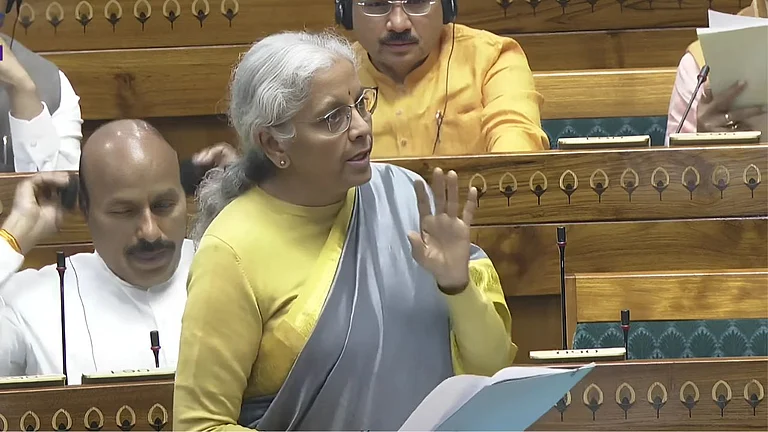

Crypto investing is becoming more and more mainstream. Considering the growing popularity of cryptocurrency, Finance Minister Nirmala Sitharaman announced an amendment to Section 158A of the Income Tax Act, 1961 as a part of her Budget speech. The amended section has also been included in the New Income Tax Act which was tabled today on February 13.

"Amendments proposed in provisions of Block assessment for search and requisition cases under Chapter XIV-B,” Sitharaman said.

Following the amendment the Income Tax Department can now undertake assessment for search cases for undisclosed virtual digital assets (VDA) for up to six assessment years preceding the year in which the search was conducted.

After the amendment virtual digital assets (VDA) are to be included in Section 158A of the Income Tax Act. In the New Tax Bill, VDAs have been added to Section 301 (g). Prior to the amendment, the section included assets such as money, bullion and jewellery.

“Any money, bullion, jewellery, virtual digital asset or other valuable article or thing or any expenditure or any income based on any entry in the books of account or other documents or transactions, where such money, bullion, jewellery, virtual digital asset, valuable article, thing, entry in the books of account or other document or transaction represents wholly or partly income or property which has not been or would not have been disclosed for the purposes of this Act, in respect of the block period,” the New Income Tax Bill said.

As per the New Tax Bill VDAs refer to any information or code or number or token generated through cryptographic means or otherwise which provides a digital representation of the value exchanged, with the promise or representation of having inherent value, or functions as a store of value or a unit of account including its use in any financial transaction or investment which can be transferred, stored or traded electronically.

The definition also extends to NFTs (Non-Fungible Tokens) or any other token of similar nature. Additionally, other digital assets specified by the Central Government will also be included in the definition of VDA. As per the bill, all crypto-assets which are a digital representation of value which rely on a cryptographically secure distributed ledger or a similar technology will also be considered VDAs.