The Goods and Services Tax (GST) Council’s decision to exempt life and health insurance from GST has put a spotlight on these policies. From September 22, 2025, the day the new rule kicks in, these policies will come without any GST, reducing the cost for policyholders and making them more affordable. Until now, premiums for individual life and health insurance policies carried an 18 per cent GST.

The relief, however, comes with a timing twist which has confused many policyholders regarding their policy renewals. Some may even be wondering whether to delay purchasing insurance till this date. Let’s understand why September 22 is an important date and what it means for you now.

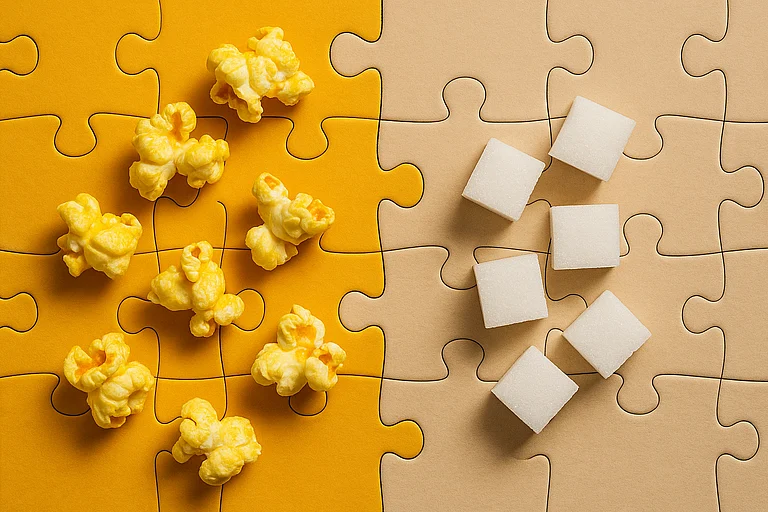

Full GST Exemption

Here are some key facts regarding your insurance premium payments vis-a-vis this date:

If your renewal falls after September 22, you will automatically benefit from the exemption. But if your premium is due earlier, the old rate still applies.

If you pay in advance before September 22, the GST you have already paid will not be refunded since taxes are collected at the time of transaction, and once paid, they are final.

What Changes After September 22, 2025

From that day, all individual life insurance policies, be they term plans, unit-linked insurance plans (Ulips), endowment policies, individual health covers, family floater policies, and senior citizen health plans will be exempt from GST. Reinsurance for these products has also been included.

Union Minister of Finance Nirmala Sitharaman, while announcing the cut earlier this month, said the move is intended to make insurance more affordable and expand coverage in India.

Many insurers are gearing up for the transition. Niva Bupa Health Insurance, said it is already working with back-end systems so that customers can start getting the GST exemption benefit from the effective date, according to a report in Mint.

Should You Delay Buying Or Renewing A Policy

This is where many policyholders are weighing their options. On social media platform X (formerly Twitter), insurance expert Nikhil Jha explained the situation in simple terms: if your renewal falls just before September 22, 2025, you have two choices, wait and renew in the grace period to take advantage of the cut (but risk being uncovered if you need to claim), or renew now and enjoy the GST benefit at the next cycle.

His advice: never let your policy lapse just to save on GST. The risk of losing coverage far outweighs the tax savings.

However, it is important to note that there is no final clarity on how this exemption will work out if you renew your policy or pay the premium price during the grace period. It is best to check with your insurer before taking any such decision.

So, if your renewal is before September 22, it is still safer to pay on time. If it’s after, the benefit will reflect automatically.

How Much Will Premiums Fall

On paper, the drop looks significant. With 18 per cent GST scrapped, premiums could fall by around 12-18 per cent, depending on the product and the insurer. For instance, a Rs 25,000 health plan would cost Rs 29,500 now with GST (18% on this will be around Rs 4,500). After September 22, the same cover should come closer to the base premium.

That said, insurers may face cost pressures. As Outlook Money has reported, the exemption also means insurers lose input tax credits (ITC) they previously used to offset expenses. This embedded cost could lead to some reworking of pricing. Experts weigh that the premiums would be 10-15 per cent cheaper and not the full 18 per cent of the exemption.

Yogesh Agarwal, CEO and Founder, Onsurity says that since individual health and life insurance remain GST-exempt, insurers will face disputes over how much credit they can actually claim on expenses not directly tied to those exempt businesses. This will give rise to possible litigations.

“At the operational level, insurers cannot claim input credit on large cost items, such as commissions (which can be approx 25 per cent of premiums) and administrative expenses (5 per cent). This unabsorbed GST directly adds to their cost structure. In the short term, it eats into profitability, because insurers cannot instantly reprice existing policies or pass on the higher costs to customers.”

What About Long-Term Policies Already Paid In Advance

Here, there is no relief. If you bought a three-year policy in 2023 and paid upfront with GST included, no refund will be issued. The benefit applies only from your next renewal date after September 22, 2025. Your coverage, terms, and benefits remain unchanged until then.

Why This Matters

India’s insurance penetration has long been seen as low, partly because of affordability. The removal of GST from individual life and health policies could help reduce the entry barrier, especially for first-time buyers. As Sitharaman emphasised, the intention is to make insurance a mass product, not a privilege.

For consumers, the immediate message is clear: don’t let your policy lapse just to save GST. If your renewal is after September 22, you will benefit anyway. For new buyers, it may make sense to wait a little if possible, but not at the cost of staying uninsured.