Summary of this article

Robotic-assisted surgeries lower complications, speed recovery, and improve implant longevity.

Insurance coverage remains inconsistent, with caps and exclusions raising patient costs.

State insurers are more generous, while private plans often restrict payouts.

Wider coverage could cut long-term claims and make advanced care accessible.

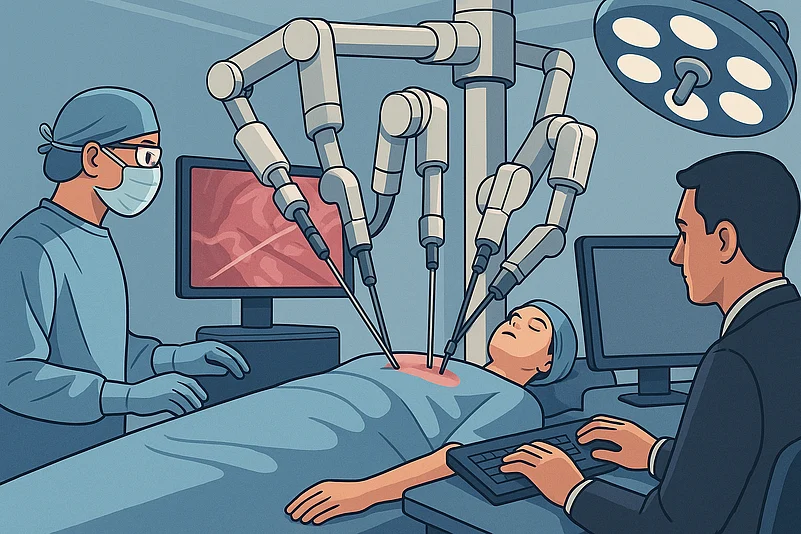

Step inside an operating theatre in any major city hospital and chances are you’ll see robotic arms assisting surgeons. What was once considered cutting-edge is now steadily becoming routine. Patients undergoing robotic-assisted procedures often walk away with smaller scars, lose less blood, recover faster, and face fewer complications, according to a recent Zee News report. Hospitals are buying into the technology, and surgeons are increasingly convinced of its value.

But the question that follows every healthcare innovation soon appears here as well- who can afford it? And, more importantly, will insurance pay for it? Back in 2019, India’s insurance regulator directed companies to widen their coverage and include newer medical technologies such as robotic-assisted surgeries.

Yet patients today still find a gap between promise and practice. Coverage depends heavily on the policy. Some reimburse most costs, others impose tight caps, and many leave families facing heavy out-of-pocket expenses.

Insurance Still Catching Up

Robotics has made its biggest mark in orthopedics, particularly joint replacements. Surgeons point out that robotic precision improves alignment and lowers the chance of revision surgery. For patients, that means the implant lasts longer and the recovery is smoother. On paper, it is exactly the kind of outcome insurers should want.

The reality is uneven. State-owned insurers are often more generous, but many private health plans stop short of full coverage. When claims are filed, disputes arise. Should equipment charges be covered? Does the “technology fee” count as a standard surgical expense or an extra? The lack of clarity slows down settlements, cuts payouts, and adds to patient stress at a time when recovery should be the priority.

A Case For Smarter Coverage

Doctors and medical bodies have urged insurers to treat robotic surgery as mainstream. Their argument is not that it is a luxury; it is increasingly part of the standard of care. Limiting coverage, they say, leaves patients stuck between wanting the best option and being forced to compromise because of cost.

Insurers also stand to gain from wider coverage. Patients who undergo robotic procedures are often discharged sooner, face fewer complications, and return to work earlier. That means fewer follow-up claims and lower costs in the long run. Covering such procedures more comprehensively may, in fact, bring long-term savings.

The Road Ahead

The challenge lies in striking a fair balance. Robotic systems are expensive, and so are the procedures. But as adoption grows, insurers, regulators, and hospitals will have to work together to create coverage that reflects today’s medical reality.

If insurance evolves, robotic-assisted surgery could shift from being an option for the few to a treatment available to many. The technology has already changed how surgeons work. The next step is to ensure that insurance does not remain a barrier for patients who stand to benefit.