The current financial year, FY 2025-26, is coming to an end. Ahead of the beginning of the new financial year, individuals seek ways to make the most of their investments. Investors who are on the lookout for new investment opportunities can consider investing in the Public Provident Fund (PPF).

The scheme is backed by the government and earns an annual interest rate of 7.1 per cent per annum. Individuals can deposit any amount ranging from Rs. 500 to Rs. 1.5 lakh in a PPF scheme annually. The investment can either be made on a lump-sum basis or an installment basis. Individuals are eligible for only 12 yearly installment payments into a PPF account.

Why Is The April 5 Deadline Important

Investors should take note of the April 5 deadline, as an investment made before this date can increase the interest earnings accrued in the PPF account. Notably, the interest your PPF deposit earns is calculated on the minimum balance present in the account between the fifth day and the last day of the month.

Notably, if an investor puts in the full amount that can be invested in one year (Rs 1.5 lakh) between April 1 and April 5, then he or she can get the highest interest possible. On the other hand, if an individual deposits the same amount in monthly increments, he or she will lose out on interest income for that particular month. Notably, the interest earned in PPF accounts is calculated on a monthly basis but gets credited into the account only once the fiscal year ends.

How Investing Before April 5 Helps

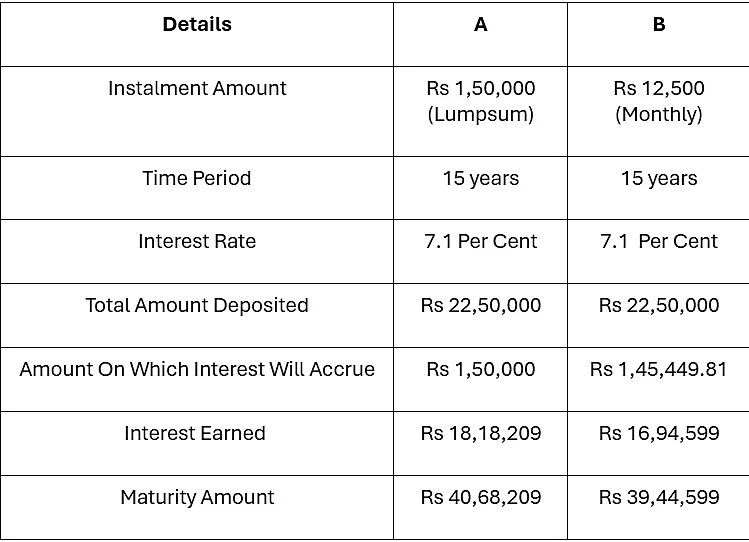

Let’s understand how much an investor can benefit by investing Rs 1,50,000 in a lump sum before April 5, compared to how much an investor will benefit by investing the same amount in monthly installments of Rs 12,500:

Let’s assume investor ‘A’ puts the entire Rs 1,50,000 in the PPF account between April 1 and April 5 every year. In this example, the interest rate for PPF has been kept constant at 7.1 per cent per annum. If A repeats this for the 15-year maturity period of the scheme, A’s investment of Rs 1,50,000 over the course of 15 years will result in a total deposit of Rs 22,50,000. At the end of the lock-in period, A’s deposits will earn an interest of Rs 18,18,209, and he will receive a total of Rs 40,68,209 once the 15-year lock-in period ends.

Now let’s assume another investor ‘B’ has invested the same amount (Rs 1,50,000 every financial year for 15 years) but in monthly instalments of Rs 12,500. In this case, the amount on which the interest will be calculated will be less than the total investment of Rs 1,50,000, as the interest your PPF deposit earns is calculated on the minimum balance present in the account between the fifth day and the last day of the month.

Therefore, the total amount deposited will be Rs 1,50,000, but ‘B’ will only earn interest on nearly Rs 1,45,449.81 every year. B will earn an interest of Rs 16,94,599 instead of Rs 18,18,209. Additionally, once the 15-year lock-in period for the scheme ends, B will be left with Rs 39,44,599, which is less than A’s maturity amount of Rs 40,68,209.

Let’s see the same through a table:

To conclude, not only is investing in PPF via lumpsum more convenient compared to making monthly instalments, but it also earns more interest. In the example mentioned above, ‘A’ also managed to earn Rs 1,23,610 more than B by making a lump sum investment into the PPF account between April 1 and April 5.