Summary of this article

· Income tax collection from seniors aged 70 and above increased 137 per cent from AY2020-21 to AY2024-25

· Government plans no additional tax exemptions for seniors

· Basic exemption for seniors in new tax regime is Rs 4 lakh for FY2025-26

Senior citizens get a higher basic tax exemption in the old tax regime than people aged below 60 years of age. However, in the new tax regime, it is the same for all. In the old regime, the basic tax exemption limit was Rs 2.50 lakh for the general public, Rs 3 lakh for senior citizens, and Rs 5 lakh for super seniors. Compared to this, in the new tax regime, the basic exemption is Rs 3 lakh for all individuals, including seniors and super seniors (80 years and above) for the financial year (FY) 2024-25, and Rs 4 lakh for FY2025-26. Notably, from FY2025-26, the total income (except special income) up to Rs 12 lakh is tax-free, but there is no special tax relief for senior citizens.

When Parliamentarian T R Balu asked in Lok Sabha whether the government planned to grant some additional tax relief to senior citizens or to enhance the exemption limit to Rs 25 lakh for those aged 70 years and above, Union Minister of Finance said in a written reply that there are no such plans at present.

“There is no such plan under consideration at present. Under the Income-tax Act, 1961, a number of reliefs have already been provided to the senior citizens. It is the stated policy of the government to reduce the tax rates while removing exemptions and deductions. Accordingly, a new tax regime with liberal slabs, lower rates, and higher rebates has been put in place effective from the previous year, starting from 1.4.2025,” Union Minister of Finance Nirmala Sitharaman said in a written reply:

She further said: “Further, any matter relating to tax rates or relief is decided during regular budgetary exercise and the outcome of the same is reflected in the respective Finance Act.”

Amid this, the data shows that income tax collection from senior citizens has increased more compared to the total income tax collection over the year.

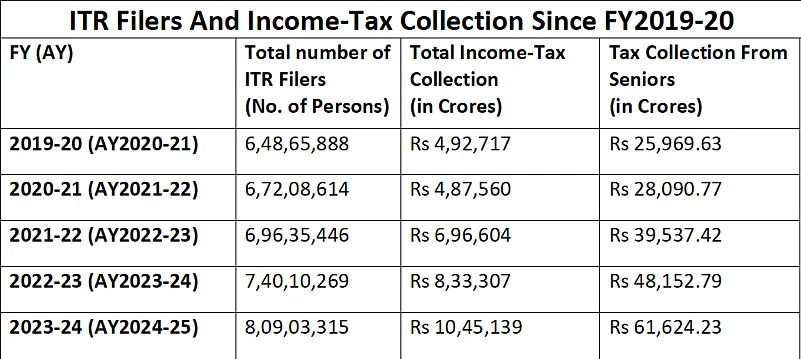

Here are the details:

Source: Income Tax Website, Lok Sabha Reply

This shows that the number of individuals filing income tax return (ITR) increased by nearly 25 per cent over five years, and the total income tax collected has also increased by 112 per cent over the last five years (since AY2020-2021). Income tax collection from senior citizens (aged 70 and above) has also grown by around 137 per cent over the same period.

Over one year to AY2024-25, the number of people filing ITRs increased by 9 per cent, where the total income tax collection grew by 25 per cent, and collection from senior citizens rose by 28 per cent.