Summary of this article

Waiting to buy term insurance can cost you double, or even price you out completely. For those in their 40s or 50s, the message is urgent: don't put it off another year. After all, the true cost of delay isn’t just higher premiums. It’s the risk of leaving your family unprotected.

When a 42-year-old project manager in Pune finally decided to buy term insurance this year, he was shocked to see that for a Rs 1 crore cover, his annual premium was quoted at nearly Rs 28,000. His younger colleague in his early 30s, for the same policy, was paying less than Rs 15,000.

This isn’t an exception; it's how term insurance is designed. And the price shock only grows steeper with age.

Why Waiting Costs More

Insurance is built on risk. The older you are, the higher the probability of illness or death, and the higher the premium you’ll pay.

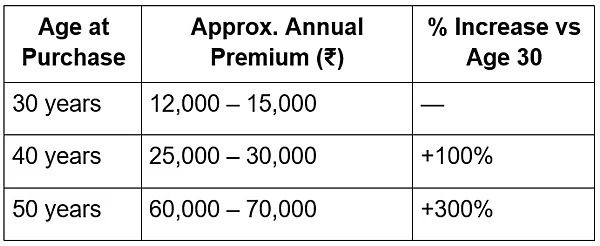

At 30: A healthy non-smoker buying Rs 1 crore cover for 30 years may pay around Rs 12,000–15,000 annually.

At 40: The same cover could cost Rs 25,000–30,000 annually, nearly double.

At 50: Premiums jump to Rs 60,000–70,000 annually, and many insurers insist on medical tests or reject applications outright.

Put simply: every decade of delay can double, or even triple, your cost of protection.

The Hidden Trade-Off

Many mid-career professionals delay buying term insurance because they feel financially stable, or assume they can “get it later.” But insurers don’t just look at age, they consider health conditions too. Diabetes, hypertension, or obesity common after 40 can further load premiums or lead to exclusions. In some cases, cover might not be available at all.

Venkatesh Naidu, CEO at BajajCapital Insurance Broking Ltd, explains why this is one of the biggest mistakes consumers make: “Term insurance works best when you buy it early. The earlier you lock in your premium, the lower it stays for the entire policy tenure. Waiting till your 40s means paying almost double for the same peace of mind.”

He adds that delaying cover is not just about paying more, it's about exposing your family to years of unnecessary risk. “Your responsibilities are usually highest in your 30s and 40s, whether it’s home loans, children’s education, or dependent parents. This is exactly when you need strong cover. Every year you wait is a year your family goes unprotected,” Naidu says.

What Mid-Career Buyers Should Do

Act now, not later: Even in your 40s, buying term insurance today is better than postponing further.

Choose adequate cover: A thumb rule is 10–15 times your annual income. For someone earning Rs 20 lakh, that means at least Rs 2–3 crore in cover.

Keep it simple: Avoid unnecessary riders if they inflate costs. Start with plain term insurance and add health or accident riders, only if needed.

Term Insurance Premium Comparison (Rs 1 crore cover, non-smoker, 30-year policy)

The Bottom Line

The reality is clear: waiting to buy term insurance can cost you double, or even price you out completely. For those in their 40s, the message is urgent: don't put it off another year. After all, the true cost of delay isn’t just higher premiums. It’s the risk of leaving your family unprotected.