For Shubham Pandey, a 29-year-old manager at a consulting firm in Ghaziabad, managing personal finances is no longer limited to Excel spreadsheets, which he previously used for calculation and budgeting. Over the past year, it has morphed into a live data set, which he can check online, with the help of conversations with generative artificial intelligence (GenAI) tools like OpenAI’s ChatGPT and Google’s Gemini.

What started as curiosity last year has now become a habit. “Earlier, I had to download PDFs of statements from multiple accounts, check credit card spends, and manually sort everything on my excel sheet. Now, I just upload my bank statements to the tool, and it categorises everything, from shopping, household spends, equated monthly instalments (EMIs), and even small Unified Payments Interface (UPI) transactions, without me wracking my brain over calculations,” he says.

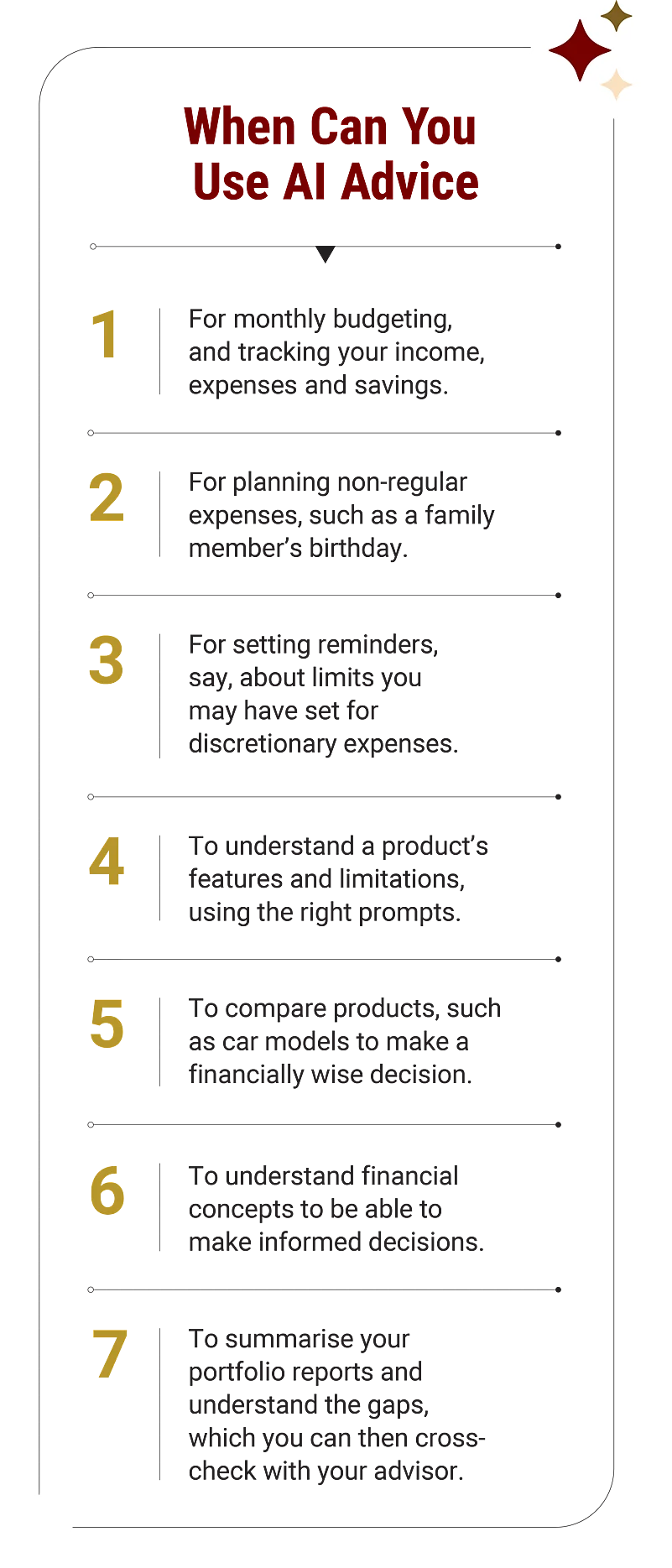

Shubham uses AI in layers. At a basic level, it tracks monthly expenses and sends him prompts about bill due dates, emergency fund balances, or whether he is overspending in certain categories. At a more advanced level, Gemini, which is integrated with his Google email ID, helps him file tax returns, integrate receipts from trips, and run calculations on investment options. The AI remembers his past inputs, analyses spending patterns and when “prompted”, offers suggestions aligned to his financial goals.

