The Reserve Bank of India (RBI) has unveiled plans to develop a ‘Framework for Responsible and Ethical Enablement of AI (FREE-AI)’ for the financial sector. During its Monetary Policy Committee (MPC) meeting, which concluded on December 6, 2024, the central bank announced the formation of a specialised committee to offer recommendation for tackling AI-related challenges.

RBI's Big Announcement On Artificial Intelligence For Financial Sector; Check Details

The Reserve Bank of India (RBI) is set to launch ‘FREEAI: Framework for Responsible and Ethical Enablement of AI’. To support this initiative, the RBI announced the formation of a committee to provide recommendations

This initiative aims to address ethical concerns and ensure the responsible integration of artificial intelligence within financial systems. The RBI’s proactive approach reflects its commitment to balancing innovation with accountability in the evolving landscape of AI-driven financial services.

Framework For Responsible And Ethical Enablement Of AI (FREE-AI):

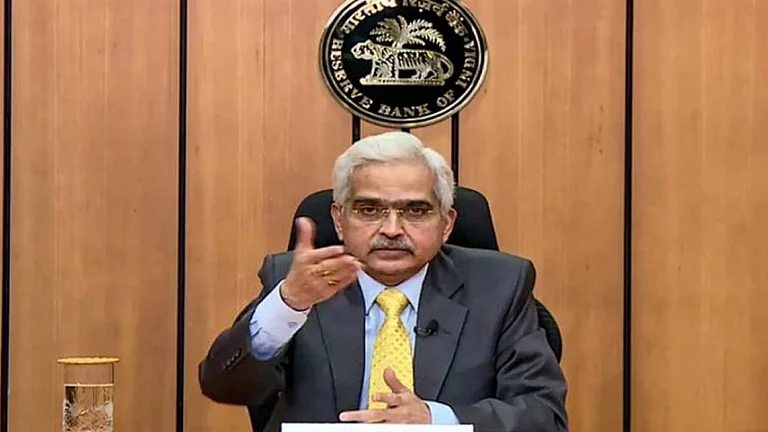

RBI governor Shaktikanta Das stated, “It is proposed to constitute a committee to develop a Framework for Responsible and Ethical Enablement of AI (FREE-AI) in the Financial Sector. The committee will comprise of experts from diverse fields and shall recommend a robust, comprehensive, and adaptable AI framework for the financial sector. The details of the committee will be notified separately.”

Rapidly Evolving Technology And Its Risks:

As technology is rapidly evolving, it brings with it several risks that did not exist in the system previously. So, to safeguard from any systemic risks and to deal with the large quantum of data, RBI not only takes note of the benefits technology brings but also the risks.

“The financial sector landscape is witnessing paradigm shifts with the advent of frontier technologies. Technologies like Artificial Intelligence (AI)/ Machine Learning (ML), tokenisation, Cloud Computing hold transformative potential for the financial sector as they can handle enormous volumes of data, automate complex processes, enhance decision-making, and bring in unprecedented efficiencies”, said Das.

How Would This Benefit Help?

“While the benefits are many, the attendant risks like algorithmic bias, explainability of decisions, data privacy, etc., are also high. To harness the benefits, it is critical to address the attendant risks early in the adoption cycle”, stated Das in his statement.

Rahul Jain, CFO, NTT DATA Payment Services India, says, “Forming a committee to develop Framework for Responsible and Ethical Enablement of AI (FREE-AI) in the financial sector should address the rising concerns around the use of modern technologies. It should not only address risks associated with the banking operations and business continuity at bank level but also cater to consumer centric issues such as data privacy and fraud protection. This committee should offer a framework that creates a tech-driven sustainable growth environment for the Indian financial sector”.

It is important to assess the risks of diverse usage of technology and make the system ready to handle the existing and any other evolving disruptive technology.

RBI also announced to start of a podcast to reach more people and ‘for wider dissemination of information that is of interest to the general public’.