The loss of a family member is a heavy burden to bear, more so when it happens unexpectedly. While dealing with paperwork may be the last thing on your mind when you are already under emotional stress, it is a necessity these days to avoid risks of identity theft and cyber fraud.

When Bhopal-based Sunil Chawla’s father passed away suddenly in 2013, he was mentally unprepared; however, he had the presence of mind to complete the basic paperwork. After receiving the last rites receipt from the crematorium, he presented it to the local authority and obtained his father’s death certificate, which he knew was required for settling insurance claims and closing his accounts. Sunil, who is in his late 50s, also ensured that his chartered accountant cancelled the Permanent Account Number (PAN) of his father after filing the income tax returns (ITR).

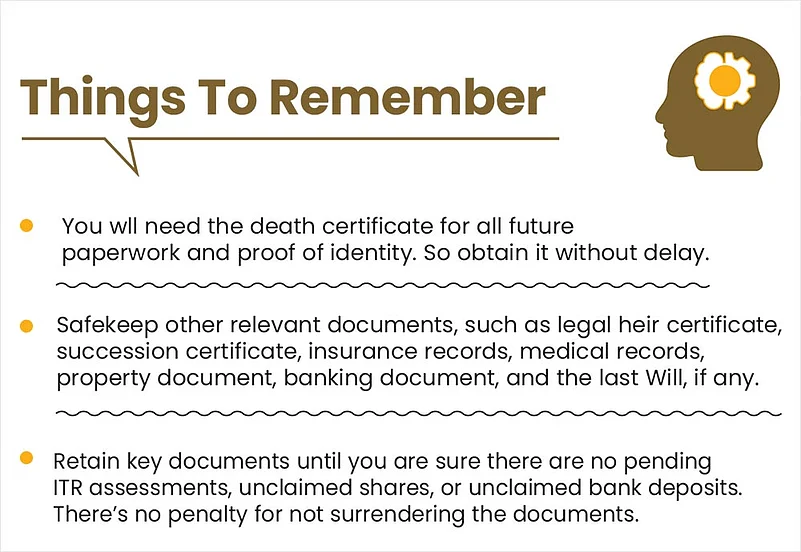

In India, when someone dies, the death must be registered with the concerned state or Union Territory in accordance with the rules under the Registrar of Births & Deaths Act, 1969. The registration can be done for free within 21 days of the death.

If the death occurs at home, a family member must report it to the local registrar within 21 days to obtain the death certificate. In case of a delay, the process becomes longer, as permission from the area magistrate or registrar is required, along with a payment of late fee. Generally, deaths are reported within this time frame, and family members receive the death certificate.

If a person dies in a hospital, the doctor in-charge registers the death. If the death occurs in jail, the jail in-charge is responsible for registering it. For someone found dead in a deserted area, it must be registered by the local police station or the village head of that place.

Like Sunil, many people are aware that the death certificate is needed for claiming life insurance, settling bank accounts, and closing demat accounts and other investments, but very few pay attention to securing and settling other personal documents, such as Aadhaar, driving licence and even social media accounts. Sunil himself didn’t know what to do with his father’s Aadhaar and Voter ID. He still holds them.

To avoid risks and a long-winding process, it’s important to close all the paperwork of the deceased.

We tell you why you must do this, the documents you should surrender, and how to tie the loose ends.

Know The Risks

There have been numerous cases where fraudsters have used a deceased person’s personal details for monetary gain, such as by transferring unclaimed shares, executing fraudulent sale deeds, or to receive subsidies.

Cases where fraudsters have used the PAN of a deceased person came to light only when the income tax department sent notices for not filing ITR, and the deceased person’s family informed the authorities that the person had passed away. In some cases, these people had passed away more than 10 years ago, according to media reports.

There have been numerous cases where fraudsters have used a deceased person’s personal details to commit fraud, such as transferring shares or to execute sale deeds

Talking about the risks of leaving a deceased person’s personal IDs and documents unattended, Shaishavi Kadakia, partner, Cyril Amarchand Mangaldas, a law firm, says, “As technology advances and more IDs and information are digitised, there could also be a leakage of the deceased’s sensitive information, which may be linked to personal IDs if they are not protected.”

