Credit cards work only if repaid fast: Clear dues within the interest-free period to avoid steep 30–48% annual interest.

Personal loans offer predictability: Lower interest rates and fixed EMIs make them safer for larger, planned expenses.

Minimum dues are a trap: Paying only the minimum on cards can stretch repayment for years.

Borrow mindfully: Assess necessity, repayment capacity, and income stability before taking any debt.

Credit Card Vs Personal Loan For Holidays: Which Hurts Less In New Year?

Easy credit has made holiday spending tempting, but not all borrowing hurts the same. As interest rates and household debt climb, choosing between a credit card and a personal loan can decide whether your New Year starts relaxed or financially strained.

The digital revolution in India's financial sector has transformed borrowing from an inconvenient, paperwork-heavy process into something as simple as a few taps on your smartphone. While this convenience has democratised access to credit, it has also created a worrying trend; people borrowing without fully understanding repayment terms, interest implications, or their own repayment capacity.

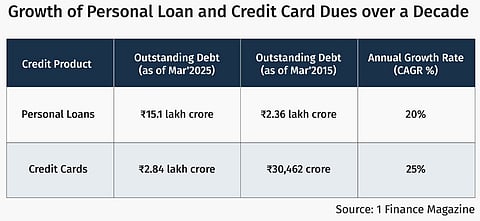

Among the various credit products available today, credit cards and personal loans remain the most sought-after sources of unsecured credit. India's household debt has risen from 34 per cent of GDP in 2019 to 42 per cent in 2025.

Understanding Credit Cards

A credit card offers a revolving line of credit, allowing you to borrow up to a predetermined limit and repay the amount flexibly. The appeal lies in the 20-50-day interest-free period. Add cashback, reward points, and equated monthly instalment (EMI) conversion options, and it's easy to see why credit cards are attractive.

“However, the moment you carry forward a balance, you enter expensive territory. Credit card interest rates in India range from 30-48 per cent per annum. Pay only the minimum due, and you will find yourself trapped in a debt spiral where interest compounds rapidly. A Rs 50,000 outstanding balance at 3 per cent monthly interest rate, if paid only through minimum dues, could take 5 years and 10 months to be completely repaid,” says Dev Patel, quantitative research analyst at 1 Finance, a personal finance institution.

Understanding Personal Loans

Personal loans, by contrast, offer a fixed lump sum with fixed monthly EMIs over a predetermined tenure, typically 12-72 months. Interest rates are considerably lower, ranging from 9-24 per cent per annum, depending on your credit profile. This predictability makes budgeting easier and the overall cost of borrowing significantly cheaper than revolving credit card debt.

However, “personal loans come with processing fees (1-3 per cent of the loan amount) and potential prepayment charges on fixed-rate loans. Missing EMIs triggers late payment penalties, penal charges, and can severely damage your credit score. A single missed EMI can drop your Cibil score by 50-70 points,” says Patel.

Which Hurts Less In The New Year?

If you must borrow, the numbers speak clearly. For short-term needs where you can pay off the entire amount within 30-50 days, a credit card costs you nothing, provided you clear the full balance. Personal loans also enforce discipline through fixed EMIs, preventing the “minimum dues trap” that keeps credit card users perpetually indebted.

Before you swipe that card or sign that loan agreement, pause and evaluate. Is this purchase necessary? Can you comfortably afford the EMI without compromising essential expenses? What happens if your income is disrupted?

The credit industry needs to embrace a philosophy of mindful borrowing and mindful lending. For borrowers, this means borrowing only within their repayment capacity. For lenders, it means responsible credit approval, transparent communication of terms, and avoiding aggressive cross-selling and mis-selling of credit products.

Adds Patel: “Always consult a qualified financial advisor who can help you assess your behaviour with money, your financial situation, plan your borrowing, and ensure that your credit decisions align with your long-term financial goals. The convenience of borrowing should never come at the cost of your financial peace of mind.”