If there is an unauthorised debit transaction done from your bank account, you will have to bear the loss if you do not report the transaction to the bank timely. While electronic banking transactions are increasingly popular due to the digitalisation of services, digital frauds are also on the rise.

Unauthorised E-Banking Transaction From Your Account? Know When You Are Not Liable For The Loss

If your account is debited without your authorisation, you may become liable for the loss if the transaction is not reported to the bank promptly

However, if a transaction is not genuine and done without the authorisation of the account holder, it is crucial for the account holder to promptly report the unauthorised transaction to the bank. This is required to limit your liability to 'zero' for any losses and ensure that the bank is liable to refund our money.

What Are The Different Types Of Electronic Banking Transactions?

These electronic transactions can be online payment using internet banking, mobile banking, pre-paid instruments, where physical instrument is not required or physical transactions using ATM, point of sale, etc., where a physical payment is required.

When a transaction is done without the account holder's authorisation, it becomes an unauthorised transaction.

According to the Reserve Bank of India (RBI) guidelines, if such transactions are not reported to the bank within 30 days from the date of occurrence, these are considered undisputed, and no compensation is allowed to the account holder.

What Is The Liability Of An Account Holder/Customer?

To determine the liability of an accountholder and the bank in such cases, RBI's circular dated July 6, 2017, provides the guidelines.

Zero Liability Of A Customer

If fraud or negligence occurred due to the bank's action or negligence, the customer/account holder is not held liable, regardless of whether they reported the transaction.

Limited Liability Of A Customer

However, if the transaction occurred due to customer's negligence, such as sharing personal details, account number, password, PIN, OTP, etc., it becomes customer's liability to bear the loss until it is reported to the bank. Once reported, the concerned bank becomes liable to bear the loss.

If the transaction is done by a third party and there is no involvement of bank or the customer, the customer should inform the bank within three working days of receiving the communication of such transaction.

Reporting Within Three Days:

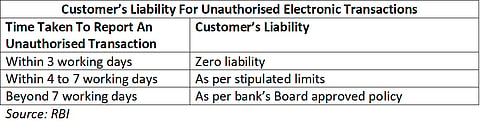

If customers report fraudulent transactions within three days, RBI absolves customers from any liability associated with fraudulent transactions.

Reporting Within Four To Seven Days:

However, if the transaction is reported after three days but within four to seven working days, the customer becomes liable to bear the loss but to the stipulated limits.

• The maximum liability is Rs 5,000 for such a transaction from a Basic Savings Bank Deposit (BSBD) account

• The liability becomes Rs 10,000 for debit from a savings banks account, pre-paid instruments, gift cards, overdraft or cash credit account or current accounts – with limit up to Rs 25 lakh, and credit card – with limit up to Rs 5 lakh

• The accounts (current, cash credit, overdraft) with higher withdrawal limits than Rs 25 lakh, and credit cards limit more than Rs 5 lakh create a maximum liability of Rs 25,000 on the customer

Reporting After Seven Days:

On delayed reporting of the transaction (beyond 7 days), the customer's liability is determined according to the concerned bank's policy, as approved by its Board. This information is provided to customers at the time of opening their accounts and must also be displayed on the bank's website as well, as per RBI's guidelines.

What Is The Liability Of A Bank?

Once the transaction is reported to the bank, it becomes a bank liability. Even if it is customer’s negligence, the bank is responsible to prove the negligence on the part of the customer or bear the loss.

Recently, the Rajasthan High Court gave a customer relief by directing the concerned bank to refund the entire Rs 58 lakh debited from the customer’s account because the customer reported the transaction to the bank within three working days.

So, keep your details such as mobile number and email ID updated in the banking records and if there is any unauthorised come into your notice, inform the bank immediately to safeguard yourself against any loss.

.png?auto=format%2Ccompress&fit=max&format=webp&w=768&dpr=1.0)