Summary of this article

Procrastination in retirement planning can significantly reduce compounding benefits.

Early retirees often overspend on travel and gifts without a plan, leading to underspending later, driven by fear of high medical needs.

Tax inefficiencies from inaction miss exemptions like Section 80TTB, LTCG harvesting, and senior slabs, requiring years of proactive strategy.

By Bhuvanaa Shreeram

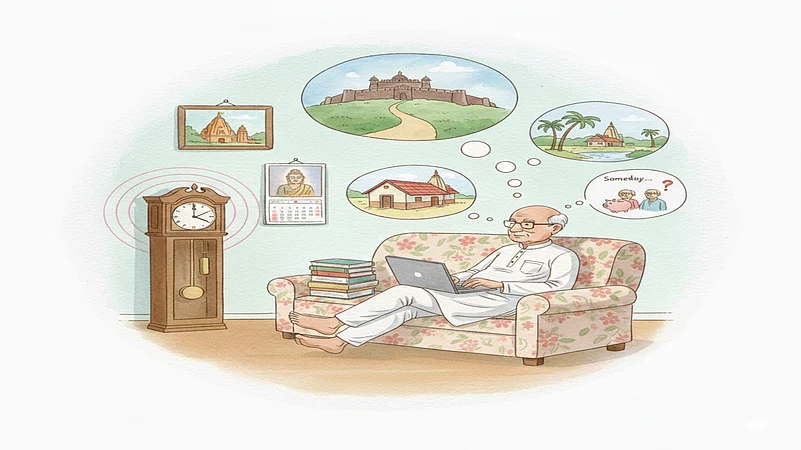

When Mahesh and Lakshmi finally walked into our office, they were already 63. Between his years as a doctor and her decades as a school principal, they had done all the right things: raised two daughters, paid off their home loan, and saved steadily. But now, with Mahesh about to retire, a nervous energy hung in the air. They had no clear spending plan, no cash flow strategy, and no idea whether their money would last 25 years or just 10.

For years, Lakshmi had gently asked Mahesh to get help, but he would smile and say, “We’ll figure it out after I retire. Let’s not overthink it now.”

That “someday” had arrived. And it came with more questions than answers.

A Stitch in Time!

In retirement planning, procrastination has consequences that ripple across decades. It does not just delay action; it shapes outcomes.

People often imagine that if they delay planning, they are “preserving flexibility”. But what they are really doing is giving up control. The costs add up quietly.

Let us explore them, one by one.

1. Missed Compounding = Missed Wealth

The easiest to quantify this is that a delay in investing equals delay in compounding.

Someone who starts planning at 45 can use the next 10–15 years to rebalance, de-risk, and prepare. Someone who starts at 60 often has to make rushed decisions. Even a 5-year delay in starting can reduce your retirement corpus by Rs 1–1.5 crore for a household saving Rs 10–15 lakh annually.

That is not just money lost. That is years of freedom and peace lost.

2. Travel Now, Worry Later: The Lifestyle Miscalculation

In the first two years of retirement, most people spend more than ever before.

The excitement of freedom leads to impulsive travel, expensive gifting, and lifestyle upgrades that are rarely budgeted for. One client spent Rs 18 lakh in their first 12 months after retirement on three international trips.

Their corpus could absorb it, but only if it was part of a larger plan.

In the absence of structure, people confuse ‘can spend’ with ‘should spend’. This leads to depletion early on and panic later.

The tragedy is that they often cut back on spending in the years they actually need it the most-when they are older, slower, and dealing with rising medical needs.

3. Unplanned Gifting: Love Without Logic

Parents in India are generous to a fault. Many clients hand over money to children at weddings, during home purchases, or to fund business ventures, with no clarity on how it impacts their own retirement.

One couple had transferred Rs 1 crore to their son to “help him settle down”, but had no plan in place for their own healthcare needs. The generosity is admirable, but financial caregiving should come after self-care.

Procrastination leads to gifting without boundaries; something that proper planning could help structure thoughtfully, with a balance of heart and head.

4. Emotional Cost: The Fear Of Spending Later

Ironically, those who procrastinate often swing between two extremes:

• Overspending in the early retirement years

• Underspending in later years driven by fear

I have seen retirees avoid a Rs 20,000 dental procedure, saying, “We don’t want to dip into the corpus.” They gift lakhs of rupees to relatives at 60, but hesitate to hire part-time help or go on a short trip at 75.

This fear is not irrational. It comes from uncertainty. When you do not know how long your money will last, you keep postponing joy in the name of caution, only to reach your 80s and realise you denied yourself things you could have afforded all along.

5. Medical Bills in the Last Mile

The last five years of life are often the most expensive and the most unpredictable. Health insurance has limits. Inflation in healthcare is higher than the consumer price index (CPI) inflation. Planning for retirement without projecting for final-stage medical costs is like flying a plane with no plan to land.

The cost of inaction here is devastating. It means stress for your family, decisions under pressure, and the possibility of needing to sell assets or depend on children for urgent care.

A planned drawdown strategy allows for better allocation of funds toward end-of-life care without compromising your dignity or independence.

6. Tax Efficiency is a Time Game

One of the highest invisible costs of inaction is tax leakage. Smart retirement planning uses:

• Long-term capital gain exemptions (Rs 1.25 lakh per year)

• Tax-loss harvesting (carry forward for 8 years)

• Capital gains harvesting pre-retirement

• Strategic use of senior citizen slabs (Rs 3 lakh basic exemption for 60-plus, Rs 5 lakh for 80-plus)

• Section 80TTB, 80D, 80C, and other exemptions

None of this can be done overnight. It needs a runway, and multiple years of proactive moves. When you procrastinate, that runway disappears. What you lose is not just money, but its flexibility.

Overcoming Cost of Delay

Here is a quick checklist to overcome the cost of delay:

1. Mark A Date On The Calendar

Stop saying “someday”. Book a conversation. Mark a review date. Action begins with intention.

2. Create A Spending Plan, Not Just An Investment Plan

Retirement is not a monolithic 25-year phase. Break it down. Plan different kinds of expenditure across the journey: from fun to functional.

3. Track And Adjust

Build a strategy that evolves. The needs of a 62-year-old are different from those in their late 70s. Do not let your plan stagnate.

4. Communicate With Family

Unspoken expectations are the source of many regrets. Talk to your spouse, children, and advisors openly.

Conclusion

The cost of inaction is not just financial. It is a lost opportunity; it is an avoidable stress; it is a retirement that feels like a countdown instead of a second beginning. So, if you have been telling yourself, “I’ll do it someday,” let today be the day you choose clarity over delay.

(Disclaimer: Views expressed are the author's own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.)