Imagine a situation when you worked hard all your life and built a significant retirement corpus. But what should you do when you retire and regular pay cheques stop coming? This is where most investors stumble. After focusing for decades on growing their wealth, they find themselves uncertain on how to manage it once the flow reverses from accumulation to decumulation.

It is at this stage that they need to put their corpus to work so that it not only helps meet their monthly needs, but also lasts long enough.

And what’s the common mistake people commit at this stage? They, typically, shift their entire corpus into a savings accounts or other low-yield instruments for safety, thereby sacrificing growth.

Fortunately, mutual funds offer not just accumulation tools like systematic investment plans (SIPs), but also decumulation tools like systematic withdrawal plans (SWPs). They are designed to help retirees enjoy financial independence through steady, tax-efficient withdrawals. An SWP is designed to do exactly what SIPs do, but in reverse. While SIPs help you invest regularly during your working years, SWPs help you withdraw regularly during your retirement years.

Says Gaurab Parija, head–sales and marketing, Bandhan AMC: “SWP allows retirees to withdraw a fixed sum of money at regular intervals—monthly, quarterly, etc.—from their mutual fund investments. In essence, it transforms an investment corpus into a salary-like income stream, bringing consistency and financial confidence in the post-retirement years.”

Predictable Income With Growth

The biggest concern in retirement is income continuity. One of the reasons why SWPs work is that the income is predictable, as per the investor’s instruction to the fund house.

For instance, many retired individuals depend on income sources like rental income, but there is an inherent unpredictability to it—the tenant may end the lease on a short notice, and getting a new tenant may take time. In fact, during the Covid-19 pandemic, many homeowners faced duress as tenants stopped paying rent or abruptly ended their lease or asked for a reduction in rent. New tenants were also difficult to come by during the period at the same rate. Any economic uncertainty, which leads to job losses, can tip the scales against homeowners in this regard.

In such scenarios, your savings become your safety net—and that’s where SWPs from mutual funds can offer a reliable and flexible solution to maintain consistent cash flows.

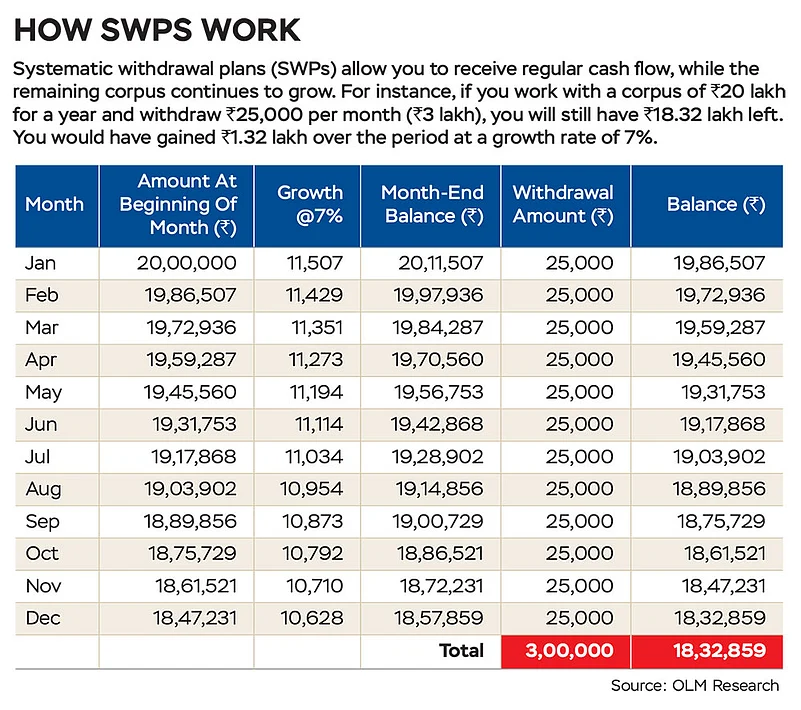

With SWPs, you can withdraw a fixed amount every month, say, Rs 25,000 from a corpus of Rs 1 crore, while the balance fund continues to stay invested and participate in market growth.

This structure provides two key benefits—stable cash flow just like your monthly pay cheques, and potential for capital appreciation as the remaining corpus is not sitting idle (see How SWPs Work).

