Summary of this article

EPFO’s new withdrawal rules allow up to 75 per cent partial withdrawal of the EPF corpus

A minimum of 25 per cent of the EPF balance must be maintained to protect retirement savings

Increased digitalisation under EPFO 3.0 aim to enhance user experience

The central board of trustees (CBT) of the Employees’ Provident Fund Organisation (EPFO) approved the change in employee provident fund (EPF) withdrawal rules in its October 2025 meeting. The changes in withdrawal rules include zero documentation for taking advances, an increased number of withdrawals for education and marriage purposes, and up to 75 per cent of the accumulated EPF corpus, among others. These are aimed at making EPF funds easily available for withdrawal for various needs and improving subscribers’ overall experience.

Although the partial withdrawal option already exists, it is with restrictions. Under the new rules, it will become more convenient; however, with the condition that EPFO’s digital system and website are also improved, updated, and made faster.

However, an important question remains.

Would A Higher Number Of Withdrawals And No Documentation Have A Negative Effect On Accumulation?

Says Anuj Kesarwani, a certified financial planner, chartered trust and estate planner, and founder of Zenith Finserve: “This flexibility in the withdrawal feature should be used judiciously. Otherwise, it can derail retirement savings. The withdrawals should be made by understanding the overall implications on retirement.”

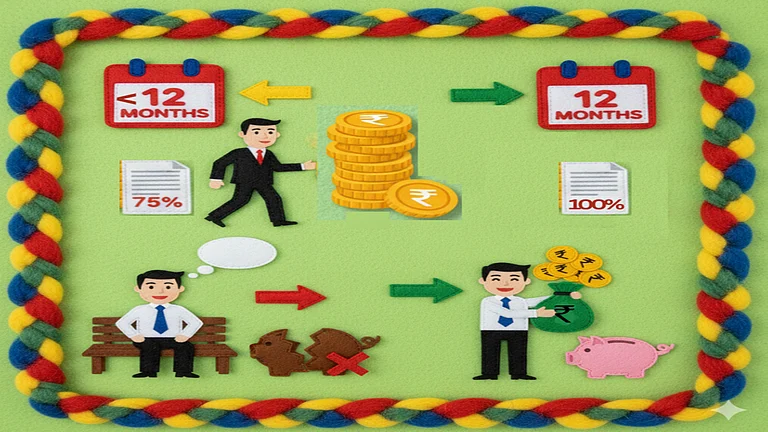

Notably, a minimum of 25 per cent of the EPF corpus must always be maintained in the account to ensure savings for retirement, but the remaining 75 per cent can always be withdrawn for various reasons.

According to the government statement, in the existing system, most of the subscribers have saved only up to Rs 50,000 by the time they retire. More specifically, around 50 per cent of subscribers had less than Rs 20,000 and around 75 per cent had less than Rs 50,000 in their EPF account at the time of retirement as their final settlement.

Repeated withdrawals mean fewer funds in the account, and thus lower interest income and losing out on the compounding benefit. The primary purpose of EPF, to provide financial security, is defeated if there are frequent withdrawals from the account. The government ensures this by making 25 per cent of the EPF corpus non-withdrawable during the service and even 12 months after that. So, those who remain in service and keep contributing need to use the funds prudently.

Do The New Partial Withdrawal Rules Place The Onus On Subscribers To Save For Retirement?

Kesarwani says, “The withdrawals should be made by understanding the overall implications on all financial goals, including retirement. Otherwise, it may be very easy to withdraw more for the pre-retirement goals and then later have less funds for retirement. This puts a lot of responsibility on the subscribers.”

He advises subscribers to understand their financial situation comprehensively before taking advances from EPF. He says, “It is very easy to get carried away by the near-term financial goals, especially those that hold more emotional value like child education, marriage, medical treatment, or house purchase. All goals are important. Though with limited funds, prioritising financial goals becomes a crucial decision-making point. Only a comprehensive and forward-looking view may be the solution.”

Here, the popular saying that “with more power comes more responsibility” becomes crucial. With more flexibility and less formalities, subscribers need to behave responsibly so that they don’t lose out on EPF’s guaranteed and higher-than-fixed deposit interest rates and compounding benefits.