Abhishek Baid, an advocate at the Supreme Court of India, explains in detail. He says: “Personal IDs of a deceased person can be highly vulnerable to misuse, posing risks, such as identity theft, fraudulent financial transactions, and unauthorised access to services. Fraudsters can exploit these IDs to create fake identities, access bank accounts, obtain loans, or manipulate investments, leading to financial losses for the family. Additionally, such misuse can result in legal complications if the IDs are linked to illegal activities, such as money laundering or scams.”

Other than the government IDs, social media and digital accounts associated with these IDs can also be hacked and used for phishing or impersonation, he adds.

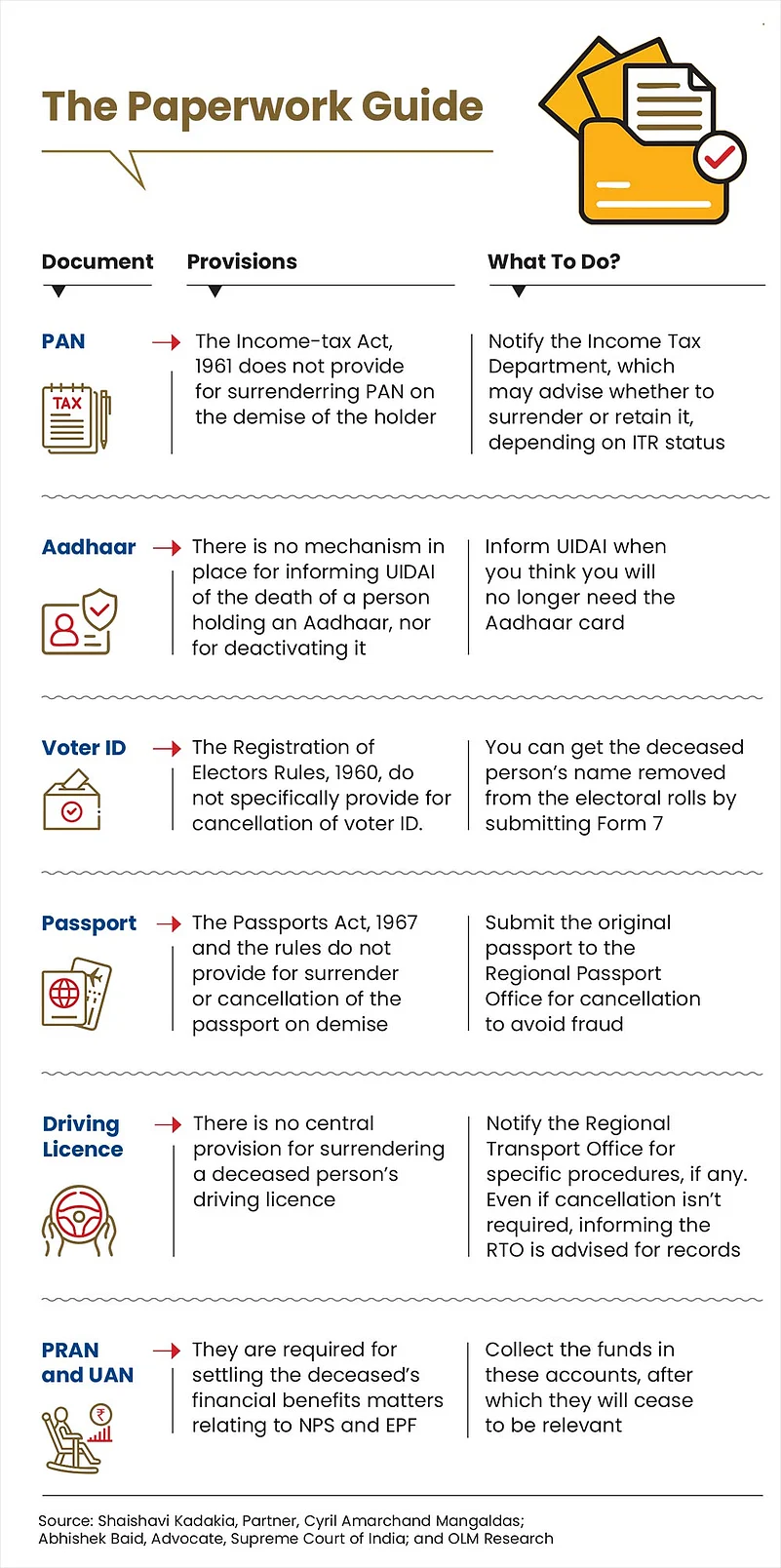

List Of Documents

The primary documents to close, deactivate or block, apart from PAN, include Aadhaar, Voter ID, passport, driving licence, Permanent Retirement Account Number (PRAN), and Universal Account Number (UAN) of the deceased.

