Summary of this article

While gold remains a symbol of prosperity, its returns often trail behind many investment instruments like mutual funds or Sovereign Gold Bonds. This Diwali, the message is clear: let your gifts not only shine but also secure the future.

A 31-year-old professional stood at a jewellery counter, clutching a velvet box containing a delicate gold bracelet for her niece’s first Diwali. After saving Rs 45,000 over six months, she felt the warmth of tradition and love as she stepped out with her purchase. But during the ride home, a lingering thought surfaced: Will this gold truly secure her niece’s future, or just sit in a locker, gathering dust?

That single question transformed how she viewed gifting, reminding her that tradition and smart wealth-building don’t have to conflict; they just need a fresh perspective.

Why Gold Feels Timeless But Isn’t Always Enough

Gold is woven into the fabric of Indian celebrations. According to the World Gold Council (WGC), Indians buy over 800 tonnes of gold annually, with 35 per cent purchased during festive seasons. It’s a symbol of prosperity, love, and care.

Yet, the numbers tell another story. Gold has delivered around 10 per cent annualised returns over the past two decades at a decent pace, but not extraordinary. Compare that to equity mutual funds averaging 12–14 per cent, and the financial sparkle begins to fade.

Physical gold is also costly. Making charges can be 8–25 per cent, storing it safely is a hassle, and selling prices rarely match purchase prices.

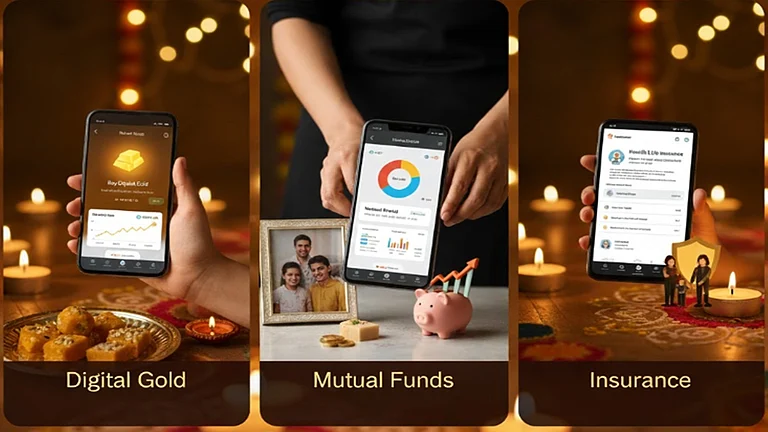

Digital Gold and Bonds: A Modern Twist

Enter digital gold and Sovereign Gold Bonds (SGBs). You get the same potential for growth, without making charges, storage worries, or liquidity issues. SGBs even offer 2.50 per cent annual interest on top of market-linked appreciation. Imagine gifting 10 grams digitally or an SGB certificate. It's meaningful, modern, and financially smart.

“Gold has always been about security and tradition. But today’s gifts can honour tradition while also giving loved ones a stronger financial start,” says Sanjiv Bajaj, joint chairman and MD at Bajaj Capital.

Gifts That Grow

What if, instead of a Rs 45,000 bracelet, she had started a small mutual fund systematic investment plan (SIP) in her niece’s name? Over 15 years at 12 per cent returns, that gift could become nearly Rs 2.50 lakh, funding college, a wedding, or a first business venture.

Insurance can be just as thoughtful. A term insurance plan for newly-weds or a health top-up for ageing parents may not sparkle, but they protect against life’s uncertainties.

Even siblings or friends can benefit from equity-linked savings schemes (ELSSs), which combine wealth creation with tax efficiency. You are giving more than a gift, you’re giving financial confidence.

A Quick Tax Lens

Gifts to immediate family: parents, children, siblings, spouses are tax-free. Gifts above Rs 50,000 to friends or distant relatives may be taxable, but instruments like mutual funds or gold bonds remain tax-efficient, if not cashed immediately.

“Smart gifting isn’t just generosity, it's foresight. A well-chosen gift can impact decades, not just a single season,” says Bajaj.

Finding The Balance

The professional found her answer in balance. A small gold coin kept the tradition alive, a tangible symbol of love. So, she also started a Rs 2,000 SIP in her niece’s name, planned for 10 years. One gift honours the past. The other builds the future.

This Diwali, your gifts can sparkle and grow. They can carry warmth, love, and meaning—and also help dreams take root. That's because the brightest gifts aren’t just the ones that shine for a night—they are the ones that keep lighting the way for years to come.