For instance, in August, Shubham wanted to plan a gift and celebratory day for his sister’s birthday. He asked AI to set aside a target at the end of July and followed through with it. It helped him plan the monthly budget without compromising on his home loan EMI and daily spends.

He says: “Even buying a phone is not just about picking the model. I ask the AI to compare specs, calculate the cost with credit card offers, and tell me the best time to buy.”

Generative AI is open-ended which can given biased results, while robo-advisory works with verified datasets linked to actual accounts

Over the last year, he estimates these tools have directly helped him save nearly Rs 6,000 every month, mostly by flagging impulse spends, optimising purchase timings, and keeping credit card limits in check across three different accounts. “The AI agent reminds me when I am drifting from my targets. Sometimes it is just Rs 500 here or Rs 1,000 there, but it adds up. Earlier, I wouldn’t have noticed until the month-end. Now, I course-correct in real time,” he adds.

Shubham primarily uses AI for budgeting, but has figured out other use cases, such as comparing mobile phone models, weighing loan terms, choosing between the old and new tax regimes, and so on. He stays away from seeking direct investment recommendations, but has recently started looking at AI to pull up market trends to analyse stock histories for comparative assessments. “Time is money. I can get in one minute what would otherwise take half a day,” he says.

AI is omnipresent. But the big questions are: how does AI advice work, can you really trust it or stick to our good-old financial advisors, and what are the risks of AI?

Shubham has figured out a way for himself, but what about you? We give a lowdown on this new territory of financial advice.

How Does AI Advice Work?

To the uninitiated, there’s a difference between generative AI tools, such as ChatGPT or Gemini, which respond to free-form prompts, and structured AI-backed platform, like robo-advisories, designed for investments, which have been in existence for a while now.

Sadique Neelgund, a qualified personal finance professional (QPFP), certified financial planner (CFP) and founder of Network FP, says users often confuse the two. “Robo-advisory is rules-based and works with verified datasets, typically linked to your actual accounts. Generative AI is more open-ended, which makes it powerful, but also less predictable as it can be factually wrong or globally biased,” he says.

Says Krishan Mishra, CEO of Financial Planning Standards Board India (FPSB): “Robo-advisory is built for efficiency. It pulls, cleans, and presents your data, while Gen AI like ChatGPT can synthesise answers from a number of sources.”

If Shubham’s AI journey is about conversational budgeting, Kaustubh Jadhav’s is about structured, automated oversight. The 29-year-old venture capitalist based in Bengaluru relies on a dedicated AI-powered robo-advisory tool linked directly to his investment accounts.

Every month, the platform emails Kaustubh a clean, visual report of his portfolio, performance summaries, allocation breakdowns, and even red flags where investments are lagging. “It’s like having an analyst on retainership. I don’t have to manually log into multiple platforms or track individual stocks and funds. Everything comes to me, already digested,” says Kaustubh.

The tool doesn’t just show him numbers; it tells him when something needs attention. If a mutual fund starts underperforming, it prompts him to review alternatives. If his portfolio tilts too heavily towards one asset class, it flags the imbalance. For all this, Kaustabh doesn’t have to type in too many prompts; the AI consumes raw account data (via secure integration) and structures it into actionable insights.

For Kaustubh, the biggest advantage is the clarity this tool offers. “I have always been comfortable with investments, but dealing with financial data can be tedious. AI turns it into something I can glance at over coffee and still stay informed,” he says. That clarity has helped him to make quicker, more confident portfolio adjustments, and not ignore underperforming assets.

Shubham’s ChatGPT prompts and Kaustubh’s automated portfolio reports prove that AI in personal finance isn’t uniform. It is a spectrum, from open-ended, democratic, free conversational tools that can answer almost anything, to tightly engineered platforms that only touch your verified accounts, based on the access you provide. Though there are many in-house robo advisory platforms, the capital markets regulator, the Securities and Exchange Board of India (Sebi), has guidelines that require robo-advisors that are servicing clients to register as investment advisors.

For Kaustubh, AI’s role is clear. “It’s my early warning system. It doesn’t make decisions for me, it just ensures I never miss a sign,” he says.

Limitations Of AI Advice

All’s not hunky dory when it comes to AI advice.

Accuracy Is Questionable: The problem with AI is you cannot trust it blindly because it pulls data and information from a large collection of Web resources and knowledge. Also, this doesn’t always get updated in real time. This delay becomes significant when it comes to getting answers from AI chatbots and the “knowledge cutoffs” they have. Knowledge cutoffs are the specific date till which a Large Language Model (LLM) has been trained.

