Summary of this article

Rs 10,000 SIP builds substantial wealth long-term through compounding

Time and returns together sharply amplify compounding outcomes

Higher returns reach crore goals significantly faster over time

Most investors exit early, missing long-term benefits despite discipline

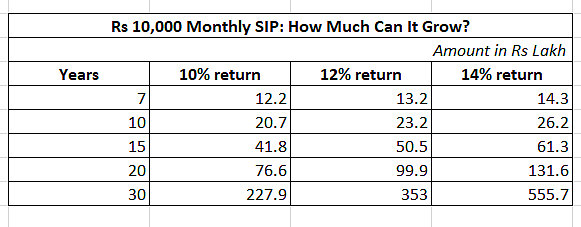

Investing through a systematic investment plan (SIP) is widely known to be one of the most convenient ways to build long-term wealth. Let’s look at how much wealth a Rs 10,000 monthly investment via SIP in mutual funds can potentially create over 7, 10, 15, 20 and even 30 years. We will also see how time and returns together shape outcomes.

For calculation purposes, we have assumed three different annual return scenarios – 10 per cent, 12 per cent and 14 per cent, to reflect conservative, moderate and optimistic long-term equity outcomes. Mutual fund returns are never fixed, which is why analysing multiple return scenarios provides a more realistic picture of potential wealth creation.

A comparison of investments at different rates of return shows that a disciplined SIP of Rs 10,000 per month earning an assumed average return of 12 per cent can grow into over Rs 23 lakh in 10 years, about Rs 50 lakh in 15 years, and nearly Rs 1 crore in 20 years. The longer the investment horizon, the higher the impact of compounding.

Even though the monthly investment amount remains the same, time allows returns to amplify sharply in later years.

The Power of Compounding

One of the most important advantages of mutual fund investing is the power of compounding, where returns earned are reinvested and begin to generate returns of their own. Starting early dramatically magnifies this effect.

For example, at 12 per cent returns, the corpus doubles in a period of five years from 15 to 20 years (see table above), even though the investment amount remains constant. This highlights why equity investing rewards patience far more than timing.

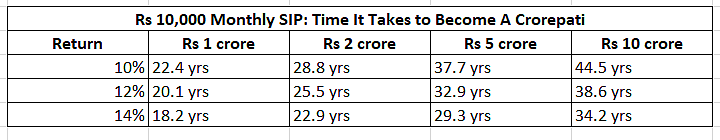

How Long Does It Take to Reach Rs 1 Crore, Rs 2 Crore or More?

Another way to look at SIP investing is through goal-based milestones.

Theoretically, at 14 per cent returns, a Rs 10,000 SIP can create Rs 1 crore in just over 18 years, while at 10 per cent, the same goal takes more than 22 years. (See table for details). This gap widens significantly for larger targets such as Rs 5 crore or Rs 10 crore, underlining why returns and time are equally powerful.

While the calculations may look interesting, many novice investors fail to accumulate wealth. It happens mainly as they do not remain patient and are influenced by short-term volatility.

According to data from the Association of Mutual Funds in India (Amfi), as of March 2025, on average, only 33 per cent of mutual fund investors had an average investment holding period of more than five years in the case of regular plans. In the direct plan of mutual funds, the number dropped even further. Only 19 per cent continued their SIP investment for a period of over five years. The most worrying part was that 64 per cent of investors in the case of the regular plan and 48 per cent in the case of the direct plan exited their investments in just two years.

“Not staying invested long enough often results in less than expected returns or even loss of capital,” says Aditya Agarwal, Co-founder of Wealthy.in. The only antidote, he says, is patience.

To sum up, a Rs 10,000 monthly SIP may appear modest, but time and compounding can turn it into a substantial corpus over the long term. However, to achieve what we have seen in numbers, investors need to start early, stay invested and avoid emotional decisions for successful wealth creation.