Highlights:

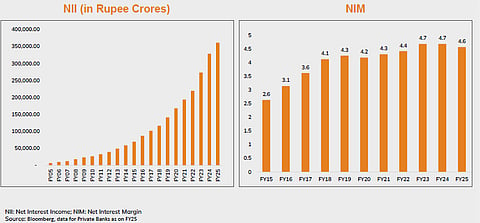

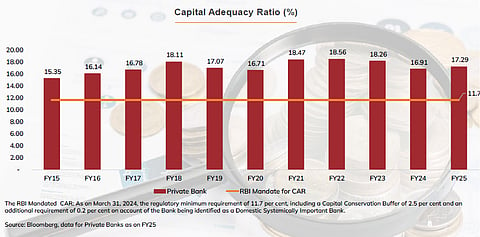

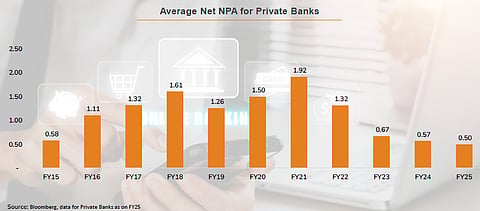

The scheme aims to invest in India’s private sector banks, which are central to the country’s economic progress. These banks have consistently demonstrated high profitability, improving market share in loans and deposits, sound capitalisation, and low levels of non-performing assets

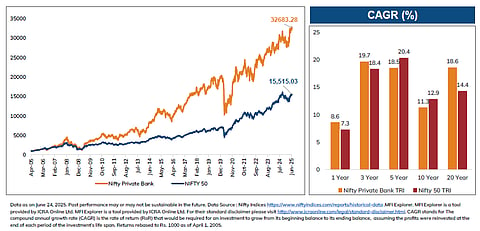

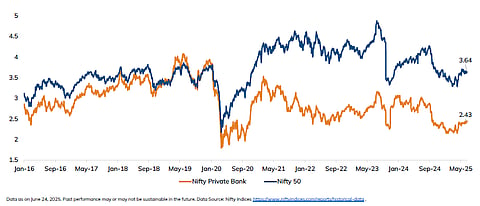

The scheme follows a passive, rules-based strategy that mirrors the Nifty Private Bank TRI, providing transparent, disciplined exposure to India’s private banks

The scheme is designed for investors looking to capitalise on India’s growing banking sector, with private banks contributing 37% of the Nifty 50’s profits in FY2025 despite representing only 28% of its market capitalisation*

*Source - Nifty Indices and Capital Line for the Reported Profit After Tax data, Nifty 50 and Nifty Private Bank index constituents as on June 24, 2025 and Reported, Profit After Tax data as on Financial Year 2024-25.

Mumbai, July 01, 2025: ICICI Prudential Mutual Fund announces the launch of ICICI Prudential Nifty Private Bank Index Fund, an open-ended index scheme replicating Nifty Private Bank Index. This scheme offers investors an opportunity to invest in a basket of India’s private banks, which have delivered fundamentals and supported India’s economic expansion.

Abhijit Shah, Chief Marketing and Digital Business Officer at ICICI Prudential AMC, said:

“Through this product, we offer investors a unique opportunity to access the strength of India’s private banking sector in a simple, cost-effective manner. These banks have demonstrated high profitability, robust asset quality, and capital adequacy, making them a potential long-term investment.”

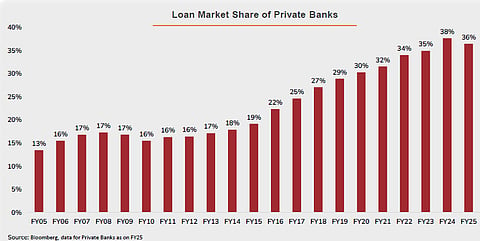

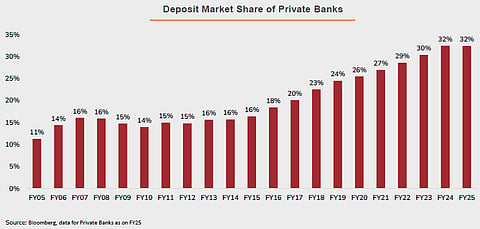

Private banks have shown growth in their share of the Indian credit and deposit markets over the past two decades. Loan market share rose from 13% in FY2005 to 36% in FY2025, and deposit market share improved from 11% to 32% over the same period.