Knowledge cutoffs can result in the chatbot citing outdated regulations and tax laws, as it won’t factor in recent changes related to deductions, Provident Fund (PF) contributions, new investment rules, and so on. Following outdated rules can lead to penalties or missed opportunities. The absense of context is another challenge.

Nishant Pradhan, chief AI officer, Mirae Asset Investment Managers (India), says that to counter the challenges related to the knowledge cutoff, it’s important to approach outputs thoughtfully and apply individual judgement. He says: “AI can be a powerful tool for research and insight generation, but its value depends on how it is used. It is important to approach outputs thoughtfully and apply individual judgment throughout the process.”

Shashi Shekhar Vempati, co-Founder of DeepTech for Bharat Foundation (AI4India) and chairperson of Science & Technology Communication Apex Advisory Committee, Government of India, says that AI chatbots, which run on LLMs are trained on vast amounts of text, but often fail to contextualise it.

“The vast amounts of text they have been trained on is typically the content that is widely available on the public Internet,” says Vempati.

Moreover, it could pull global data, or even information that has been taken from an unverified source.

Says Neelgund: “Generative AI tools like ChatGPT or Gemini synthesise responses based on patterns from their training data. That is powerful, but also risky, because the data may not always reflect the regulatory environment or the market reality in India. In such cases, you can end up with misleading advice.”

In other words, an AI tool might give you an elegant, convincing answer, but one rooted in, say, US tax rules or outdated investment logic. And unless you catch the mismatch, you could take action on advice that doesn’t apply to you. This is especially true in the case of generative AI.

Prompts Can Be A Tricky Game: What can help sort the problem is proper prompts. Generative AI tools are all about “prompts”—the better and more detailed your questions are, the more elaborate the answers will be.

Says Shubham: “The suggestions are either too generic or assume that I live in the US. I have learned to refine my prompts, specify ‘in India’, give the full financial context, and ask for multiple options.”

And that’s where the major challenge lies. Experts say this trial-and-error approach is common, and risky if users are not well-informed or careful. Inaccurate prompts can generate unreliable information.

Confirmation Bias Can Skew Results: Mishra and Neelgund both flag something critical that users must know: If you ask enough times, AI will eventually give you the answer you want, which is known as confirmation bias. “If you keep prompting AI until it tells you what you want to hear, that’s confirmation bias, and it can be dangerous,” adds Neelgund.

Jaspreet Bindra, CEO of AI & Beyond, an AI advisory and education firm, explains, “AI doesn’t ‘feel’ anything; it only recognises patterns in language and mimics empathy based on data. It’s a very convincing performance, but it’s still a performance. It can identify cues like frustration in your words or joy in your tone, and respond accordingly, but it has no inner life, no stake in your well-being, and no understanding beyond probabilities.”

“Money decisions based on unverified reassurance can be dangerous, especially in things like insurance or mutual funds,” Mishra warns (see Prompt Away AI Biases, Black Boxes). That again makes accuracy questionable.

The danger is when users start treating simulated empathy as a genuine connection. In fact, Open AI CEO and ChatGPT’s founder Sam Altman stated in a viral post on social media platform X (formerly Twitter): “People have used technology including AI in self-destructive ways; if a user is in a mentally fragile state and prone to delusion, we do not want the AI to reinforce that. Most users can keep a clear line between reality and fiction or role-play, but a small percentage cannot.” He went on to say, “I can imagine a future where a lot of people really trust ChatGPT’s advice for their most important decisions. Although that could be great, it makes me uneasy.”

Bindra notes that people may overtrust AI’s advice in emotionally charged situations, whether in mental health, relationships, or money, forgetting it does not truly care. That can lead to misplaced reliance, poor decision-making, or even emotional manipulation if the AI is optimised for engagement rather than truth.

