ICICI Bank and HDFC Bank have reduced their fixed deposit (FD) interest rates this week. In the wake of the Reserve Bank of India (RBI) monetary policy committee (MPC) meeting held from June 4 to 6, 2025, in which the RBI MPC cut the repo rate by 50 basis points (bps) against the expectations of a 25 bps rate cut, several banks have started aligning their lending and borrowing rates. Following this, these two private sector banks also revised and reduced their interest rates. Notably, they have reduced FD interest rates by up to 25 bps to bring them down to 7.10 per cent for seniors and 6.60 per cent for general public. Before revising the rates, both banks offered the highest 7.35 per cent and 6.85 per cent to seniors and the general public, respectively.

Here are the latest rates for the general public and the seniors.

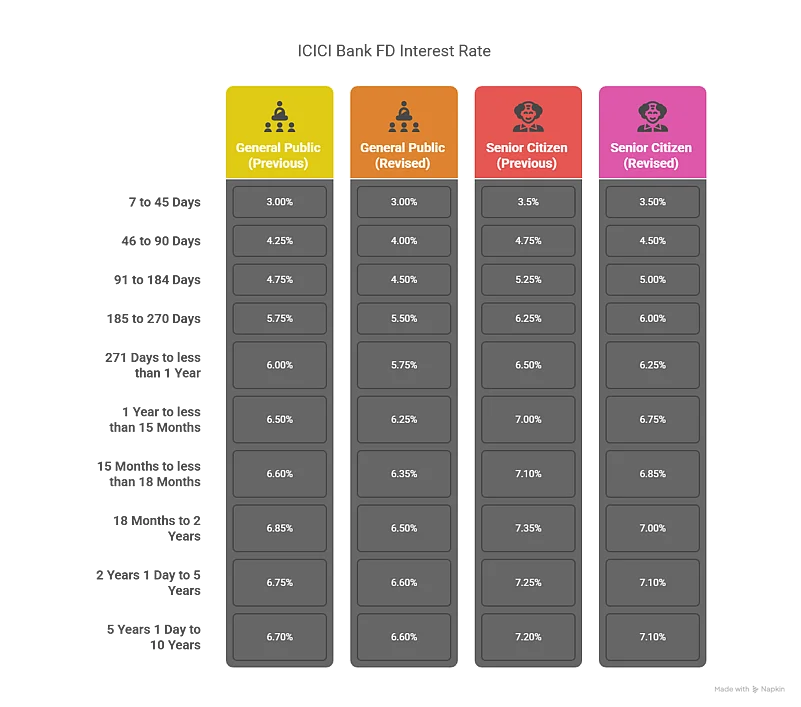

ICICI Bank

The bank revised the rates on June 9, 2025. It reduced the rates by a maximum of 25 bps and offers the highest 6.60 per cent to general citizens and 7.10 per cent to senior citizens for tenures from two years onwards.

Here are ICICI Bank FD rates:

Source: ICICI Bank Website

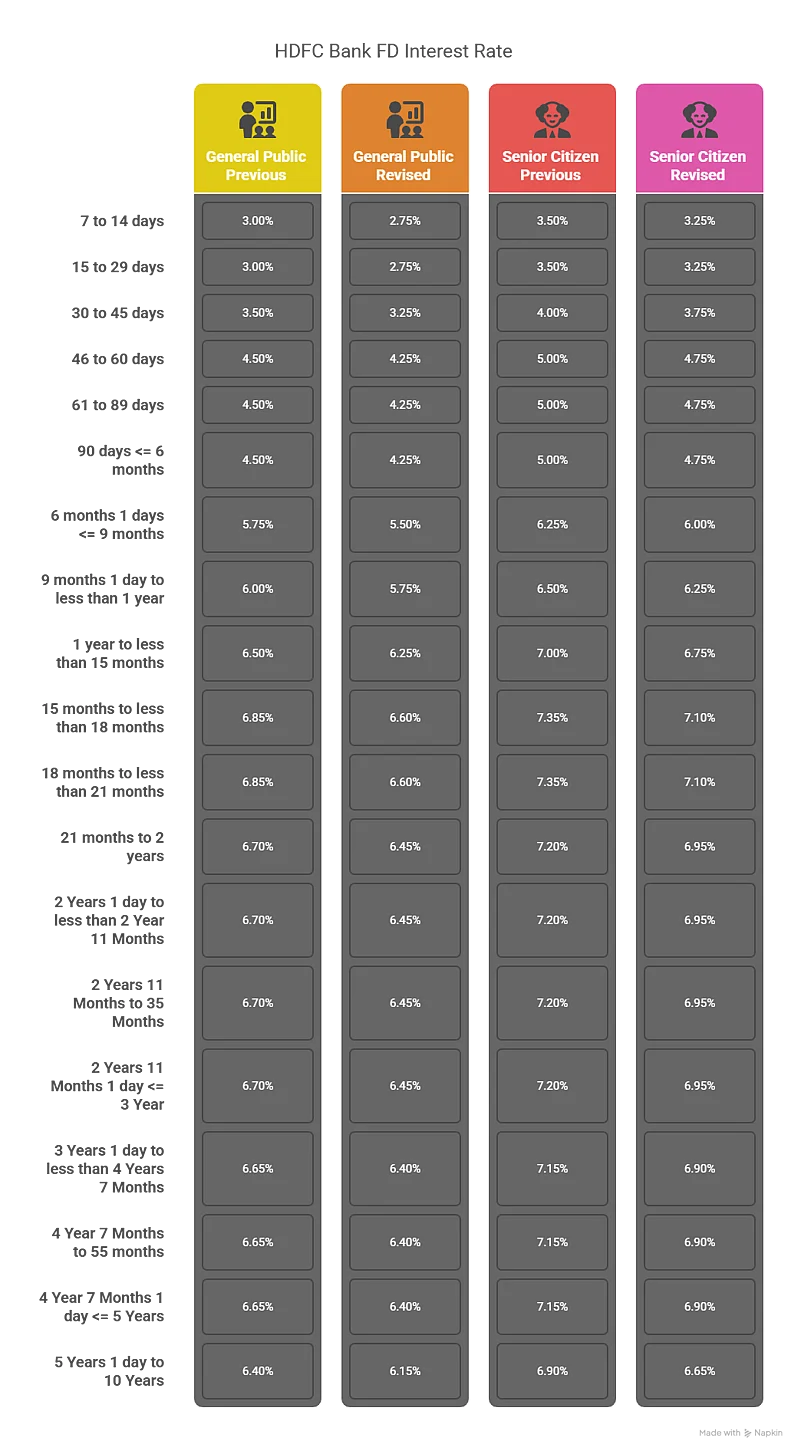

HDFC Bank

The bank’s revised rates are effective from June 10, 2025. It reduced the highest rates by 25 bps from the highest 7.35 per cent to 7.10 for seniors and 6.85 per cent to 6.60 per cent for the general public.

The details of HDFC Bank FD rates are:

Source: HDFC Bank Website

Amid easing inflation and falling interest rates environment, banks are revising their interest rates to align with the repo rate. There may be other banks joining the rate-cut regime.

According to experts, those who want to book FDs may do so now because the rates may go down further. Seniors may think of other savings schemes to invest money for guaranteed returns, such as the senior citizens savings scheme (SCSS) which offers 8.2 per cent interest. However, SCSS interest rates may also be reduced in the next quarterly review.