Summary of this article

SBI reduces ‘Amrit Vrishti’ FD rate by 15 basis points.

New rate stands at 6.45 per cent for the general public, effective December 15, 2025.

Senior citizens to earn 6.95 per cent and super seniors 7.05 per cent on this FD.

The State Bank of India (SBI) reduced its special fixed deposit ‘Amrit Vrishti’ interest rates by 15 basis points (bps), effective December 15, 2025. The bank last revised rates for a '444 day’ FD in June this year. At that time, the interest rate was reduced from 6.85 per cent to 6.60 per cent for the general public, and now, it has been lowered again by 15 bps to 6.45 per cent. Senior citizens (60 years and above) and super senior citizens (80 years and above) receive an additional 50 bps interest rate over these rates. So, Amrit Vrishti FD interest rate for seniors and super seniors will now be 6.95 per cent and 7.05 per cent, respectively.

Amrit Vrishti FD

SBI’s Amrit Vrishti FD, a special FD for 444 days, was launched on July 15, 2024. Initially, it was issued for a few months. In April this year, it was reintroduced and offered seniors 7.55 per cent. The bank reduced the rates in June 2025, after the repo rate cut by the Reserve Bank of India (RBI). After the rate revision in June, it offered seniors 7.10 per cent and super seniors 7.20 per cent.

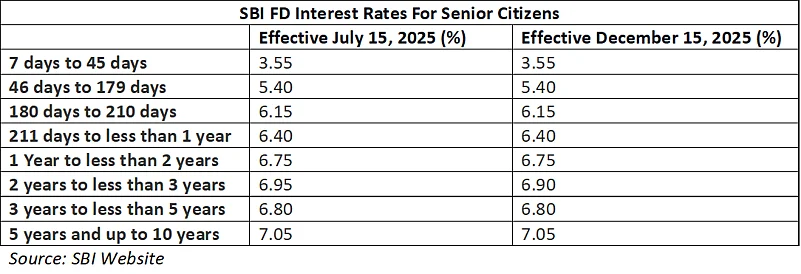

Now, after the 25 bps repo rate cut by the RBI in December 2025, SBI again reduced its FD interest rates. Here are the details for senior citizens:

The highest rate for the general public is now 6.40 per cent, for seniors, it is 7.05 per cent, and for super seniors, it is 7.15 per cent.

Note that the bank offers an additional 10 bps to super seniors over the rates available for senior citizens, 60 bps (50 bps + 10 bps) on FDs.

However, it clarifies on its website, “An additional benefit of 10 bps is applicable for Super Senior Citizens (80 years and above) over the interest rate applicable for senior citizens. The scheme is not applicable to the Recurring Deposit Scheme, Green Rupee Term Deposit, Tax Savings Scheme 2006, MODS, Capgain Scheme and Non-Callable Term Deposits.”