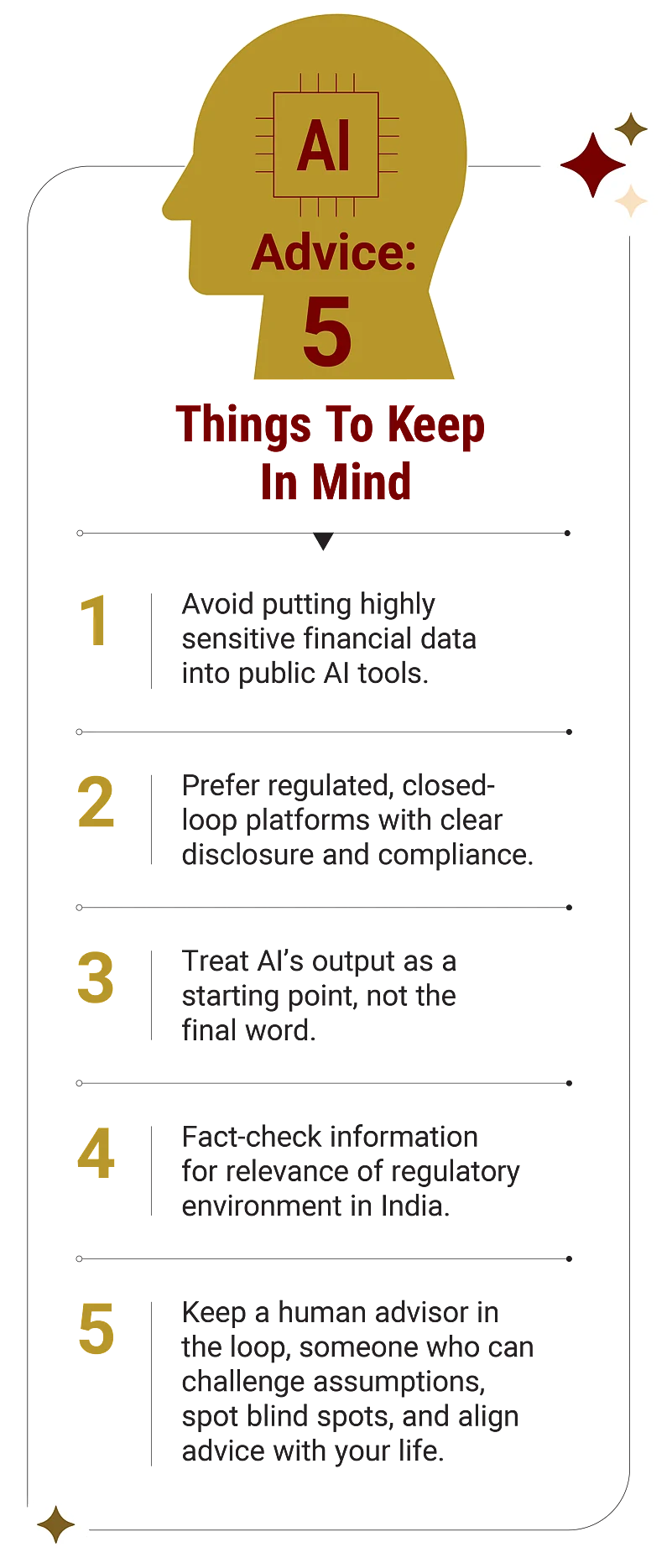

Data Privacy Is A Concern: The risks extend way beyond accuracy. When asked if he worries about data privacy, given the scale of information he’s sharing with AI tools, Shubham says he’s aware of these limits and has set his own boundaries. He avoids entering account numbers or sensitive bank details, focusing instead on broad summaries, cropped screenshots, and sometimes hypothetical numbers. “It’s still a machine. I’d never tell it everything,” he says.

Altman recently acknowledged that there’s “zero privacy” in AI tools unless the platform explicitly promises otherwise.

Says Bindra: “If you are feeding an open AI tool your bank statements or credit card details, you are essentially sending them into a black box. Even if the provider claims they don’t train on your data, breaches, misuse, or accidental exposure can happen.”

The risks, Bindra says, range from identity theft and financial fraud to breaches of confidentiality agreements (if you are handling company-related expenses).

There is also the legal angle, depending on your jurisdiction. Sharing such data with a tool that stores it outside your country could violate data protection laws like General Data Protection Regulation or India’s Digital Personal Data Protection (DPDP) Act, 2023.

Adds Bindra, “If you must use AI for your personal finance tasks, go with tools that are enterprise-grade, locally hosted, and compliant with relevant financial data security standards (like PCI DSS). Otherwise, you are better off using AI as a guide, not a vault.” For safety, keep account numbers, personal IDs, and raw statements away from public models.

Brijesh Patel, chief technology officer (CTO) of SNDK Corp, an IT solutions and support services firm, says true “safe AI” needs in-built privacy-preserving mechanisms, with encryption, local hosting, disclosures, and deletion controls. “Without that, safe is just a marketing term, not a practice,” he says.

Adoption By Advisors

For all the talk of AI replacing financial planners, many in the industry are not treating it as a rival at all, but as a quiet, efficient colleague. They are not trying to predict your next stock move or dictate a tax strategy using AI, but for handling time-consuming work.

