Retail investors will surely enjoy the conveniences, but many of them may be unable to give the right prompts to get the right results

- EDITOR'S NOTE

Not embracing AI can hold you back as the world explores new technological territories, so try you must but with a little or a lot of caution

AI in personal finance can be your on-demand explainer, number-cruncher, and budget tracker, freeing up time and mental space for the bigger picture. But when money decisions are tied to human behaviour, emotions, and long-term trade-offs, its role is best kept as a co-pilot to a human financial advisor

Gen Z is exploring AI tools, reels and other material alongside traditional advisors and textbooks, but they need to take an informed approach

AI solutions can help senior citizens directly and indirectly, but India’s hesitant elderly don’t seem ready to embrace them yet

AI can give you brutally honest answers related to your money based on facts. But our money decisions are also based on emotions which AI does not seem to understand

Relying on AI for inputs on your investing decisions may not be in your best interest, as chatbots typically tend to give response that are likely to be overly flattering and agreeable, and align with your existing biases

AI has made it easier for scammers to manipulate the market by way of spoofing, latency arbitrage or exploiting other vulnerabilities. But market participants are also relying on AI to fight AI and prevent and detect frauds

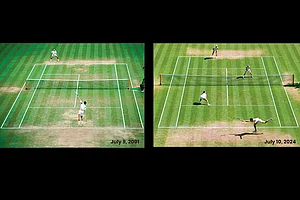

Traditionally, investment decisions were made only by the human mind, but there is a seismic change afoot. Advanced tech is doing to investment what it did to hockey and tennis

Many fund houses are using AI to crunch data, while leaving decision-making with the fund manager. To keep matters safe, Sebi guidelines mandate data confidentiality and compliance, and to keep investors informed

Not embracing AI can hold you back as the world explores new technological territories, so try you must but with a little or a lot of caution

AI in personal finance can be your on-demand explainer, number-cruncher, and budget tracker, freeing up time and mental space for the bigger picture. But when money decisions are tied to human behaviour, emotions, and long-term trade-offs, its role is best kept as a co-pilot to a human financial advisor

Gen Z is exploring AI tools, reels and other material alongside traditional advisors and textbooks, but they need to take an informed approach

AI solutions can help senior citizens directly and indirectly, but India’s hesitant elderly don’t seem ready to embrace them yet

AI can give you brutally honest answers related to your money based on facts. But our money decisions are also based on emotions which AI does not seem to understand

Relying on AI for inputs on your investing decisions may not be in your best interest, as chatbots typically tend to give response that are likely to be overly flattering and agreeable, and align with your existing biases

AI has made it easier for scammers to manipulate the market by way of spoofing, latency arbitrage or exploiting other vulnerabilities. But market participants are also relying on AI to fight AI and prevent and detect frauds

Traditionally, investment decisions were made only by the human mind, but there is a seismic change afoot. Advanced tech is doing to investment what it did to hockey and tennis

Many fund houses are using AI to crunch data, while leaving decision-making with the fund manager. To keep matters safe, Sebi guidelines mandate data confidentiality and compliance, and to keep investors informed

OTHER STORIES

After the big wave of digitalisation, banks are entering the age of AI, which is making banking not just convenient, but smart. With strong guardrails in place, the industry is ready for its next big technological leap

The insurance industry has adopted AI in a big way and is relying on it for several backend processes from underwriting to claims processing. However, data privacy and biased recommendations remain a concern

AI is streamlining the tax filing process, providing personalised recommendations and automated document classification, but it has its limitations. Too much reliance can lead to errors and even legal hassles

AI is helping homebuyers navigate the process with the help of 3D models and virtual tours, but the human element in design, aesthetics, negotiation and decision-making remains paramount

One of the dangers of AI is the advent of convincing deepfakes generated by morphing images, voice notes and videos that can hoodwink you into erroneously revealing financial details or making payment to scamsters

Kailash Kulkarni, CEO, HSBC AMC, in a conversation with Kundan Kishore, shares what he did with his first pay cheque, how his career changed his relationship with money and how he later realised that starting to save early can set you up for life. His advice to new professionals is to enjoy their first salary, but also start saving—however small the amount—and remain consistent with it.

Generative AI is a subset of AI that mimics human intelligence to analyse data, identify patterns, and create new content, such as text, images, audio, or videos. It is called generative because of its ability to “generate” human-like responses to prompts

Personalised, bias-aware, multilingual AI widens access, cuts friction and helps families build resilient wealth.

For patient investors, value funds provide downside buffers, sensible valuations, and superior long-term risk-adjusted outcomes.

Let professionals set the mix, manage risk and rebalance calmly while emotions stay out.

In choppy markets, blue chips cushion volatility and compound wealth at reasonable valuations.

Blend equity, debt and gold; rebalance calmly to steady returns and lower risk.

When salaries stop, expenses don’t; save early, insure health, create a steady retirement income.

SBI Life Smart Shield Plus ensures protection evolves with milestones and responsibilities right up to age 100