Investors are often advised by financial experts to invest for longer time periods to get the most out of their investment. A longer investment period allows investors to benefit from the effect of compounding, resulting in higher returns and lower taxes. Long-term investing generally involves holding an asset for a time period of 5 years or longer. A report by investment website Funds India titled Wealth Conversation reveals the varying returns assets such as Indian equities, US equities, gold, real estate and debt instruments have given over the long-term.

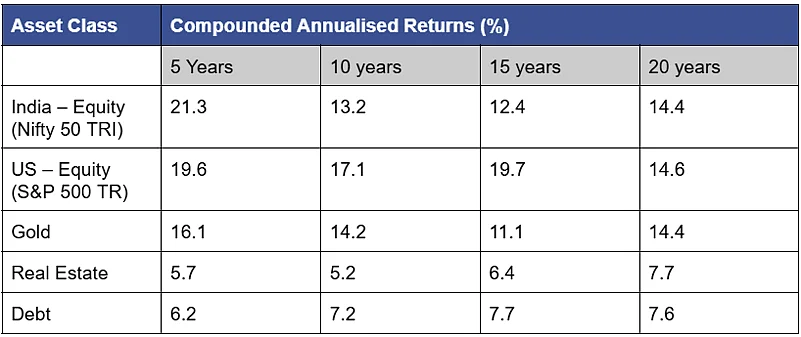

The report showed that in the last two decades, equities have outperformed all other asset classes. Notably, US equities represented by the S&P 500 total returns have outperformed all other asset classes, giving 19.6 per cent returns in five years, 17.1 per cent returns in ten years, 19.7 per cent returns in fifteen years and 14.6 per cent returns in twenty years. Here’s a look at how other asset classes have performed over a 10-year, 15-year and 20-year time period:

Indian Equities

The returns made by Indian equities represented by the Nifty 50 Total Returns Index in the last fifteen years are 12.4 per cent, in the last 10 years the returns stood at 13.2 per cent, and in five years Indian equities have given returns of 21.3 per cent. In the last twenty years, Mid and Small Cap equities have outperformed the Nifty 50 TRI, which tracks the performance of large caps. In twenty years the Nifty Midcap 150 TRI and Nifty Small cap 250 TRI have given returns of 17.7 per cent and 16.2 per cent.

The market factors in negative news and reacts accordingly. This volatility often alienates investors or spooks them from investing in equities. However, the report found that over longer time periods, the risk of facing negative returns declines significantly. The report claimed that the risk of incurring negative returns while investing in the Nifty 50 TRI can decrease from 46 per cent for a single-day investment horizon to 6 per cent in three years. However, the risk becomes negligible with the passage of time, going down to 0.1 per cent in five years and 0 per cent after seven years. Despite widespread beliefs regarding equities being risky investments, the asset class has outperformed inflation by 7-9 per cent in the last twenty-five years, according to the report.

Gold

Gold has historically underperformed equities from a long-term perspective (over five years). However, when we compare 20-year returns, gold has yielded 14.4 per cent, catching up with the return on investing in Indian equities. The report found that in the last twenty years gold has consistently given 2-4 per cent higher returns compared to inflation. Despite the returns the yellow metal gives, it also goes through long periods of subdued returns. The study found that the returns generated by the safe haven asset fluctuate on the basis of central bank demand, mining costs and US Dollar to Rupee exchange rates.

Real estate

According to the Funds India report the returns for real estate have been calculated on the basis of the NHB Residex. The report showed that the compounded annualised returns in the last five years for real estate investments are 5.7 per cent. In ten years investments in real estate have given returns of 5.2 per cent and in fifteen years the returns have increased to 6.4 per cent. The twenty year returns stand at 7.7 per cent.

The report showed that over the long-term (15-20) period, investments in real estate have yielded returns which are above inflation. However, returns from real estate investments go through cycles of ups and downs. According to the report real estate investments had a compounded annual growth rate of 15 per cent between 2002 and 2012. However, in the next decade, the returns moderated to 5 per cent between 2013 and 2024. Thus, a key determining factor of the returns an individual can get from real estate is when they enter the real estate market.

Debt

The returns for investment in debt instruments have been calculated on the basis of returns from debt schemes like Aditya Birla SL Low Duration Fund, HDFC Low Duration Fund, Aditya Birla SL Corporate Bond Fund.

The report showed that investments in debt instruments have yielded returns of 6.2 per cent in five years and 7.2 per cent in ten years. The returns have grown over longer time periods, with the fifteen-year and twenty-year returns increasing to 7.7 per cent and 7.6 per cent, respectively. The report found that over a longer investment horizon of 10-15 years, debt has given returns which are above inflation.