Since February 2025, the Reserve Bank of India (RBI) has reduced the repo rate three times, making a total of 1 per cent rate cut. This led to a general decrease in fixed deposit (FD) rates of banks. However, the Senior Citizen Savings Scheme (SCSS), which is fully backed by the Government of India, stands out as a secure investment option for senior citizens, especially in the context of declining FD rates. As of now, the SCSS offers an attractive 8.2 percent interest rate—the highest among all small savings schemes available among all small savings schemes offered by the post office.

The government reviews interest rates for all small savings schemes quarterly, and for the July–September 2025 period, rates, including those for SCSS, remain unchanged.

Senior Citizen Savings Scheme (SCSS)

The scheme is designed for senior citizens (60 years and above), allowing them to invest for an initial period of five years. It also provides a guaranteed quarterly interest payout on the invested amount. So, an individual aged 60 years or above, whether retired, self-employed, or non-working, can open an SCSS account at a post office or a bank. The maximum permitted investment is Rs 30 lakh per individual, and while multiple accounts can be opened, the total investment must not exceed this limit.

Interest Rates In SCSS And Fixed Deposits

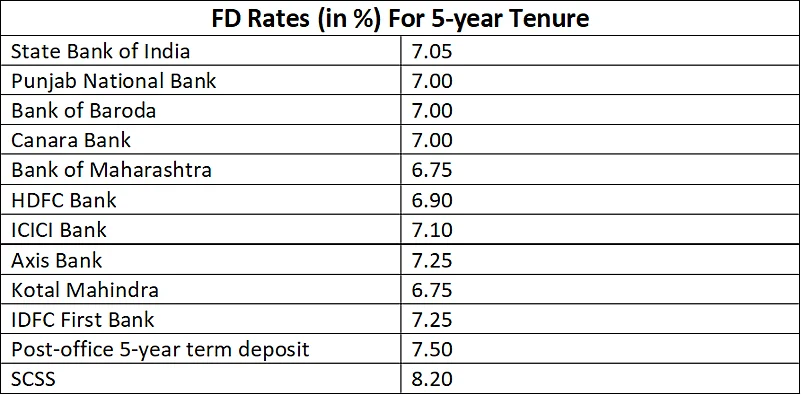

Unlike fixed deposits, where interest may be paid at maturity or periodically (monthly, quarterly, half-yearly, or yearly) based on bank rules, the SCSS disburses interest quarterly and locks in the rate at account opening. Following the RBI’s repo rate revision, most banks now offer between 6.5 and 8 percent on FDs for seniors.

Here is the comparison of SCSS and bank FD rates for 5-year tenure.

Source: Banks’ websites, Ministry of Finance Circular dated June 30, 2025

*Interest rates as of July 17, 2025

While the SCSS account is initially opened for five years, it is extendable in blocks of three years for a lifetime without any limit on renewals. In addition to higher interest rates compared to most fixed deposits, the SCSS provides tax benefits under Section 80C of the Income-tax Act, 1961 (applicable under the old tax regime).

SCSS: Invest Or Ignore

CA Anjali Sharma, Head of Products- Sapient Finserv Private Ltd, says, “It works best for those looking for steady quarterly income and who don’t mind limited liquidity”, and adds, “If you're a senior citizen and don’t need immediate access to these funds, this is a great window to secure high guaranteed returns before rates drop further.

Launched in 2004 at 9.0 percent, SCSS’s rate increased to 9.30 percent on April 1, 2015, and remained so until March 31, 2016, before trending downward. During the COVID-19 pandemic, the rate fell to 7.40 percent from April 1, 2020, to September 30, 2022. Then the rate was gradually increased to the present 8.2 per cent and has been effective since April 1, 2023.