Summary of this article

· Central Bank of India reduced MCLR by 0.5 per cent to lower loan interest rates

· Effective from September 10, 2025, benefitting floating-rate loans

· The Bank also revises deposit rates, impacting savers.

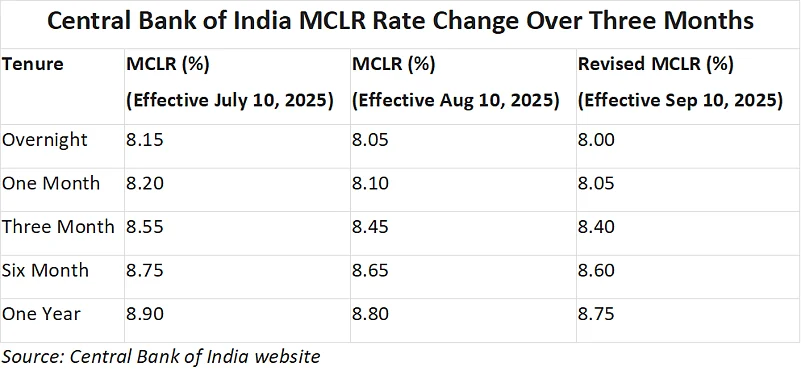

The Central Bank of India (CBI) reduced the Marginal Cost of Fund-Based Lending Rate (MCLR) by 0.5 per cent (5 basis points—bps). The new rates take effect today, September 10, 2025. The reduced MCLR suggests lower interest rates and cheaper loans for borrowers. Since the three rate cuts totalling 1 per cent (100 bps) by the Reserve Bank of India (RBI) this year, banks, too, have continually been adjusting and reducing their rates, including both lending and deposit rates. However, compared to the previous MCLR cut, the latest cut is smaller. This time, the bank reduced the MCLR by 5 bps, which was 10 bps in August 2025.

Here are the details of the revised MCLR rates of the bank.

Central Bank of India (CBI)

The revision is effective from September 10, 2025.

The reduced MCLR will bring down the interest rates of floating-rate loans. This will particularly benefit those whose loan rates are reset every six months or once a year. The rates will also be low for new loans; however, it is not the only factor determining the final rates for new loans. For them, their credit score and interest profile will also matter.

MCLR cut refers to the reduced interest component in a loan, which means lower equated monthly instalments (EMIs). The reduced MCLR affects floating rate loans, such as personal, consumer, and home loans. In this situation, borrowers can benefit either from lower EMIs or reduced repayment tenure. Note that a change in MCLR does not affect the fixed-rate loans, existing loans against the FDs, or external benchmark-linked lending rate (EBLR) loans.

Over the past few months, several banks revised their lending rates, including the State Bank of India (SBI), Punjab National Bank, Central Bank of India, Bank of Baroda, and HDFC Bank.

Along with revising the MCLR, the Central Bank of India has also revised its deposit rates, bringing them down by up to 25 bps.

Central Bank Of India Fixed Deposit (FD) Rates

It reduced the FD rates from 6.50 per cent to 6.40 per cent for one year to less than two years, from 6.70 per cent to 6.50 per cent for two years to less than three years, and from 6.50 per cent to 6.25 per cent for three years to 10 years. For senior citizens, the rate cuts are equal for these tenures, at 10 per cent, 20 per cent, and 25 per cent, respectively.

These rates are also effective from September 10, 2025.