Ashutosh Mishra was 27 when he walked away from a regular job. The burnout was real—he worked long hours, had tight deadlines, and developed a gnawing sense of going into no particular direction. When he thought of taking a break, others around him suggested, “perhaps it’s too early” in his career to embark on such a sabbatical.

But the pressure had reached a breaking point, “I just needed to cool off,” he says. What followed was what people are now calling “micro-retirement”. Though Ashutosh didn’t know the term then, he knew he couldn’t continue in his existing job.

A 2024 Deloitte Global Gen Z Survey found that 40 per cent of Gen Zs and 35 per cent of millennials feel stressed at work. This has driven many to hit a pause on their careers, often to recuperate, travel, or re-think their career choices.

Says Ashutosh: “The motivation stemmed primarily from feelings of burnout and frustration. The daily demands left no time to reflect on my career path.” His family’s support proved crucial. “I can see many colleagues lacking this safety net and feeling trapped,” he says.

After five months, during which he slept properly, interacted with family and friends, and tried new roles, Ashutosh returned transformed. “The break wasn’t an escape; it was a recalibration. I came back knowing my worth wasn’t tied to relentless hustle,” he says.

Across industries, Gen Z professionals are embracing micro-retirement—an intentional, extended career break taken multiple times, and not just at the end of one’s career. Unlike traditional sabbaticals (often reserved for mid-career professionals), these pauses are happening earlier, driven by burnout, curiosity, or a refusal to equate hustle with worth.

Sabbatical Or Micro Retirement?

Career breaks are not new. Boomers took gap years, millennials once popularised the “Eat, Pray, Love” reset. But Gen Z is formalising the idea of planned, recurring breaks as part of a strategic life design.

However, experts argue that the term “micro-retirement” is dangerous and could have practical repercussions, such as pay cuts, as not all employers appreciate gaps. “When you’re young, don’t call it ‘retirement’. It’s just a break. And if you’ve only worked two years, expect consequences,” says Rituparna Chakraborty, co-founder and non-executive director of TeamLease, a human resource services company. Chakraborty says that, ideally, one should reach a certain level in their career before taking such a break.

“This helps in maintaining professional credibility and makes it easier to return to work afterwards. If you take a break without a solid foundation, you may lose momentum and find it challenging to re-enter the workforce,” she says.

Vivek Manali’s approach couldn’t have been more different than Ashutosh’s, yet the idea was the same. At 28, the sales operations professional from New Delhi shares that he has successfully planned multiple career breaks with military precision. He started working soon after passing his 12th Board exams in 2017, but that didn’t stop him from looking for possible career pivots. “At one point, I was preparing for the Combined Defence Services (CDS) exam, and that needed full-time focus,” he says.

His game plan? Negotiating the break without quitting.

Says Sumit Duseja, a Security and Exchange Board of India-registered Investment advisor (Sebi RIA), “Not all breaks require your resignation.”

Duseja’s advice: The first smart move would be to talk to your current employer and see if you can work around a break. Draft a proposal outlining the duration of the break you are seeking (for instance: one or two months) and how you plan to manage your responsibilities during your absence. This shows your employer that you are serious and have thought through the implications of your request.

This worked for Vivek during his first break, but the following ones were not as smooth. During his second break, Vivek understood the importance of dealing with unexpected expenses. A minor hiccup taught him the importance of thinking beyond setting monthly budgets for the break. When he faced costs related to servicing of the air conditioning units in the house, Vivek neither anticipated nor was prepared for this expense, which strained his budget.

“Although I had an emergency fund, the need to dip into it for unexpected costs highlighted the importance of having a well-planned financial strategy,” he says.

Plan The Break

When your sabbatical is a complete break from work, the most crucial thing to do is have a financial plan.

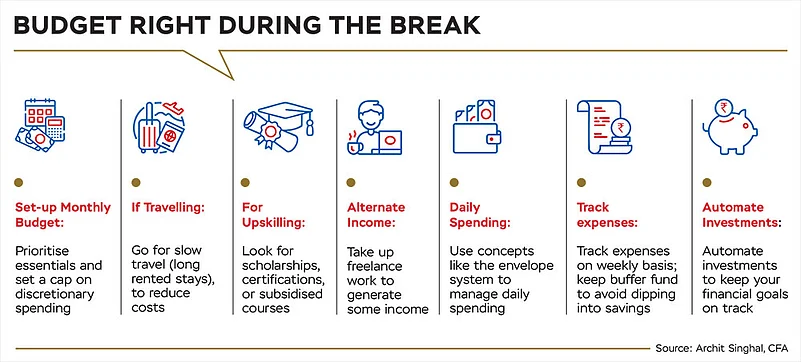

Duseja emphasises on keeping a “Break Fund” ready before going for career sabbaticals.