A recent global research by FPSB titled Impact of AI on Financial Planning found that over three-fourths of financial planners believe AI will help them serve clients better, and 60 per cent think it will enhance the quality of advice. The most common uses of AI today is client communication, data collection, and risk profiling, groundwork that is time-consuming but makes planning more efficient, and relies on human judgement to tie it all together.

Neelgund says that some planners now use AI to profile clients without disclosing their identities or personal information to these tools, run quick simulations, summarise complex reports, and even prepare visually intuitive charts for client presentations. “It’s about freeing up the planner’s time from routine analysis so they can spend more time in client conversations,” he says. In other words, the machine sifts through the data, the human makes sense of it and puts it in context.

Platforms like Novelty Wealth that use AI for personal finance advisory take a similar approach, but at scale by blending Sebi-registered human expertise with an AI layer that works as a “conversation agent” for clients. Co-founder Naveen Changoiwala says their AI runs dozens of checks on a client’s linked accounts, flags tax inefficiencies or overexposure, and then offers a list of suggested corrections. Human advisors remain in the loop, reviewing the AI’s findings before a client acts. This hybrid model solves two problems: making expert advice accessible while keeping its quality intact.

Even firms that are openly sceptical of AI in direct advisory see value in using it as a filter. 1 Finance, a personal finance advisory firm, for instance, uses AI to scan over 50,000 financial products, run quantitative analysis, and shortlist potential fits. But the actual recommendations, and time to enter or exit, remains human-led. “AI is a remarkable co-pilot, but it will never be the pilot in command,” says Keval Bhanushali co-founder and CEO of 1 Finance.

Mishra frames it in simpler terms: AI can take an eight-hour job and finish it in half an hour. The remaining time should go into refining the plan, stress-testing it against the client’s needs, and making sure it actually gets implemented, he says. “Financial planners who learn to work with AI will sharpen their skills and add more value, but the ‘financial doctor’ role will remain human,” he says.

AI is speeding up pattern recognition and number crunching, while human planners navigate the emotional terrain, behavioural biases, and life-context decisions that numbers alone can’t settle.

What Works For You?

If AI can already do so much heavy lifting, does the client really need a human financial planner?

