Retirement planning has taken momentum in the past few years, especially with the younger demographic, as people have started thinking about retirement and saving for it from a younger age. Early retirement has also emerged as a new trend for people who want to work for a shorter period and then go on to live a life, pursuing their hobbies and interest without having to worry about money.

According to Sanket Prabhu, director and head-wealth, Finhaat, people in the age group of 30-40 years have started discussing this concept of early retirement. He said that while there is discussion on the subject, there are no definitive figures on the number of people who are actually executing it.

Reasons To Choose An Early Retirement

While people think of retirement as an end to a professional career which gives them something to look forward to, many are choosing to retire early after planning their financials properly in order to ensure their financial security in their retired years.

Those who choose early retirement do so for various reasons. Some of the significant ones are as follows.

Creative Pursuits: According to Prabhu, an increasing number of people are looking to invest time and efforts in their creative pursuits or move away from the daily grind of routine work.

Creative fields in India are still seen as something that does not have a proper scope of having a well-paid career. Many people take up different careers to create a safety fund or investment fund to sustain them through their retired life as a second career.

Flexibility: A proper job requires dedicating a fixed amount of time per day according to schedule. Elsewhere, those with other hobbies and other pursuits like to take out time for other things, such as spending time with friends and family or any skill they might want to learn while working. According to Prabhu, a number of options are available to move away from a full-time employment to income-earning opportunities that are interest-based, and can be taken up as time permits.

Better Control: As you age, you might feel the need to have more control over your life and on your schedule. Many people decide to join a gym or take up different type of sports, which can help them gain control of their health. Some plan to set up their own small business and be their own boss and be more in control of their finances.

Prabhu said that individuals belonging to certain age and income categories have started saving early in their careers, thus allowing them to be more in control of their personal finances and time by the time they decide to retire.

Burn-Out: This is another reason why many seek early retirement. Says Prabhu, “With increasing professional stress, there are higher cases of mental burn-out, which in turn, leads to people to opt for early retirement.”

Burn-out is very common for those working demanding jobs, such as IT, media, medicine, law, and sales, among others, which typically come with odd working hours that requires much more time than other sectors. Working too much can drain one’s energy and leave him/her mentally exhausted; this can cause health problems, such as bad digestion or inability to focus properly.

Basic Considerations For Early Retirement

Saving for an early retirement requires multiple considerations, starting from life expectancy, investment instruments according to one’s risk appetite, age of retirement, years of retired life to save for, and passive income after retirement taking into account inflation, among others.

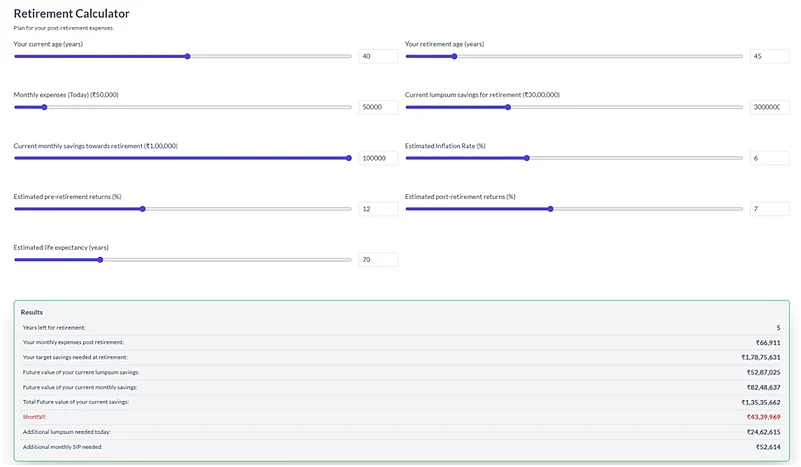

Prabhu shared the following case study to show how a person should save for retirement:

Name: Anubhav Mishra

Age: 40 years

Income per month: Rs 2.25 lakh

Job Profile: UX Director

Anubhav is a design graduate, working in a design consultancy firm. He has been working since the age of 22. He has been contemplating early retirement for the last 2-3 years and believes that he would like to step out of the demand of his professional day-to-day life by the age of 45.

He is keen to explore options in permaculture in his home state of UP. He has been spending time and efforts to know more about it and get himself trained in the field. According to him, retiring early will give him time to actively follow his pursuits beyond his professional career.

Over the last few years, he has managed to save a corpus (Rs 25 lakh) through his savings in mutual funds and estimates that a corpus of Rs 2 crore will help him live a life that he wants to in his hometown.

Calculations:

Advantages Of Early Retirement

Here are some of the benefits of early retirement.

Time And space To Pursue Active Interests: Having extra time will help you feel more in control, give you more flexibility in working hours, and consequently, more time to pursue your creative interests. It may help you live a slower life and help you recharge and connect with yourself. Early retirement will also allow you to spend more time with your family.

Devoting More Time To Health And Personal Life: An early retirement will allow you to devote more time towards maintaining your health by way of better diet, more time for exercise, and lesser screen and mobile time. Prolonged hours at the desk is bad for health in the long run and can cause your body to react negatively and show symptoms of bad physical and mental health in your retired life.

Disadvantages Of Early Retirement

Here are some of the disadvantages of an early retirement.

Social Life: An early retirement can drastically change your life for the worse due to lack of a social circle. Says Prabhu, “A number of people are not able to adjust to their new lives, since it involves a considerable change in the lifestyle and a change in the social environment around.”

Many people not only look at their financial health, but also think of what will be there next for them. Joining a sports club, book club, learning new skills, such as new language, or, a creative skill, such as playing an instrument, or painting can help one meet new people while staying busy and flexible at the same time.

Lack Of Steady Income: In a few cases, additional income activities that were expected to chip in to the corpus dry up leading to tightening of purse strings and reasons to go back to work.

Having a steady income can help when one is in need of money, which can be difficult if one does not have a steady income, as it could make it difficult for you to repay your loan, if you have any. It is suggested that one has a passive income through previous investment to make up for the lack of stability.

Exposed To Emergencies

Prabhu says that with an ever-changing economic world view, unexpected personal emergencies may lead to drying up of one’s corpus. An unexpected medical emergency can exhaust the corpus and bleed the funds, especially if one does not have a proper emergency fund, which is difficult to acquire, especially in early retirement, as there is less time around and a higher amount to save for.