Summary of this article

Stablecoins bring relative stability to the volatile crypto market.

Offer faster, cheaper transactions with reduced price fluctuations.

Raise key concerns about transparency, regulation, and real-world backing.

By Joydeep Sen & Dr Vaishali Ojha

Not long ago, the idea of digital money sounded like science fiction. Then came Bitcoin - a cryptocurrency with no bank, no boss, and no borders. It sparked a revolution, but also confusion. Prices soared and corrected. People made fortunes and lost them just as fast. For many, crypto felt like a wild rollercoaster that thrills but is too risky to ride.

Against that backdrop, stablecoins with relatively stable value now carry a growing share of on-chain activity: In June 2025, USDT (US Dollar) moved approx. $1.01 trillion on chain for about $33 billion/day. Stablecoins have been around for some time now; their rising share of trades and transfers signals durable traction rather than hype.

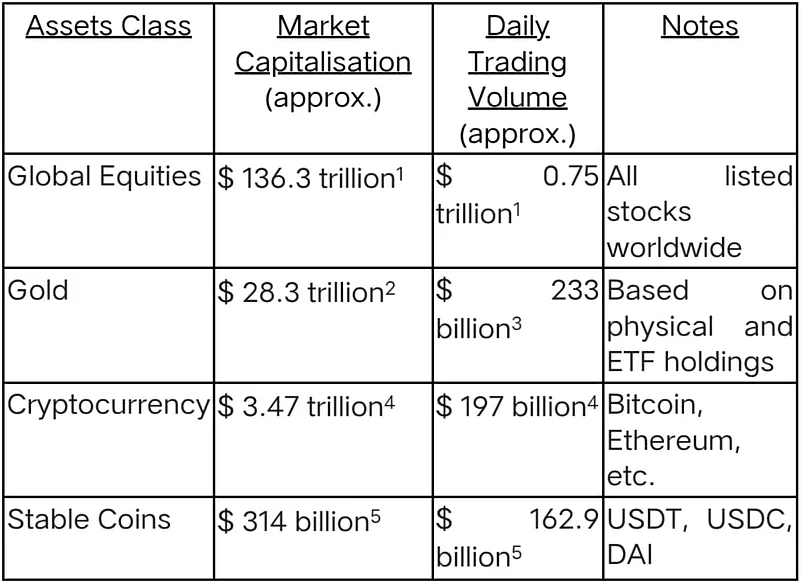

It may be noted that, unlike dollars or euros, cryptocurrencies are not issued by a central authority, such as a government or central bank. Instead, they’re powered by software and traded directly between people. The 24-hour volume tells us that large sums are moving between buyers and sellers each day, reflecting global activity spanning both investments and real-world uses. If we talk about the two networks accounting for about three-quarters of all cryptocurrency value, it is Bitcoin with approximately 59 per cent of the total crypto market cap and Ethereum with approximately. 12-14 per cent. Whether it is Bitcoin or any other type of crypto, all numbers vary daily due to market fluctuations. A higher market cap and trading volume point to a robust, actively used financial system that is global and mostly unregulated compared to traditional banking.

Stablecoins: The calm in the storm

These stablecoins are a special kind of cryptocurrency that are designed to keep their value relatively stable against a traditional currency like US Dollars. For example, 1 unit of a stablecoin like USDT or USDC is meant to always equal $1. USDT is the stablecoin which are issued by a company named Tether and pegged to the US dollar, and is currently trading at a premium in India of about 4-5 per cent. USDC, which stands for USD Coin, is also a stablecoin but is issued by Circle in partnership with Coinbase with different reserves and transparency policies. The goal is simple: give people the speed or flexibility of crypto, without the relative wild price swings. But how? Stablecoins are changing the game in three big ways. First, it allows the investor to send money across borders in seconds with lower fees than banks or apps, which is also available in conventional crypto as well. Second, when the crypto market swings, traders park their funds in stablecoins to avoid losses. Finally, Stablecoins power Decentralised Finance (DeFi), where people lend, borrow, and earn interest without banks.

There are three main types of stablecoins: first, Fiat-Backed Stablecoins, which are backed by real money or assets in a bank account, for example, Tether (USDT), USD Coin (USDC). Second is Crypto-Backed stablecoins that rely on other digital assets locked up as collateral, like DAI. The last one is Algorithmic stablecoins, which use complex computer rules to keep their price steady, sometimes without direct backing like Ethena’s USDe.

At first glance, stablecoins and cryptocurrencies like Bitcoin or Ethereum may seem similar as they are both digital, traded online, and based on blockchain. But they are very different. Let's see how:

But sometimes they work together. How?

Stablecoins and conventional crypto often complement each other. Traders use stablecoins to move in and out of volatile positions. DeFi platforms use both crypto for yield and governance, stablecoins for liquidity and pricing. In many ways, stablecoins are the ‘cash’ or ‘liquid funds’ of the crypto world, which is a steady medium that keeps the system running. If cryptocurrencies are the wild assets of the digital boundary, stablecoins are a tranquil currency that makes the boundary usable. In a world where processes swing like a pendulum, one kind of crypto intends to stay still: the stablecoins.

Stablecoins are not perfect. Some have failed to maintain their peg, losses and causing panic. Others lack transparency about their reserves. Before using or investing in stablecoins, one must check who issues them. Is it backed by real assets? Are the audit and reports available? Can you redeem it for fiat?

1. World Federation of Exchanges, “October 2025 Dashboard”

2. World Gold Council, “How Much Gold Has Been Mined?”

Reuters, “Gold hits two-week high on Fed rate-cut bets, slowdown worries”

3. London Bullion Market Association (LBMA), “Clearing Data — September 2025”; World Gold Council, “Gold Trading Volumes”

4. CoinGecko’s global market, accessed Nov 11, 2025 (IST).

5. CoinMarketCap, “Top Stablecoin Tokens by Market Capitalisation”

Conclusion

Cryptocurrency opened the door to digital finance. Stablecoins are helping us walk through it with a relatively safe option of crypto. They offer stability in a world of volatility, and they’re quietly reshaping how money moves from Mumbai to Manhattan. Whether you’re a curious reader or a cautious investor, understanding stablecoins is key to understanding the future of money.

Digital money is growing fast, from volatile cryptocurrencies to so-called ‘stable’ coins. But not all innovation is progress. Stablecoins may offer convenience, but they also raise questions about regulation, transparency, and real-world stability. As citizens, investors, and users, we don’t need to adopt every new tool; rather, we need to understand them. Because in the end, the future of money is not just technology, it is about trust.

Joydeep Sen is a corporate trainer (financial markets) and author

Dr Vaishali Ojha is Asst Prof, NL Dalmia Inst of Mngt Studies and Research

(Disclaimer: Views expressed are the author's own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.)