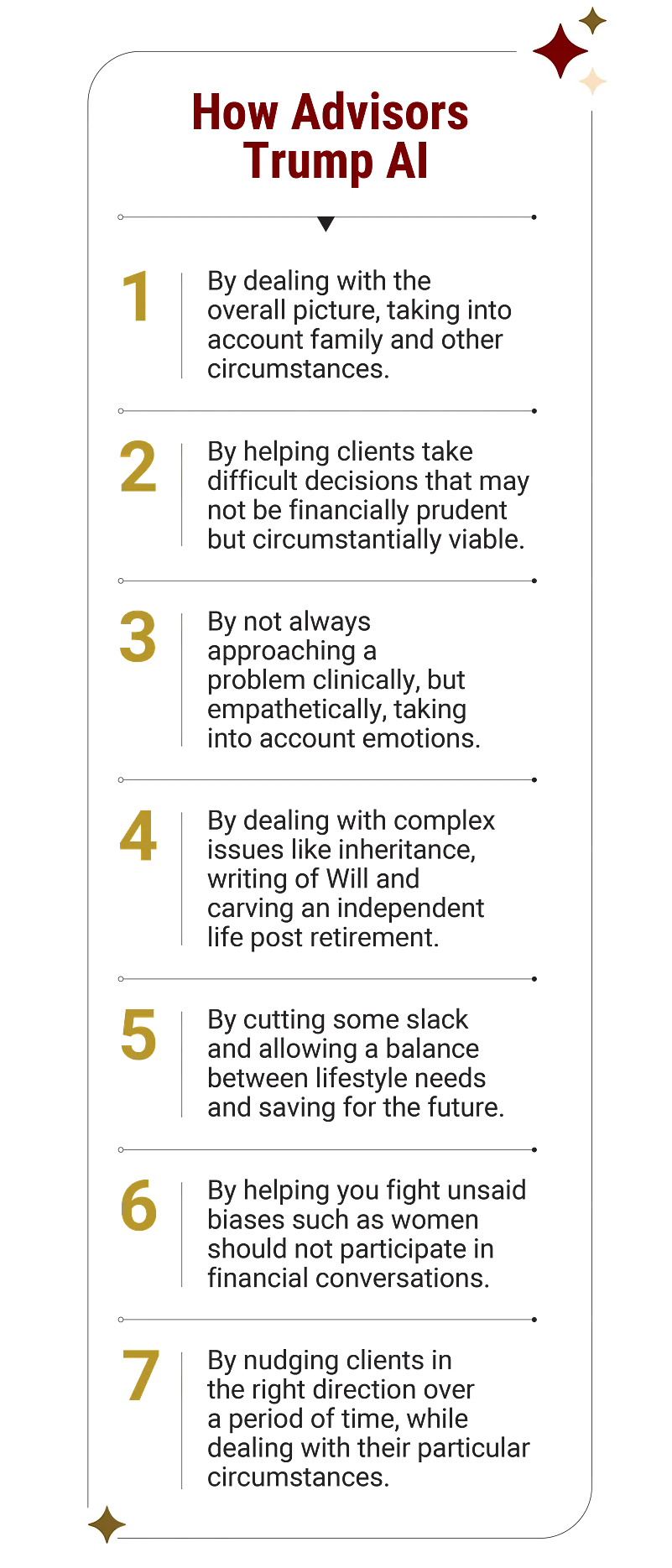

The biggest criticism that AI faces at present is that it is unable to take context into account, which means it can’t customise advice the way an efficient financial planner can do. Both generative AI and robo-advisories focus on bare numbers, but that’s not the only aspect that financial advisors tackle.

Neelgund, who conducts regular workshops for financial advisors on the use of AI, says that the relationship between a client and a financial advisor often goes far beyond numbers on a spreadsheet.

“This is not just about financial advice; it’s about being part of someone’s life journey,” he says. This emotional and social bond plays a crucial role in decision-making, he adds. An AI tool, no matter how advanced, cannot understand the subtleties of family dynamics, or provide the steady hand that comes from years of shared history.

Says Kaustubh: “It doesn’t know my long-term life goals or risk appetite. It’s a data interpreter, not a planner.” In fact, he sometimes feels that the sheer volume of insights gets overwhelming, and too much information can tempt hasty decisions. “When a chart tells you something’s underperforming, the impulse is to act, even if holding on might be the better choice,” he adds.

That’s where financial experts see the dividing line between AI robo-advisory, GenAI, and humanled advice. Says Mishra: “Both (Gen AI and robo-advisories) lack the ability to truly understand your personal context unless you provide it in detail. And even then, it’s interpreting, not empathising.”

Kaustubh’s experience underscores another critical aspect: the emotional buffer. Says Mishra: “An AI report is cold and factual. It doesn’t reassure you when markets are down or talk you out of panic selling. That’s still the role of a human advisor which is to keep you aligned with your plan.”

Mishra believes AI will never fully replace the human role, especially in understanding emotions and navigating life events. “A financial planner is like a doctor. AI can do your tests, process the data, and tell you the numbers. But deciding the treatment, requires empathy, judgement, and a personal connection,” he says. He points out that even robo-advisory, which seemed revolutionary when it emerged in 2009, could not achieve full adoption for this reason. GenAI may be its evolved form, but without the human follow-through, advice can remain just theory.

Dilshad Billimoria, managing director and principal officer, Dilzer Consultants and Sebi-registered investment advisor (Sebi RIA), distils the decision-making process into four questions: “What is the risk? Can I lose money? What is the return? What is the goal and time frame?” AI can help you get those answers faster, but it is still you, or a trusted advisor, who must interpret them in the context of your life.

Integration Is The Key: But how does one tackle the growing curiosity among the younger generation, a lot of whom prefer short-cuts rather than detailed discussions.

Mohini Mahadevia, a Mumbai-based CFP, says AI-driven tools are being used especially for budgeting and expense tracking, where its ability to respond instantly, repeatedly, and without judgment is genuinely helpful. She adds that while AI can customise trackers, crunch numbers, and explain concepts in plain language, but when it comes to investment planning, it requires reading between the lines. “A 40-year-old professional, a single mother, and a businessman with generational wealth have different financial goals. AI can’t fully grasp those nuances. If you don’t have first-hand knowledge, it can damage your finances,” she says.

Himanshu Ranjan, a 22-year-old marketing professional in Delhi NCR, seems to have found a middle path. For him, AI is a great teacher and quick reference guide, but he doesn’t trust it for decisions that can change the course of his financial life.

When he needs to understand a new tax rule, compare credit cards, or figure out how an FD works, generative AI is his first stop. But the moment the conversation shifts to buying the right health insurance, rebalancing his portfolio, or making any significant investment, he turns to the people who know him best, first his parents, and when they don’t have the answers, the family’s long-time financial planner.

That human advisor is aware of not just Himanshu’s financial history, but emotional triggers, lifestyle, and risk appetite, too. The planner is able to challenge his assumptions, point out blind spots, and offer solutions that work in the real world. Himanshu says AI sometimes reinforces his own pre-set biases, particularly if he is already leaning towards a certain investment.

