For some time now, the market was expecting a rate cut from the Reserve Bank of India (RBI). Finally, on February 7, 2025, the RBI cut the repo rate by 25 basis points (bps) from 6.50 per cent to 6.25 per cent. This is a signal for interest rates across the system to decline. Based on this expectation, longer duration funds have been recommended.

How RBI's Rate Cut Affects Debt Funds

It is recommended you match your investment horizon with the portfolio maturity. When there is adverse volatility, the accrual over your holding period will take care of it

The rationale is: given that the interest rate and bond prices move inversely, the longer the duration of the fund, the higher will be the gains.

View Going Forward

The expectation going forward is that RBI would execute another 25 bps cut, or at most two more cuts of 25 bps each, at an appropriate time. This cycle is going to be a shallow rate cut cycle, as RBI has to take care of inflation as well.

Markets, however, react in anticipation. The 10-year government bond yield eased from 7.2 per cent on January 1, 2024 to 6.75 per cent on February 6, 2025, even before any rate cut. As and when market starts anticipating the next rate cut, the yield level on bonds would ease further. That is because there is further scope for gaining from interest rates coming down. However, it has to be seen in context.

How Debt Funds Work

Returns of debt funds come from two avenues. One, bonds and other instruments in debt funds have a coupon or interest, which is accounted for in every day’s net asset value (NAV) on a proportionate basis. This component, which is known as accrual returns, as it accrues gradually every day, happens irrespective of market movements. Two is the mark-to-market gains or losses. The daily NAV is computed, taking that day’s bond prices into account. When interest rates come down (bond prices move up), adding to the accrual returns. When interest rates move up (bond prices come down), taking away from accrual returns.

When there is a rally in the market, bond yields come down, bond prices move up, adding to your returns, and accrual levels for the subsequent period come down.

Let us take an example to understand this. Say, in Year 1, the yield-to-maturity (YTM) of the fund is 8 per cent and recurring expense is 1 per cent, the net accrual level will be 7 per cent. A point to be noted here is that this 7 per cent is not a given, and not a commitment from the mutual fund house, but an illustration for understanding. If the yield level in the market does not move, over one year, you will get approximately Rs 7 per Rs 100 of investment. Now let us say there is a rally in the market of 50 bps (0.5 per cent). The addition to accrual due to yield coming down is a function of the modified duration of the fund, which is a data point available in the monthly factsheet.

If the portfolio maturity of the fund is, say 9 years, and modified duration is say, 5 years, then the mark-to-market addition is 0.5 per cent X 5 = 2.50. Your overall return becomes 7+2.50 = Rs 9.50 per Rs 100. If the portfolio maturity of the fund is three years and modified duration is 2.5 years, then the mark-to-market addition is 0.5 per cent X 2.5 = 1.25. Your overall return comes to 7+1.25 = Rs 8.25 per Rs 100.

Now, let’s say, after the rally of Year 1, in the second year, your accrual level is 6.5 per cent, down from 7 per cent. Unless there is further rally in year two, your returns will be approximately 6.5 per cent.

If your approach is to benefit from the rally and move out with 9.5 per cent returns, then you have to be clear about what you do with the money. You should ideally not jump from one asset class to another, and instead manage your portfolio with judicious allocation as per your objectives.

Recommended Approach

One defining aspect of debt funds is that there is a correspondence between fund portfolio maturity, volatility and ideal investment horizon. While volatility will be there, the accrual will take care of it. The impact of volatility on fund returns will be proportionate to the modified duration, which is a function of the portfolio maturity of the fund. Longer the maturity and duration, higher the impact, and vice-versa.

As a ballpark guidance, it is recommended that you match your investment horizon with the portfolio maturity. When there is adverse volatility which means yield levels move up, the accrual over that period of time (your holding period) will take care of it.

In the earlier examples, when you get, say, 9.50 per cent or 8.25 per cent in Year 1 and 6.50 per cent in Year 2, the overall return averages out. Your annualised return would be somewhere around what you would have realistically expected initially.

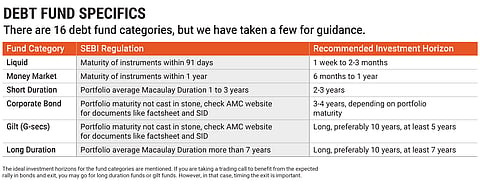

The Securities and Exchange Board of India (Sebi) has defined 16 debt fund categories, and there is some extent of uniformity in the mutual fund industry on the portfolio maturity in a given category. For example, gilt funds (government bond funds) would be run with a long portfolio maturity and portfolio duration. Corporate bond funds would have a portfolio maturity of say 4-5 years, and short duration funds around three years. Portfolio maturity and duration data is available in the monthly factsheet of mutual funds on their websites.

Conclusion

If you want to benefit from the remaining part of the rally, say, 10-year government bond yield moving to 6.50 per cent, you can play it through gilt funds, which usually have a long duration. Towards the end of the rally, if you do not have the requisite long investment horizon, you can move to a shorter maturity and/or duration fund.

However, note that this has a tax implication. Capital gains are taxable as short-term capital gains at your marginal tax slab, irrespective of your holding period. Dividends (now known as income distribution cum capital withdrawal) are also taxable at your marginal slab rate. So, take a decision keeping in mind the expected returns and tax implications.

By Joydeep Sen, Corporate Trainer and Author