The US economy slipped into negative growth territory in the first quarter of this year. There are fears of a recession and to add to the challenges, Moody’s has downgraded the credit rating of that country from Aaa to Aa1. Inflation remains elevated. The Federal Reserve may go slow on the interest rate cut front.

Domestically, India is still well-placed to deliver healthy GDP growth this fiscal. Macros on inflation, current account deficit, currency and forex positions are under control, with tax collections remaining robust.

However, the geopolitical escalations in many regions and decelerating growth in advanced economies mean that markets could remain choppy in the near term.

In this regard, investing in large caps would be advisable given the stability they bring during volatile times and their ability to enable steady long-term wealth creation.

Despite the recent rally from early April, valuations still remain comfortable in large caps compared to other market segments.

Large caps to anchor portfolio

Most giant or large companies have healthy financials, a proven track record of execution on the product/service delivery front and enjoy strong fundamentals on the whole. They tend to enjoy leading positions in the industries that operate in.

Also, they are likely to weather macroeconomic and business challenges better than other market segments.

Large caps also have easier access to capital at relatively lower cost. They are more liquid and are the most preferred market cap segment for foreign investors.

Given the current global economic and geopolitical concerns, it would make sense to favour large caps given the above factors.

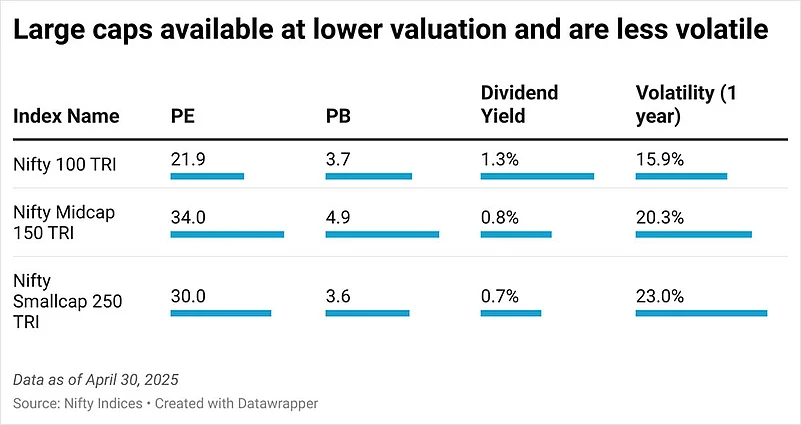

On the valuation front (as measured by price earning and price to book metrics), too, large caps are currently trading at a significant discount to mid and small caps.

It is clear from the table below that PE multiples are lower for the Nifty 100 TRI compared to the mid and small cap indices. One-year volatility is also lower.

For making the most of large cap investing, it is necessary to follow a few steps to get to the best picks.

Companies with a proven track record, quality management and good growth potential must be bought with a ‘buy and hold’ approach.

Buying a set of high conviction picks from a diverse range of sectors is necessary to generate alpha.

A bottom-up approach to stock selection is also important. Investing in a blend of value and growth stocks among large caps can be rewarding.

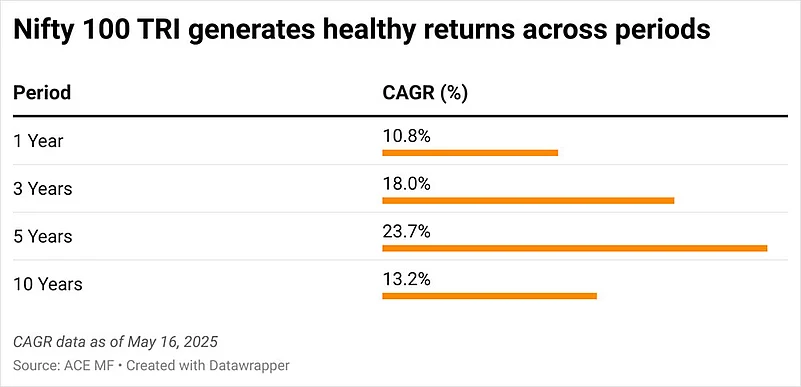

Large caps have also created significant wealth for investors when held over the long term. These returns must also be seen in light of the lower volatility that large caps come with, as indicated earlier.

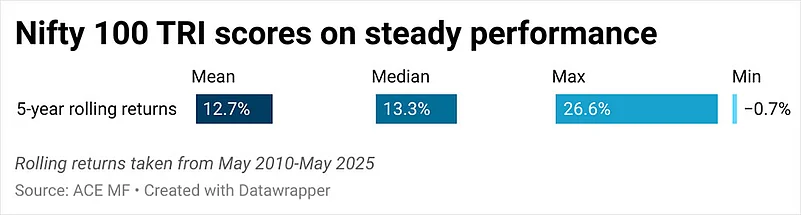

When 5-year rolling returns over May 2010 to May 2025 are taken, the Nifty 100 TRI has given 12.7% on an average.

Importantly, on a 5-year rolling basis over the above-mentioned period, the Nifty 100 TRI has given positive returns almost all the time (99.95%).

For retail investors, selecting individual large cap stocks may be challenging. Therefore, taking the mutual fund route for large cap exposure is ideal as the fund manager follows rigorous models and filtration processes to bet on the right set of stocks.

Disclaimer: The Views are Personal and not a part of the Outlook Money Editorial Feature