of the customers would be safe and there would be more accountability in the NBFC sector.