Explaining the integration of human advisory with AI on his platform, Changoiwala says that their model works as a complementary tool for human advisors. “It acts as the conversation agent, while experts provide research and recommendations. For instance, I research mutual funds, ABC is good, CEF average, XYZ not good, and feed that to the AI tool. When a user links data, it flags good and bad funds. This spreads human expert-driven research to thousands of users, overcoming the limit of one advisor serving 100-250 clients.”

Changoiwala argues that many affluent Indians never see a CFP in the first place, relying instead on generic advice from Google searches, friends, or influencers. In such cases, AI can actually provide more personalised, unbiased guidance compared with these informal sources.

“CFPs will remain relevant for complex, long-term planning like business or Wills, while AI covers basic personal finance for middle and lower-affluent segments,” he says.

Bhanushali says the execution of advice, the “why” behind a decision and ensuring it is acted upon, is inherently human work. The firm’s philosophy currently is “human-led, AI-enabled”, not the other way round. AI helps sorting through options, but the planner makes the call after weighing life stage, emotional factors, and changing personal priorities.

The split in approach reveals something important: the future may not be about choosing between humans and AI, but about deciding which mode should take the lead at what point of time.

For now, that balance depends on the complexity of the decision, an individual’s comfort with technology, and, most critically, their willingness to trust a machine with their money decisions. Over the next decade, the question, perhaps, won’t be whether AI should be used for personal finances, rather it will be about how deeply it’s embedded. Since the technology is already here, the deciding factor will be how far trust, regulation, and human oversight goes.

AI Vs Financial Planners

We posed financial planning questions to an AI and two different CFPs to compare the solutions. While the AI responses can’t be completely faulted, in many cases they are technical and in a few instances, vague. For some answers, it has considered general thumb of rules that may or may not work. The CFPs have taken a more human approach in terms of balancing finances and life, and have given pointed answers to questions. In some cases, the advice is similar, and in some, a combination of both may work well.

It’s important to mention here that this is just for illustrative purposes and overall financial plan involves multiple and intensive sessions with financial planners, and responses may differ according to the circumstances of an individual, such as the amount of debt a person has or the number of dependants in the family.

1. How do I decide the right split between saving, investing, and spending each month with a monthly salary of Rs 50,000?

Generative AI Response: Use the 50-30-20 framework: 50 per cent for essentials, 30 per cent for discretionary spending, and 20 per cent for savings and investments. Adjust only if financial goals or debts require it.

CFP Response: Rochak Bakshi, CFP: Early in your career, your salary will be on the lower side. Invest in your skills for the first 3-5 years, enjoy yourself, and later aim to save about 30 per cent of your salary, which you can also invest according to your preference.

2. What is the most effective way to build and maintain an emergency fund based on my income?

Generative AI Response: Target 3-6 months of essential expenses. Contribute a fixed sum every month to a liquid account. Replenish after usage. Automate transfers for growth without affecting expenses.

CFP Response: Dilshad Billimoria, CFP: Target 3-6 months of expenses. Save 10 per cent of the income in high-interest savings, liquid funds, or flexi fixed deposits (FDs). Use only for emergencies and review periodically.

3. How can I track and reduce small expenses that add up over time, especially, when I use Unified Payments Interface (UPI) for the majority of purchases?

Generative AI Response: Use banking or finance apps to categorise UPI transactions. Review weekly for recurring small expenses. Set limits for categories like food delivery or coffee. Small cuts accumulate over time.

CFP Response: Dilshad Billimoria, CFP: Use apps like Walnut or Money Manager to track automatically. Categorise monthly spends, set a fun budget, and review quarterly to cut leaks without feeling restricted.

4. What is the ideal way to start investing with a small monthly amount such as Rs 3,000?

Generative AI Response: Start SIPs in low-cost index funds or mutual funds. Automation reduces the risk of missed contributions or timing errors. Long-term compounding makes small amounts effective.

CFP Response: Dilshad Billimoria, CFP: Start an SIP in an equity index fund like Nifty 50 for the long term. Use balanced advantage funds for lower volatility; open a Public Provident Fund (PPF) account for safety. Avoid frequent market checks.

5. What should I do with my Diwali bonus (around Rs 10,000) received in addition to income?

Generative AI Response: Split the bonus: 50 per cent for savings/investment, 30 per cent for debt repayment, 20 per cent for discretionary spending. This will ensure financial goals progress along with personal use.

CFP Response: Rochak Bakshi, CFP: Use your Diwali bonus to gift loved ones, enjoy a special meal, or buy crackers. Spend it fully so everyone cherishes it, life isn’t only about money, but about moments and memories shared.

