Geopolitical uncertainty boosts gold, offering safe wealth growth opportunities.

Indian gold holdings surged from $1.2T to $4T, increasing wealth.

Long-term perspective: India’s economy grows despite market and global uncertainties.

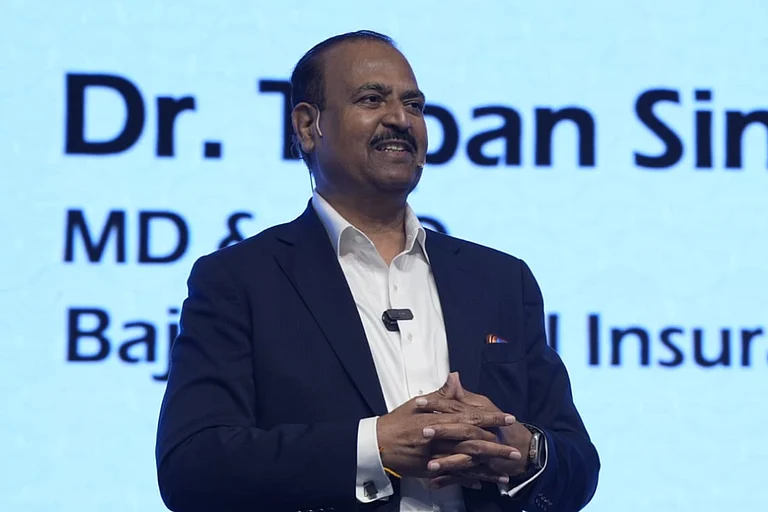

Geopolitical Uncertainties Can Help Assets Like Gold, Says Sunil Singhania Of Abakkus Asset Manager

Rising gold prices amid global uncertainties offer Indian investors a safe hedge and new opportunities to grow wealth, Sunil Singhania of Abakkus Asset Manager said at the Outlook Money 40After40 Retirement Expo

“One and a half grams of gold can get you a scooty,” Sunil Singhania, Founder of Abakkus Asset Manager, said at Outlook Money’s 40After40 Retirement Expo in Mumbai. Highlighting the wealth effect created by the surge in bullion, he added that geopolitical uncertainty can sometimes be positive for certain asset classes, giving Indian investors new opportunities to grow their wealth.

He added: “Three grams of gold can now get you a scooter, and 30 grams of gold can buy you a small car.” Singhania said the wealth effect is already starting to be seen by way of gold loans, because gold loans are ultimately used for business, and some also by way of consumption. “They also provide a backup plan in case of eventualities, and ultimately that helps a lot,” he said.

He further highlighted the growth in Indian gold holdings. He said: “Every Indian has gold according to their capacities. It is estimated that the value of gold which Indians had three years back was $1.20 trillion. It has now become $4 trillion. So that is the kind of wealth which has been added, and it has an impact, it has an effect.” On the role of gold as a hedge, he added, “I’m talking about gold because gold prices going up are also because of the geopolitical issues. Geopolitical uncertainty can also be positive for some asset classes. And I think gold is a clear example of how geopolitical uncertainty has led to gold prices going up.”

Instant News and Overreaction

Singhania also spoke of the impact of instant news on investor behaviour: “Even Trump does not know the act by which he can put tariffs. But in India, the US lawyers are also thinking we should ask the Indian experts on what kind of tariffs we can put.” He said too much analysis can paralyze decision-making. “When there is too much analysis, you don’t know what appears to be good. Suddenly, because of too much analysis, it becomes negative,” he added.

Historical Growth Amid Uncertainties

Singhania emphasised on the long-term perspective. “We got our independence in 1947. It took us 60 years to reach a $1 trillion economy in 2007. After that, the next $1 trillion happened in nine years, the third one didn’t happen in 8 years. After 78 years, we are $4 trillion. In these 78 years of reaching $4 trillion, we might have gone through so many different kinds of uncertainties,” he said.

He added, “Despite all these uncertainties, we grew from nil to $4 trillion over the last 78 years. I think India is one of the very few countries where we have seen money being made by everyone. Off late, a lot of money has been made despite equity markets not doing well because gold has gone up through the roof.”

Looking Ahead: Doubling the Economy

He said even if we grew at 7 per cent and 9–10 per cent on a nominal basis with 2–3 per cent of rupee depreciation, in the next 8–9 years, we will be $8 trillion. “So the amount of wealth which was created over the last 78 years, the same wealth is going to be created over the next 8–9 years,” he said.

He stressed that geopolitical uncertainties will continue (“small skirmishes, small issues will happen every single day going forward), but if we start to act on every event, it will be a disaster”.

Current Market Scenario and Gold

Focusing on India’s equity and commodity markets, he said: “Indian markets have underperformed massively in the last 15 months compared to global markets. We are flat on Nifty, maybe 10-15 per cent down on small caps, whereas Korea is up 100 per cent, China is up 30–40 per cent. Gold and silver are up; at one point, silver was up 4x, now maybe 2.5–3x, and gold has also doubled.”

He highlighted the diversification of Indian investors’ portfolios. “As an Indian, we are very fortunate that our basket of savings is actually automatically diversified. We don’t borrow on a house once we have paid back; that is a very small percentage of people who refinance. We have equity, almost $1.50-2 trillion worth of equity, including mutual funds as our exposure. We have now $4 trillion worth of gold, and that makes our portfolio quite insulated. Gold prices going up are also because of geopolitical issues. Geopolitical uncertainty sometimes can be positive for some asset classes. And I think gold is a clear example of how geopolitical uncertainty has led to gold prices going up,” he added.