He says: “Unlike an emergency fund, this is a dedicated pool covering living costs plus purpose (travel, courses). One should, typically, aim for 15-18 months (of expenses) if resigning, and 3-6 months (of expenses) if negotiating a pause with the employer.”

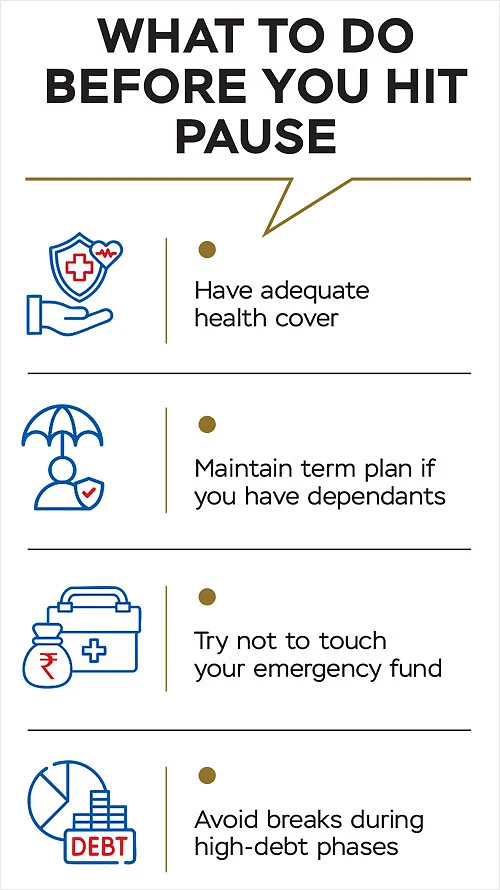

Archit Singhal, a certified financial analyst, stresses on opportunity cost, too. “Lost salary, missed promotions, and compounding gaps in retirement savings add up,” he says.

His rule? Treat the break like a financial goal, and save for it separately, without raiding your long-term buckets. He says that a one-size-fits-all six-month buffer is a baseline, but not sufficient for a meaningful micro-retirement. A practical approach is to first define the duration and purpose of your break—travel, study, or passion projects—and estimate the costs accordingly.

Singhal says the estimation should factor in fixed obligations (rent, loans, insurance), variable costs (travel, courses), a contingency fund (10-15 per cent of the Break Fund) for other costs (living, discretionary, fixed) and a buffer fund (15-20 per cent of the Break Fund) for any uncertainty that may arise.

“Include missed investments or systematic investment plans (SIPs) to avoid derailing your long-term goals. Ideally, your Break Fund should cover all these for the planned duration (of your break), plus a 2-3 months transition fund for re-entry into the workforce. Planning this fund separately from your emergency savings is key,” says Singhal.

Vivek says a similar strategy helped him sail through his two breaks, including the one that sustained him through a brief hiccup during the Covid-19 pandemic. During the pandemic (2021), he focused on strict budgeting; this included reducing discretionary expenses, such as eating out or ordering in, gym membership, and so on, to ensure that his needs were met without depleting his savings too quickly. “Still, I had to cut back on some essential expenses as well,” he says.

Now, ready to embark on another break starting July 2025 for higher studies, Vivek plans to create a new plan. With support from his brother, he hopes to build a Break Fund that can include his investments alongside his monthly expenses.

The Re-entry Battle

You also need to plan carefully about how you would re-enter the workforce after your break, before you go for micro-retirement.

Be realistic about the prevailing job market conditions at the time of re-joining the workforce. “Remember, when you are re-entering the workforce, you are competing with people who didn’t press pause,” says Chakraborty. Adds Duseja: “If you leave your job, understand that it may take longer than expected to find a new position, especially in uncertain economic climates. This is where having a robust financial cushion will help.”

Vivek’s return was not seamless. He networked aggressively, framed his break as upskilling, and at one point even swallowed a pay cut. Ashutosh, meanwhile, returned to his job with sharper boundaries, and the knowledge that “another break is always an option”.

What Should You Do?

Since Gen Zs have set the tone of a new era of career sabbaticals, perhaps micro-retirement needs to be understood as a recalibration rather than a rebellion. The key is to treat micro-retirement as a life goal, just like buying a house or retirement, and save for it systematically.

“Micro-retirement and long-term financial security can coexist with thoughtful planning,” says Singhal.

He adds: “Use buckets: one for long-term investments (retirement, children’s education, home purchase), one for essential savings (emergency, insurance premiums), and one for short-term lifestyle goals like vacations. Automate and prioritise long-term goals even during your break.”

So continue your SIPs, Public Provident Fund (PPF) or other investments, even if the amount is lower than when you were working. Also keep your lifestyle inflation in check during working years to free up more for breaks. Clarity about goals, disciplined saving, and time-bound breaks could be a key to live in the moment without compromising the future.

anuradha.mishra@outlookindia.com