6. If I get a Rs 5 lakh windfall, how should I allocate it between debt repayment, savings, and investments?

Generative AI Response: Prioritise high-interest debt. Allocate 30-40 per cent to emergency savings, 40-50 per cent to investments, and 10-20 per cent for personal use.

CFP Response: Dilshad Billimoria, CFP: Allocate 40 per cent to debt, 30 per cent to investments, 20 per cent to emergency fund, and 10 per cent for lifestyle upgrades to balance security and enjoyment.

7. I want to buy a car and would need a loan. How can I check if the EMI will fit my budget without affecting my savings and goals?

Generative AI Response: Calculate total monthly cost: EMI, insurance, fuel, maintenance. Ensure it does not exceed 20-25 per cent of net income. Adjust loan tenure or downpayment if necessary. Use EMI calculators for accurate budgeting.

CFP Response: Dilshad Billimoria, CFP: Keep EMI within 20 per cent of your income. Include fuel, insurance, and maintenance costs in your budget. If this exceeds your “wants” allocation, reconsider the purchase.

8. I pay Rs 15,000 per month for rent. In the coming two months, upon contract renewal, my rent will increase by 10 per cent per month. How should I adjust my budget?

Generative AI Response: Reduce discretionary spending or reallocate funds within essentials. Keep savings and investments unchanged. Adjust categories like entertainment or non-essential purchases to absorb increased rent without affecting your financial goals.

CFP Response: Dilshad Billimoria, CFP: Shift the extra amount from “wants” or non-essential subscriptions, or earn additional income through freelancing. Keep your savings and investments intact.

9. How should I start planning/investing for my retirement based on my current salary (Rs 50,000)? I already contribute Rs 3,000 towards Employees’ Provident Fund (EPF)

Generative AI Response: Supplement EPF with PPF, National Pension System (NPS), or mutual fund SIPs. Target 15-20 per cent of the income. Start early to benefit from compounding.

CFP Response: Dilshad Billimoria, CFP: EPF is a good start. Add Rs 2,000-3,000 to an equity index SIP, increase contributions 5-10 per cent annually, and aim for 15-35 per cent of income in retirement savings. Diversify for growth and safety.

10. I am planning to shift from a salaried job to freelancing. How should I prepare financially for the first 6 months?

Generative AI Response: Maintain a 6-month emergency fund. Estimate variable income and create a conservative budget. Separate personal and business accounts. Keep short-term liquid investments accessible

CFP Response: Rochak Bakshi, CFP: Build an emergency corpus covering three years of expenses, excluding capital costs to start your business. Three years’ cover gives you enough safety to handle income fluctuations.

11. I feel guilty spending on leisure even when my finances are stable. How do I balance enjoyment and saving?

Generative AI Response: Allocate a fixed portion, let’s say, 10-15 per cent of the income, for discretionary spending. Track it like any other expense. Maintain overall savings, while allowing controlled spending.

CFP Response: Rochak Bakshi, CFP: Use the Memento Mori calendar to see how much of your life you’ve lived and how much remains, it helps you value experiences and feel less guilty about spending on yourself.

12. My friends often push me to join expensive trips and outings. How can I say no without feeling left out?

Generative AI Response: Set a clear budget limit and decline activities exceeding it. Maintain financial priorities without overspending.

CFP Response: Dilshad Billimoria, CFP: Suggest cheaper alternatives, be honest about your goals; attend a few key events; skip others to balance relationships and finances.

13. I get overwhelmed by financial jargon. What is the simplest way to understand if an investment is right for me?

Generative AI Response: Assess purpose, risk, and expected returns. Confirm alignment with goals and timeline. Ignore complex terms initially; focus on suitability and basic parameters.

CFP Response: Dilshad Billimoria, CFP: Address four things: risk, potential loss, return, and time frame. Short-term goals need safety; long-term goals can take more risk. Keep it simple and avoid overcomplicating.

14. I feel nervous every time markets fall. How can I avoid making impulsive decisions with my investments?

Generative AI Response: Maintain long-term investment plans. Diversify portfolios. Automate contributions via SIPs. Monitor periodically rather than daily to avoid reactive decisions during market fluctuations.

CFP Response: Rochak Bakshi, CFP: Be confident in the assets you own: debt, equity, or gold. Even good stocks can drop 20-30 per cent. Those who buy based on tips panic during drops; knowing why you own them will help you stay steady.

With inputs from Ayush Khar

anuradha.mishra@outlookindia.com

priyanka.debnath@outlookindia.com