Tax Efficiency

Unlike interest income from instruments, such as bank fixed deposits (FDs), SWPs offer tax-efficient withdrawals. While the profit from FDs get clubbed with one’s income, and are taxed according to the income tax slab, the rates on short- and long-term capital gains (STCG and LTCG) for equity may be more efficient for those in the higher tax brackets. Debt funds, however, are taxed at the income tax slab rates.

There are other benefits, too. You need to pay tax on interest earned on FDs on an annual basis, which is not the case with mutual funds. Taxation comes into play only at the time of redemption. In addition, if you withdraw from equity funds held for over a year, LTCG up to `1.25 lakh per financial year is tax-free.

These aspects make SWPs attractive for retirees looking to manage taxes smartly while meeting their monthly needs.

Flexibility

SWPs are also highly flexible, which gives investors control over their cash flows depending on how much and when they require money.

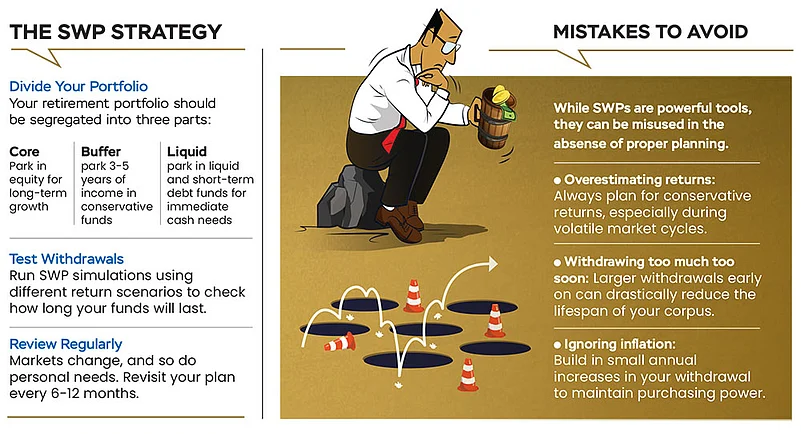

First, you can change the withdrawal amount in sync with your expenses (whether they grow or reduce). Second, you can adjust the frequency of withdrawals in accordance with your needs—monthly, quarterly, and so on. Third, you can pause or restart the plan based on changing cash flow needs or market conditions. “If expenses rise or circumstances shift, it’s simply a matter of submitting a new instruction,” says Parija.

There are also different types of SWPs to suit your cash flow needs. A Fixed Amount SWP allows you to withdraw a specific amount on each SWP date; a Capital Appreciation SWP only allows the gains on the investment to be withdrawn, while preserving the principal. A Fixed Percentage SWP allows a set percentage of the total investment to be withdrawn at regular intervals and the rest remains invested.

Riding Market Volatility

While SIPs use rupee-cost averaging to build wealth during market volatility, SWPs employ a form of reverse rupee-cost averaging, helping cushion the impact of market swings on the withdrawals.

Instead of redeeming a large chunk of your corpus at once, which is especially dangerous during a market downturn, SWPs allow for staggered and smaller redemptions. This approach helps preserve capital and ensures that the money lasts longer. “A staggered approach helps reduce the risk of redeeming a large sum during a market downturn. SWP helps in mitigating market volatility,” Parija adds.

Who Can Use SWPs?

An SWP is a useful tool for anyone looking to create a structured cash flow whether they are retired, nearing retirement, or simply seeking a steady flow of additional income. Says Parija: “For retirees, it offers a reliable way to replace regular salary. But it’s equally useful for those in the pre-retirement phase who want to plan and ensure smoother income continuity.”

In fact, SWPs can be used even by individuals who are not retiring soon, but want to set up a monthly payout for lifestyle needs, or simply to bring discipline to their investment withdrawals. “It’s a flexible solution that works across life stages; retirement just happens to be one of the most common use cases,” Parija adds.

Financial independence in retirement is not just about calculating the numbers, it is more about peace of mind. Knowing that you have a predictable income stream, without sacrificing growth, brings a sense of stability. SWPs give the confidence to enjoy life without worrying about outliving your savings. You just need to plan smartly.

kundan@outlookindia.com