Says Raghvendra Nath, managing director, Ladderup Wealth, a wealth management company: “The identity documents continue to exist until the legal heirs haven’t taken any action against surrendering or cancelling them. This can be done by submitting the death certificate to the concerned authorities. Usually, most of the documents continue to exist until they are surrendered, expired or cancelled, which happens once all the assets are transferred to the legal heirs and/or claimants, and liabilities are paid off.”

Documents Without Expiry Date: For documents without an expiry date, you will need to inform the relevant authorities.

Explains Nishant Datta, an advocate at the Delhi High Court: “The PAN remains valid, but can be surrendered to the income tax department by filling out Form 49A or by notifying the department about the person’s demise. Even Aadhaar is not automatically deactivated after death. The family can inform Unique Identification Authority of India (UIDAI) about the demise to have it deactivated. The Election Commission of India allows family members to report the death of a voter by filling out Form 7 for deletion from the electoral rolls.”

The primary documents of a deceased that should be blocked or deactivate are PAN, Aadhaar, Voter ID, Passport, Driving Licence, PRAN, and UAN

Documents With Expiry Date: Passports and driving licences have expiry dates and are automatically cancelled after those dates. However, in cases where the expiry date is still some years away, you can still approach the relevant authorities for a formal cancellation.

Apart from settling the official documents, such as Aadhaar, driving licence and others, it is extremely important to take adequate measures to close the bank account and block any related credit, debit or other cards of a deceased person. It may automatically happen if you inform the bank well in time.

Says Adhil Shetty, CEO of BankBazaar.com, an aggregator: “Any unauthorised use of a card—even by a family member—may be in violation of the card’s terms. The deceased accountholder’s family should ideally avoid using the card, and report the death immediately to initiate the closure of the deceased’s accounts or the accounts’ transfer to the intended nominees as necessary.”

He adds, “Cards may stand cancelled at the cardholder’s death or bankruptcy, and all amounts outstanding become immediately due, to be recovered as per the relevant laws.”

Documents For Social Security: The other two personal IDs—PRAN and UAN, are created for providing social security to a person. These are linked to the National Pension System (NPS) and Employees’ Provident Fund (EPF), respectively, and provide pension to the family after the subscriber’s death. These IDs do not have an expiry date and remain active until the pension claim is settled.

What Should You Do?

Though there is no penalty if an official document is not surrendered, it is advisable that the legal heirs surrender or cancel them to prevent any misuse.

Says Nath: “Failing to notify the issuing authorities leaves the documents vulnerable to misuse by fraudsters, and informing the authorities adds a layer of security against such risks.”

Since there are no legal provisions to deal with the status of these identification documents, the descendants need to separately deal with each document, says Kadakia.

The uncertainty about what might be needed in the future often leads families to store these documents indefinitely.

Sunil kept his father’s Aadhaar at home, and left the driving licence and passport to expire automatically. The voter’s list retained his father’s name until a few years later, when officials visited the address. However, he still retains the original voter ID and other personal documents “just in case”.

Says Shimpy Arman Sharma, partner, Anand Sharma & Associates, a law firm: “After death, the documents are required to claim pensions or settle accounts. The documents should be retained for as long as the claims are not settled.” The PAN should be retained for four years for ITR queries to be settled, she says.

Some experts advise keeping them for a longer period. “The duration for keeping these documents depends on the family’s legal needs but, generally, they should be preserved for at least 5-7 years after death, especially if the family is working on pension and insurance claims, or handling the estate,” says Baid.

The prudent thing to do would be to block or deactivate the documents, while retaining the original for any future need.

versha@outlookindia.com